Despite what people thought at first, the years of the pandemic were good for state and local tax collections. The big jumps in 2021 and 2022 haven't carried over into 2023, but most states' earnings are still strong and well above levels before the pandemic, even when inflation is taken into account.

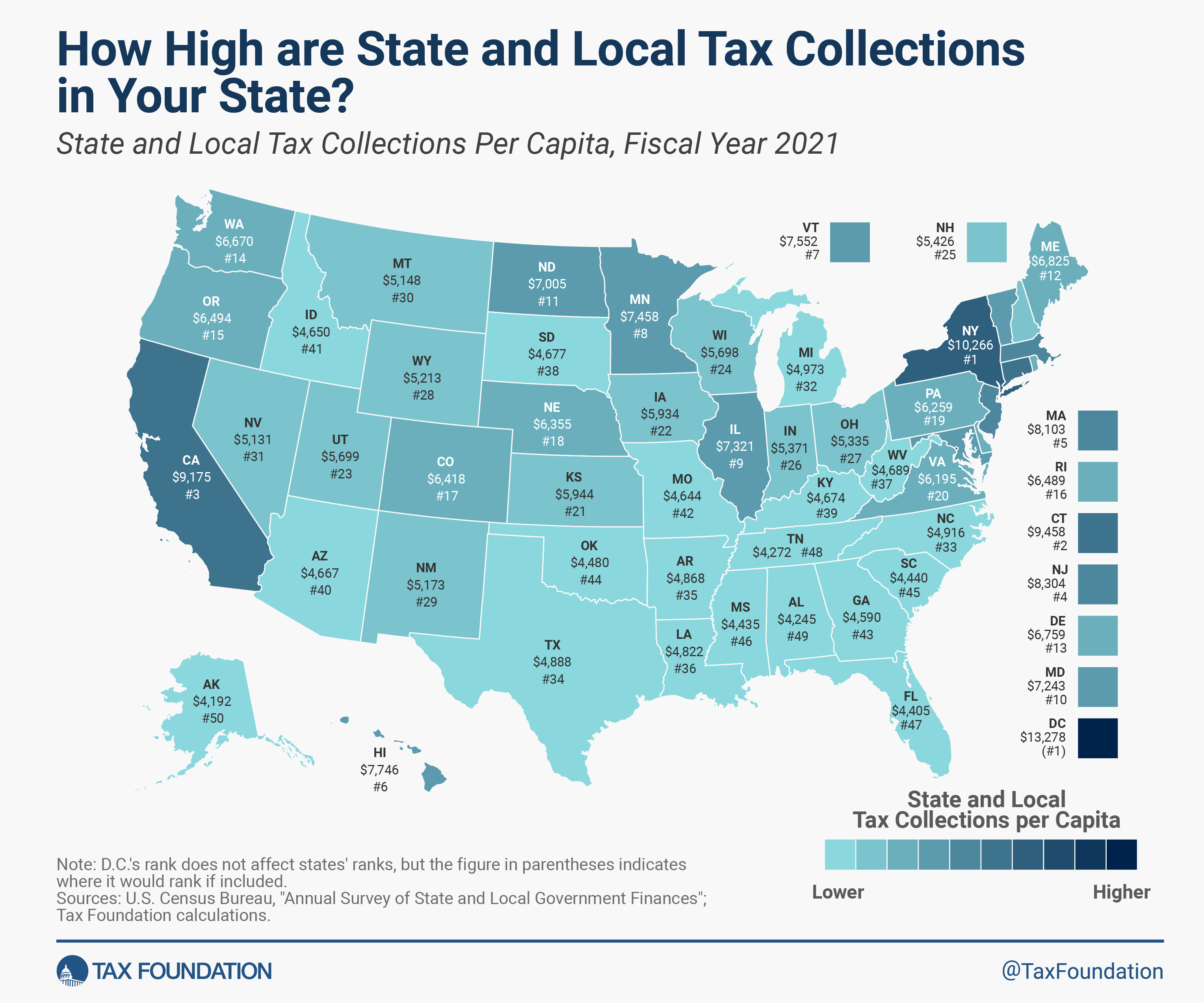

As of fiscal year (FY) 2021, which is the most recent year for which full state-by-state statistics are available, this map shows how much state and local tax money each state collected per person. But because of how important the last few years have been, we will also talk about how state and local tax collections will change through FY 2023, which finished in June of this year.

With $13,278 in per capita tax earnings for FY 2021, the District of Columbia had more than any other state. New York came in second with $10,266 in state and local tax payments per person. Connecticut came in third with $9,458, followed by California with $9,175, New Jersey with $8,303, and Massachusetts with $8,101. Alaska had the lowest price, at $4,192. Alabama came in at $4,245, Tennessee at $4,272, Florida at $4,405, and Mississippi at $4,435.

Alaska is an exception: its people don't have to pay nearly as much in taxes as other states, but its severance taxes bring in a lot of money and often result in pretty high collections per capita. However, FY 2021 included a time when oil prices changed a lot. Since then, the industry and Alaska's earnings have recovered. Other resource-dependent states, like North Dakota and Wyoming, saw similar effects. Their per capita collections were much lower in FY 2021 than they had been in previous years or since, based on their own revenue statistics. A lot of these states' taxes are sent abroad, and that year there was less to send abroad.

