The greatest source of money for the federal government is the individual income tax. For tax year 2020, the third one under the modifications introduced by the Tax Cuts and Jobs Act (TCJA), taxpayers submitted more than 164 million individual income tax returns.

The Internal Revenue Service (IRS) must receive a return from every family with taxable income. Taxpayers must list all sources of taxable income on IRS Form 1040 in order to calculate their total income. Taxpayers then calculate their deductions and credits to establish their tax burden and the amount of tax due or refunded.

This article will concentrate on the sources of the more than $12.7 trillion in total reported income on the Form 1040 in 2020. Understanding the make-up of the federal government's revenue base and how Americans get their taxable income is made easier by reviewing reported income. We categorize income into four main groups: earnings and salaries, business revenue, investment income, and retirement income. For the 2020 tax year, we evaluate each grouping.

| Income Type | Amount (Billions) |

|---|---|

| Salaries and Wages | $8,416 |

| Capital Gains Less Loss and Capital Gain Distributions | $1,128 |

| Taxable Pensions and Annuities | $828 |

| Partnership and S Corporation Net Income Less Loss | $707 |

| Unemployment Compensation | $405 |

| Taxable Social Security Benefits | $374 |

| Business or Profession Net Income Less Loss | $337 |

| Ordinary Dividends | $328 |

| Taxable Individual Retirement Account (IRA) Distributions | $284 |

| Taxable Interest | $127 |

Note: For 2020, not all unemployment compensation received was taxable. The American Rescue Plan of 2021 allowed a taxpayer to exclude up to $10,200 of unemployment compensation from income. The IRS excludes qualified dividends from total income, which amounted to $248 billion. Tax-free interest, such as interest on municipal bonds, adds another $59 billion to interest income. Source: IRS SOI Table 1.3. |

|

Wages and Salaries Make Up $8.4 Trillion of Personal Income

The largest component of total income is wages and salaries. The line on their own Form 1040 where they list their wages, salaries, tips, and other forms of payment for their employment is where the majority of tax filers in the U.S. declare their highest income. In other words, since the majority of the American economy is made up of work compensation, the majority of Americans report earning labor income, and the majority of their income originates from labor. The total wage income recorded by more over 130 million tax payers in 2020 was $8.4 trillion, or 66% of all income.

The majority of worker pay is reflected in the numbers on Form 1040, but not entirely. Businesses, for instance, contribute to Social Security and pay for employee health insurance, both of which are exempt from income tax.

A progressive rate schedule with rates ranging from 10% to 37% is used to tax wage and salary income. In the tax year 2020, the highest rate of 37 percent was applied to taxable income that exceeded $518,400 for solo filers and $622,050 for married couples filing jointly.

Business Income Makes Up $1 Trillion of Personal Income

Pass-through entities, so named because income is promptly "passed through" to individual owners' tax returns using schedules C, E, and F, are the most common tax filing structure for businesses in the United States.

Most of the private sector workers in the US work for pass-through businesses, which also generate the majority of business revenue. In 2020, partnerships and S companies reported net income of $707 billion. An additional $337 billion in personal business or professional income (revenue from sole proprietorship) was reported by individuals. When accounting for income from estates, farms, trusts, rentals, and royalties, corporate income less losses as a whole came to around $1.1 trillion.

Pass-through business income is taxed as ordinary income on owners' personal tax returns, in contrast to firms subject to the corporate income tax. Pass-through business revenue is taxed at the same progressive rate schedule as salaries and wages. Despite some restrictions and requirements, the TCJA created a temporary 20% tax deduction for pass-through business revenue.

