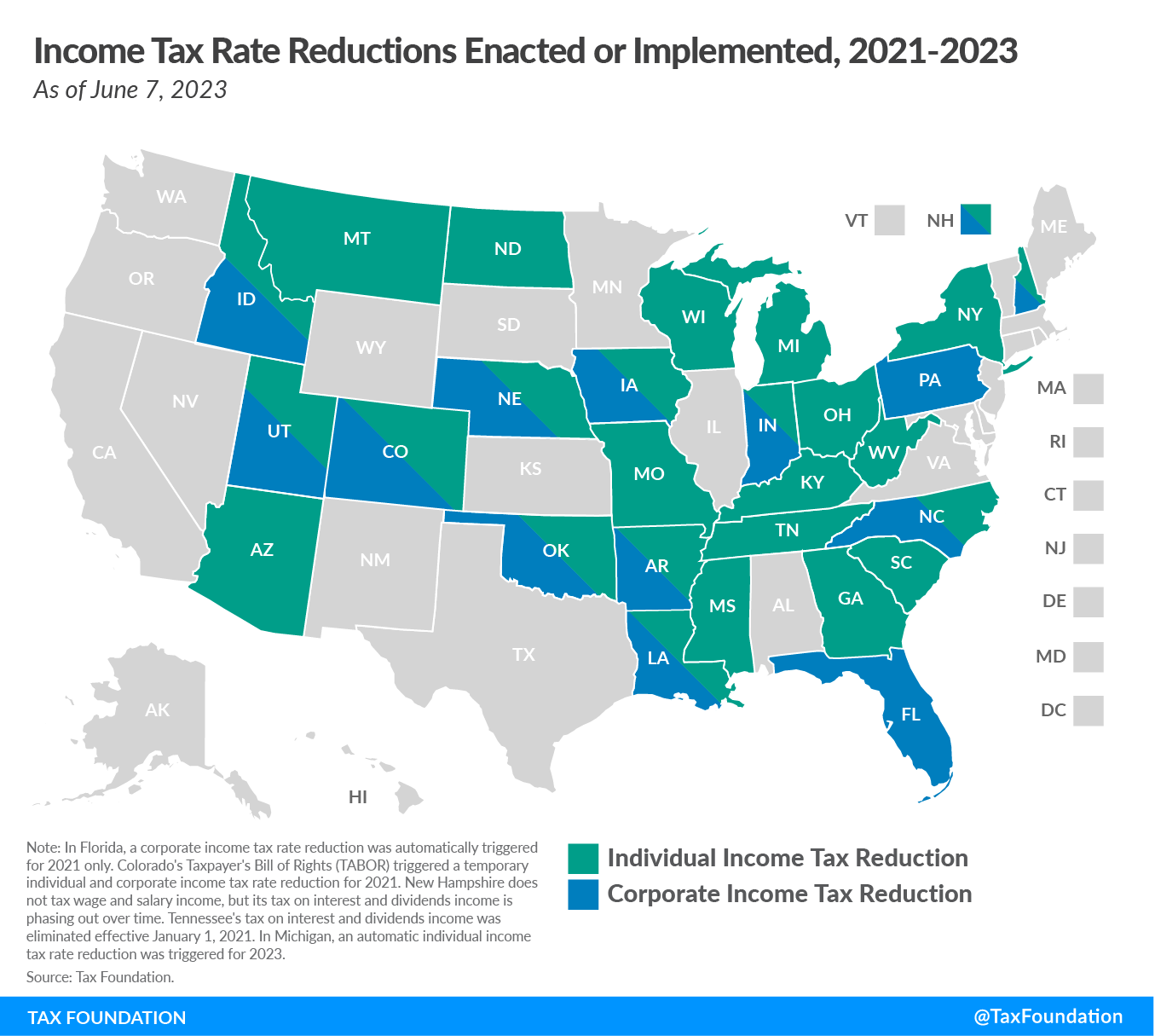

As congressional sessions end in many states, it's clear that 2023 will be the third year in a row with big changes to and relief from state taxes. Since 2021, 24 states have cut individual income tax rates (including 22 cuts to the top marginal rates), 13 states have cut corporate income tax rates, two states have cut sales tax rates, and many more have made structural improvements like getting rid of capital stock taxes, making full expensing permanent, raising the filing and withholding thresholds for nonresidents, improving how businesses treat tangible property, getting rid of throwback and throwout rules, and more.

After the big rate cuts and changes in 2021 and 2022, many people thought that things would slow down in 2023. All of those hopes have been broken.

Eight states (Arkansas, Indiana, Kentucky, Montana, Nebraska, North Dakota, Utah, and West Virginia) cut their individual income tax rates. Also, Michigan prompted a rate cut that could be temporary. In 2023, reductions that had been planned or triggered in Arizona, Idaho, Iowa, Missouri, New Hampshire (interest and dividend income tax), and North Carolina went into effect.