It is important to note that severance taxes are just one type of "tax exporting" that states do. Travel taxes, like those on hotels, cars, and meals, also affect nonresidents who don't vote unfairly and don't have many ways to get their problems fixed. Because of this, states that get a lot of tax money from tourism may also have tax collections per person that are higher than the real tax burden on the people who live in those states. Businesses may also have to pay taxes that are sent, at least in part, to owners all over the country and to workers everywhere. If you want to know how much a tax really costs, you need to think about both its legal and economic effects.

However, state and local governments did well in FY 2021. However, that seems like a very long time ago now that the world has changed so much since the pandemic began. You can always ask where things stand now, even though these maps are bound by when Census data comes out. Even though we can't look at each state individually, we do have weekly information on how much state and local tax money the country as a whole collected in FY 2023.

The last full fiscal year before the pandemic was FY 2019. Since then, state and local tax collections have gone up by more than 27%. Even though inflation has eaten away at a lot of that gain, state and local tax collections are still more than 7 percent higher than they were before the pandemic.

In FY 2021, revenues jumped a full 10 percent (adjusted for inflation) higher than they were before the pandemic. They went up even more in FY 2022, up 12 points, before settling down a bit in FY 2023. But this shouldn't worry you. Part of the reason for this is a return to the mean: state earnings went through the roof, and it's fine if they level off or even go down a little as long as the new totals are still higher (in real terms) than the old ones. Also, almost every state has cut taxes since the beginning of 2021. Since then, 25 states have lowered individual income tax rates. Some of the increase in income was meant to be given back to taxpayers by lawmakers. Even with that, revenues are still up in real terms.

Also, the recent drops in earnings are mostly happening in California and New York, which are high-tax states that depend a lot on their high marginal income tax rates. Not only are these states more likely to be affected by changes in the incomes of high earners, which is a major cause of volatility, but they're also pushing some of those high earners to move to other states. For more recent fiscal years, only state tax revenue data is provided for each state. However, the combined state tax revenue of New York and California is up 2.9% in real terms since FY 2019, while the rest of the country's tax revenue has grown 11.3%.

It was never going to be possible for income growth to reach the rate seen in FY 2021. However, most states are still much better off than they were before the pandemic, even after tax cuts, and the new baseline is likely to be much higher than it was before. Some states' incomes are high enough that the tax cuts that started in 2021 and continued through 2023 are expected to continue in 2024.

How High are State and Local Tax Collections in Your State?

State and Local Tax Collections Per Capita, Fiscal Year 2021

| State | State and Local Tax Collections Per Capita, FY 2021 | Rank |

|---|---|---|

| Alabama | $ 4,245 | 49 |

| Alaska | $ 4,192 | 50 |

| Arizona | $ 4,667 | 40 |

| Arkansas | $ 4,868 | 35 |

| California | $ 9,175 | 3 |

| Colorado | $ 6,418 | 17 |

| Connecticut | $ 9,458 | 2 |

| Delaware | $ 6,759 | 13 |

| District of Columbia | $ 13,278 | -1 |

| Florida | $ 4,405 | 47 |

| Georgia | $ 4,590 | 43 |

| Hawaii | $ 7,746 | 6 |

| Idaho | $ 4,650 | 41 |

| Illinois | $ 7,321 | 9 |

| Indiana | $ 5,371 | 26 |

| Iowa | $ 5,934 | 22 |

| Kansas | $ 5,944 | 21 |

| Kentucky | $ 4,674 | 39 |

| Louisiana | $ 4,822 | 36 |

| Maine | $ 6,825 | 12 |

| Maryland | $ 7,243 | 10 |

| Massachusetts | $ 8,103 | 5 |

| Michigan | $ 4,973 | 32 |

| Minnesota | $ 7,458 | 8 |

| Mississippi | $ 4,435 | 46 |

| Missouri | $ 4,643 | 42 |

| Montana | $ 5,148 | 30 |

| Nebraska | $ 6,355 | 18 |

| Nevada | $ 5,131 | 31 |

| New Hampshire | $ 5,426 | 25 |

| New Jersey | $ 8,303 | 4 |

| New Mexico | $ 5,173 | 29 |

| New York | $ 10,266 | 1 |

| North Carolina | $ 4,916 | 33 |

| North Dakota | $ 7,005 | 11 |

| Ohio | $ 5,335 | 27 |

| Oklahoma | $ 4,480 | 44 |

| Oregon | $ 6,494 | 15 |

| Pennsylvania | $ 6,259 | 19 |

| Rhode Island | $ 6,489 | 16 |

| South Carolina | $ 4,440 | 45 |

| South Dakota | $ 4,677 | 38 |

| Tennessee | $ 4,272 | 48 |

| Texas | $ 4,888 | 34 |

| Utah | $ 5,699 | 23 |

| Vermont | $ 7,552 | 7 |

| Virginia | $ 6,195 | 20 |

| Washington | $ 6,670 | 14 |

| West Virginia | $ 4,689 | 37 |

| Wisconsin | $ 5,698 | 24 |

| Wyoming | $ 5,213 | 28 |

Sources: U.S. Census Bureau, "Annual Survey of State and Local Government Finances," Tax Foundation calculations.