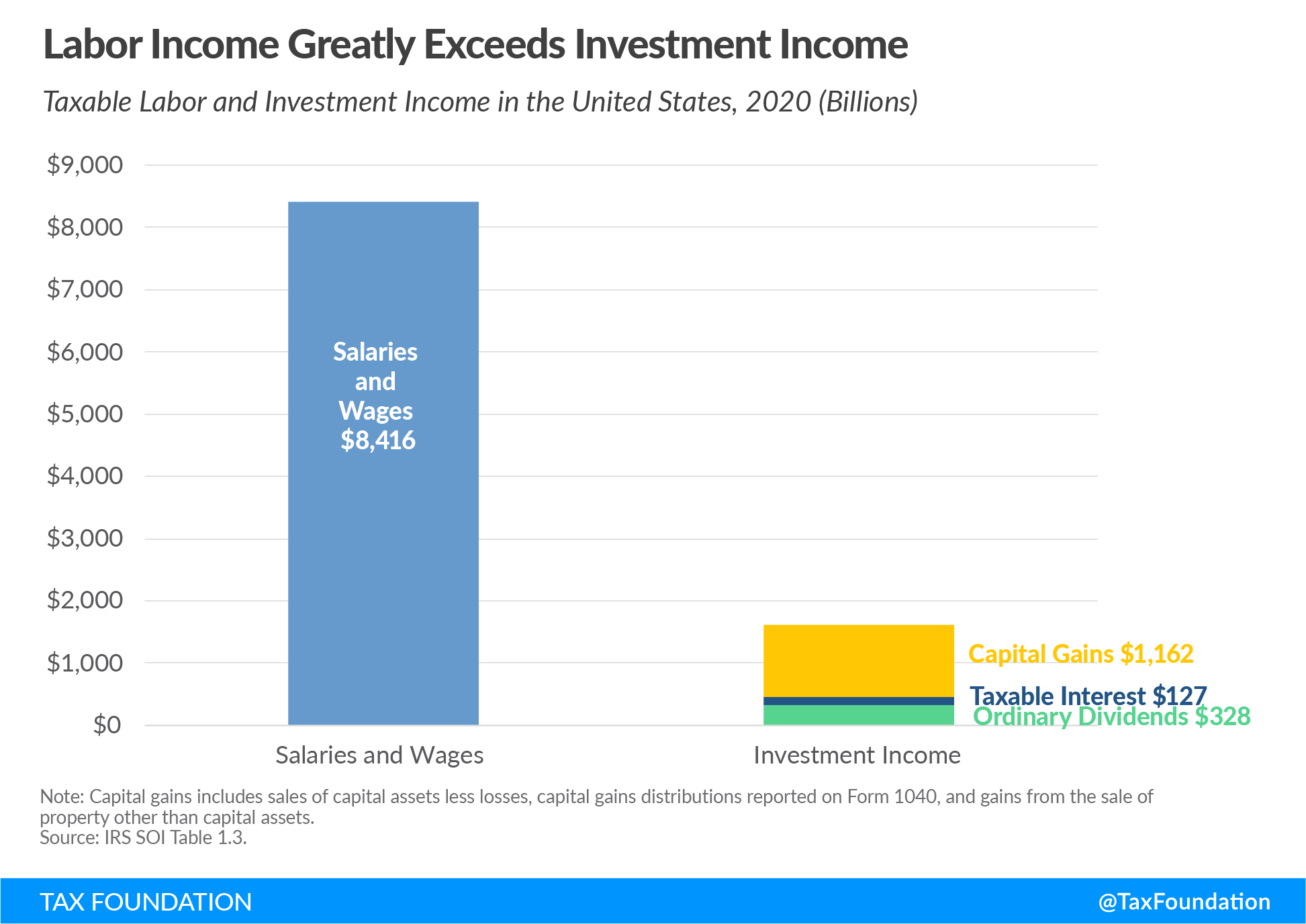

Investment Income Makes Up Nearly $1.6 Trillion of Personal Income

In 2020, the total amount of taxable investment income, which includes taxable interest, dividends, and capital gains income, was $1.6 trillion. Taxpayers reported $328 billion in taxable regular dividends, $1.1 trillion in net capital gains, and $1.1 trillion in capital gain distributions, of which only a portion was attributable to the sale of company shares. Taxpayers reported $34 billion in net gains on the sales of assets other than capital assets, such as certain real estate or copyrights, and $127 billion in taxable interest.