The table below shows what each state's top marginal income tax rate was at the start of 2021, before any changes were made to rates for that year. It also shows what the rates were for 2022 and 2023. The table also shows what the expected rates will be in 2024, taking into account any rate changes that have already been approved by legislatures. It also shows any future rate cuts that are either scheduled by law or based on income triggers.

| Top Marginal Rates Entering 2021, for 2022-2024, and Subsequent Scheduled Reductions | ||||||

|---|---|---|---|---|---|---|

| State | Rate Cut? | Entering 2021 | 2022 | 2023 | 2024 | Future |

| Alabama | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | |

| Alaska | No tax | No tax | No tax | No tax | No tax | |

| Arizona | ✓ | 8.00%* | 2.98% | 2.50% | 2.50% | 2.50% |

| Arkansas | ✓ | 5.90% | 4.90% | 4.70% | 4.70% | 4.70% |

| California | 13.3% | 13.3% | 13.30% | 14.40% | 14.40% | |

| Colorado | ✓ | 4.55% | 4.40% | 4.40% | 4.40% | 4.40% |

| Connecticut | 6.99% | 6.99% | 6.99% | 6.99% | 6.99% | |

| Delaware | 6.60% | 6.60% | 6.60% | 6.60% | 6.60% | |

| Florida | No tax | No tax | No tax | No tax | No tax | |

| Georgia | ✓ | 5.75% | 5.75% | 5.75% | 5.49% | 4.99% |

| Hawaii | 11.00% | 11.00% | 11.00% | 11.00% | 11.00% | |

| Idaho | ✓ | 6.925% | 6.00% | 5.80% | 5.80% | 5.80% |

| Illinois | 4.95% | 4.95% | 4.95% | 4.95% | 4.95% | |

| Indiana | ✓ | 3.23% | 3.23% | 3.23% | 3.05% | 2.90% |

| Iowa | ✓ | 8.53% | 8.53% | 6.00% | 5.70% | 3.90% |

| Kansas | 5.70% | 5.70% | 5.70% | 5.70% | 5.70% | |

| Kentucky | ✓ | 5.00% | 5.00% | 4.50% | 4.00% | Indefinite |

| Louisiana | ✓ | 6.00% | 4.25% | 4.25% | 4.25% | 4.25% |

| Maine | 7.15% | 7.15% | 7.15% | 7.15% | 7.15% | |

| Maryland | 5.75% | 5.75% | 5.75% | 5.75% | 5.75% | |

| Massachusetts | 5% | 5% | 9.00% | 9.00% | 9.00% | |

| Michigan | ✓ | 4.25% | 4.25% | 4.05% | 4.25% | 4.25% |

| Minnesota | 9.85% | 9.85% | 9.85% | 9.85% | 9.85% | |

| Mississippi | ✓ | 5.00% | 5.00% | 5.00% | 4.70% | 4.00% |

| Missouri | ✓ | 5.40% | 5.30% | 4.95% | 4.95% | 4.50% |

| Montana | ✓ | 6.90% | 6.75% | 6.75% | 5.90% | 5.90% |

| Nebraska | ✓ | 6.84% | 6.84% | 6.64% | 5.84% | 3.99% |

| Nevada | No tax | No tax | No tax | No tax | No tax | |

| New Hampshire | ✓ | 5.00%† | 5.00%† | 4.00%† | 3.00%† | No tax |

| New Jersey | 10.75% | 10.75% | 10.75% | 10.75% | 10.75% | |

| New Mexico | 5.90% | 5.90% | 5.90% | 5.90% | 5.90% | |

| New York | 8.82% | 10.90% | 10.90% | 10.90% | 10.90% | |

| North Carolina | ✓ | 5.25% | 4.99% | 4.75% | 4.60% | 3.99% |

| North Dakota | ✓ | 2.90% | 2.90% | 2.90% | 2.50% | 2.50% |

| Ohio | ✓ | 4.797% | 3.99% | 3.99% | 3.99% | 3.99% |

| Oklahoma | ✓ | 5.00% | 4.75% | 4.75% | 4.65% | 4.65% |

| Oregon | 9.90% | 9.90% | 9.90% | 9.90% | 9.90% | |

| Pennsylvania | 3.07% | 3.07% | 3.07% | 3.07% | 3.07% | |

| Rhode Island | 5.99% | 5.99% | 5.99% | 5.99% | 5.99% | |

| South Carolina | ✓ | 7.00% | 6.50% | 6.50% | 6.50% | 6.00% |

| South Dakota | No tax | No tax | No tax | No tax | No tax | |

| Tennessee | No tax | No tax | No tax | No tax | No tax | |

| Texas | No tax | No tax | No tax | No tax | No tax | |

| Utah | ✓ | 4.95% | 4.85% | 4.65% | 4.65% | 4.65% |

| Vermont | 8.75% | 8.75% | 8.75% | 8.75% | 8.75% | |

| Virginia | 5.75% | 5.75% | 5.75% | 5.75% | 5.75% | |

| Washington | No tax | 7.00%§ | 7.00%§ | 7.00%§ | 7.00%§ | |

| West Virginia | ✓ | 6.50% | 6.50% | 5.12% | 5.12% | Indefinite |

| Wisconsin | 7.65% | 7.65% | 7.65% | 7.65% | 7.65% | |

| Wyoming | No tax | No tax | No tax | No tax | No tax | |

| District of Columbia | 8.95% | 10.75% | 10.75% | 10.75% | 10.75% | |

Notes: Rate reductions are displayed in bold and single-rate income taxes in italics. Kentucky and West Virginia have adopted revenue triggers that could theoretically see indefinite reductions in income tax rates, though Kentucky’s reductions must be affirmed by the legislature. Since 2021, New York and Wisconsin also cut middle-income rates but did not cut—and in New York’s case added—higher top marginal rates. * Arizona’s 8 percent top rate, approved by the voters in November 2020, was retroactively reversed by the legislature in 2021 and was never collected. † Tax applies to interest and dividends income only. § Tax applies to capital gains income exceeding $250,000 (single filers) or $500,000 (joint filers). Sources: Tax Foundation research; state statutes. |

||||||

In 2023, the business income tax rates in Nebraska and Utah were cut. At the same time, Arkansas got rid of its throwback rule, Mississippi made its expensing rule permanent, Montana raised the filing thresholds for nonresidents, Oklahoma got rid of its capital stock tax, and Tennessee got rid of its capital stock tax and cut its excise, franchise, and business taxes. Louisiana is still working on more big tax changes for businesses.

These ongoing changes are important, but they shouldn't come as a surprise. Many states are still getting more money in and expect to get more in the coming years. Nearly all states expect their money to stay well above what it was before the pandemic. Even though states have a lot of money, lawmakers are becoming more aware of how important it is for taxes to be competitive in a market where people are moving around more and more. Businesses and people are better able than ever to think about taxes when choosing where to live and work. In response, lawmakers across the country are making changes that are good for growth and good for taxpayers. The 2021-started trends are still going strong, and the story of 2023 isn't over yet.

Pro-Growth State Tax Reforms Enacted in 2023

Arkansas

S.B. 549 and H.R. 1045 were signed into law on April 10, lowering individual and business income tax rates and phasing out the throwback rule. These bills build on a number of changes made in recent years. The top marginal individual income tax rate in Arkansas dropped from 5.5% to 4.9% on January 1, 2022, and from 5.9% to 5.3% on January 1, 2023. The top marginal business income tax rate also dropped from 5.9% to 5.3%. With the cuts made this year, these rates will go down even more, bringing the top marginal rate for individuals to 4.7% and the top marginal rate for corporations to 5.1%. These changes will be made back to January 1, 2023. The throwback rule in Arkansas's corporate income tax law will be phased out by H.B. 1045, and it will be gone for good by 2030.

Indiana

Gov. Eric Holcomb (R) signed H.B. 1001 into law on May 4, 2023. This is the state's budget for fiscal years 2024 and 2025. The most important tax move in the budget is a provision to speed up reductions in individual income tax rates that had already been passed. Indiana's flat individual income tax rate went from 3.23 percent in 2022 to 3.15 percent in 2023 and 2024 because of a law that was passed in March 2022. Tax triggers were also set up so that the rate could go as low as 2.9 percent by 2029. The budget for this year lowers the rate to 3.05 percent in 2024 and gets rid of the tax triggers that were there before. Instead, it calls for the rate to go down to 3 percent in 2025, 2.95 percent in 2026, and 2.9 percent in 2027 and beyond.

S.B. 3, which was also signed into law on May 4, creates a "state and local tax review task force" to look at the state's short-term and long-term finances. The law tells the task force to look at several taxes, such as the individual income tax, the business income tax, the sales tax, the property tax, and local option taxes, such as local income taxes, taxes on food and drinks, and occupancy taxes. In particular, the law tells the task force to look into ways to "reduce or eliminate" the individual income tax, the tax on homestead properties, and the tax on business personal property. The law says that the task group must give a report with its findings and suggestions by December 1, 2024 at the latest.

Kentucky

In Kentucky, lawmakers quickly passed H.B. 1, which Gov. Andy Beshear (D) signed into law on February 17, 2023. This law lowers the flat individual income tax rate in Kentucky from 4.5 percent in 2023 to 4 percent starting in 2024. It makes official a change that was made by H.B. 8, which was passed in 2022.