The amount of taxable labor compensation exceeds the amount of taxable investment income. Even though the returns on company stock and other capital assets reported on individual income tax returns are sizable, they pale in comparison to the $8.4 trillion in labor income that people received in the tax year 2020.

A separate schedule with reduced tax rates is applicable to some investment income, while ordinary income tax rates apply to other types of income. Similar to wage and salary income, taxable interest, ordinary dividends, and short-term capital gains (gains on assets held for less than one year) are taxed as regular income at the taxpayer's marginal income tax rate. Depending on a taxpayer's taxable income, long-term capital gains (gains made on assets held for longer than a year) are taxed at reduced rates, ranging from 0 percent to 20 percent, plus a 3.8 percent net investment income tax.

Retirement Income Makes Up Nearly $1.5 Trillion of Personal Income

Taxpayers reported $284 billion in taxable IRA distributions in 2020, in addition to $828 billion in taxable pension and annuity income. Taxpayers reported approximately $1.5 trillion in taxable retirement income in 2020, which included roughly $374 billion in taxable Social Security payouts in addition to personal savings.

Despite being extremely complicated, America's retirement account system is neutrally taxed, eliminating the income tax's bias against saving. The tax treatment of withdrawals from pension and annuity accounts is progressive, with rates ranging from 10% to 37%, while distributions from tax-deferred IRAs are taxed as regular income. Many retirement accounts have tax-deferred status. Depending on the overall amount of a taxpayer's income and benefits for the tax year, a part of Social Security benefits may be subject to regular income tax rates.

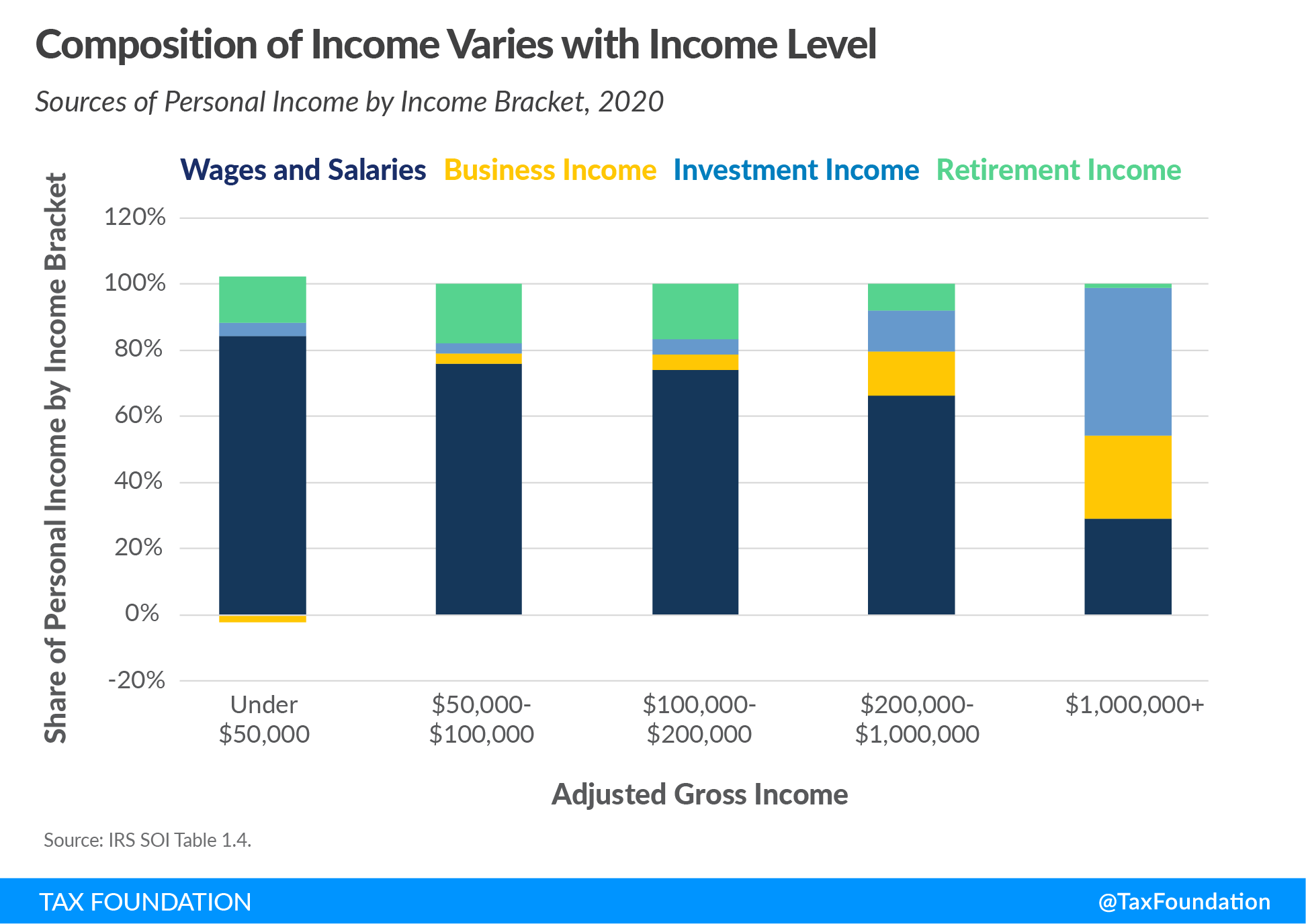

Composition of Income Varies with Income Level

Reviewing personal revenue sources by income bracket reveals the variable importance of various income sources by income level. For taxpayers reporting income between $50,000 and $100,000, retirement income, which accounts for about 18% of the total income reported by this category, is the most significant source of personal income. In reality, the majority of taxpayers of working age do not rely on retirement income, but a small percentage of retirees who are middle-class taxpayers do. For higher-income taxpayers, business revenue and investment income from non-retirement accounts are most significant, but for lower-income taxpayers, wages and salaries make up the majority of their income.

The Impact of the COVID-19 Pandemic

Data from 2020 individual income tax returns show that the COVID-19 pandemic had a significant effect on the country's economic stability in that year.

One notable example is the high increase in reported unemployment insurance revenue, which increased by more than 1,700% from $21 billion in 2019 to $405 billion in 2020. Lawmakers increased unemployment benefits starting in early 2020 and established a $10,200 income tax deduction for the 2020 tax year, which is available to taxpayers with modified adjusted gross income below $150,000. These actions were taken in response to record-high unemployment rates.

Capital gains income increased from $865 billion in 2019 to $1.1 trillion in 2020, a rise of more than 30%. Capital gains income is calculated as capital gains less losses and distributes. The stock market saw a sharp decline at the beginning of the epidemic, but it swiftly recovered and hit record highs by the end of 2020. The income from sole proprietorships, taxable IRS distributions, taxable interest, and gambling all decreased from 2019 to 2020, on the other hand.

Despite record-high unemployment, the total revenue from salaries and wages increased very little between 2019 and 2020. However, the growth in aggregate hides the variations in experiences between socioeconomic levels. Wages and salaries declined for taxpayers with incomes under $100,000. For instance, reported income and pay decreased by about 6% in the group earned under $50,000. In contrast, incomes and wages for taxpayers making more than $100,000 increased in 2019 by 5.6 percent compared to the previous year.

Conclusion

Given that the majority of our personal income comes from labor, a review of the sources of personal income reveals that the personal income tax is mostly a tax on labor. The incomes of Americans are also influenced by a variety of capital sources. Despite being less substantial than labor income sources, sources of capital income are nonetheless essential and must be taken into account by both policymakers and anyone attempting to comprehend the distribution of personal income.