Under the law from 2022, the individual income tax rate will go down by 0.5 percentage points in years when: 1) actual general fund tax collections exceed appropriations by at least the amount needed to lower the rate by 1 percentage point; 2) the Budget Reserve Trust Fund (rainy day fund) is funded to at least 10% of General Fund levels; and 3) the General Assembly makes the reduction official. With the passing of H.B. 360 in March 2023, the language of the trigger was changed to make it clearer, but the actual standards for the trigger have not changed. Recent rate cuts in Kentucky build on changes made in 2018 to make the state's tax system and competitiveness better. In our guide to tax reform choices for Kentucky, we give more suggestions for structural changes.

Louisiana

House Bill 171, which was signed into law on May 30, will make it easier for Louisiana to collect sales tax from remote sellers by changing the safe harbor provision for marketplace facilitators, getting rid of the 200-transaction threshold, which many other states have already done, and changing the $100,000 sales threshold from one that applies to gross revenue from all sales to one that only applies to gross revenue from retail sales. Other tax changes, like getting rid of the state's franchise (capital stock) tax, are still in the works and will be talked about later.

Michigan

The flat individual income tax rate in Michigan has gone down from 4.25 percent to 4.05 percent for 2023. This happened automatically because of a law passed in 2015 that said tax rates would go down starting in 2023 if general fund revenue grew faster than inflation. In March 2023, Attorney General Dana Nessel gave a formal opinion that said the rate would go back to 4.25 percent in 2024 and every year after that. This view has caused lawmakers and other interested parties to argue about what the 2025 law means and what it says. This could lead to a lawsuit. Click here to see how the Tax Foundation thinks about this decision.

Mississippi

During this session of the Mississippi legislature, important structural changes were made that built on recent rate cuts. House Bill 1733, which was signed into law on March 27, changes the way that business investments in tools and equipment are treated for income tax purposes by letting these investments be fully deducted in the year they are made. This is a big change for Mississippi, which didn't have anything like IRC 168(k)'s bonus depreciation limit before. With the passing of H.B. 1733, Mississippi joined Oklahoma as the second state in the country to offer permanent full expensing. Last year, Oklahoma passed a similar law. Other states, like the many that currently follow the federal 168(k) bonus depreciation allowance, should think about passing a permanent full expensing rule. This is because the federal bonus depreciation allowance is decreasing by 20% each year, so that in 2023, only 80% bonus depreciation will be available, 60% in 2024, 40% in 2025, 20% in 2026, and 0% in 2027.

Separately, H.B. 1733 makes it official that Mississippi allows 179 property to be written off in the first year, up to certain limits. Before, there was a 179 expensing provision in Mississippi's administrative code, but this law will make sure that those safeguards are written into the main law.

Montana

Montana was one of the states that cut income taxes in 2021. The top effective rate went from 6.9% in 2021 to 6.75 in 2022, and another cut to 6.5 percent was set to start in 2024. But on March 13, 2023, S.B. 121 was signed into law, which brought the rate down to 5.9% starting in 2024. On the same day, President Obama signed into law H.B. 221, which lowered the income tax rates for net long-term capital gains income. Long-term capital gains income is taxed at a sliding rate structure of 4.7 and 6.5 percent right now. On January 1, 2024, the rates will drop to 3 and 4.1 percent, respectively. On May 13, H.B. 212 was also signed into law. This bill raises the tax exemption for company equipment from $300,000 to $1 million.

Separately, H.B. 447 was signed into law on May 18. It exempts nonresidents who work in Montana for 30 days or less in a tax year and whose income for the previous year was less than $500,000 from having to file and pay individual income tax. This change will make it much easier for people to follow the rules, and it will also make it cheaper for the state to process low-dollar tax returns from nonresidents. The law, however, says that the safe harbor does not apply to famous athletes and entertainers, among other people.

Nebraska

In recent years, Nebraska has done a lot to make its taxes more competitive. This session, the state continued this work by speeding up and cutting individual and business income tax rates that were already in place. Legislative Bill 754, which was signed into law on May 31, 2023, will gradually lower Nebraska's top marginal individual and corporate income tax rates until they reach 3.99 percent in 2027. The first reductions will bring both rates down to 5.84 percent in 2024, which is three years sooner than was originally planned. Before, LB 873, which was passed into law in 2022, lowered both top marginal tax rates to 5.84 percent by 2027. This built on a law passed in 2021 that lowered the top marginal tax rate for corporations over two years.

This new law also changes Nebraska's graduated-rate income tax into a single-rate tax, which was one of the changes we suggested in our 2021 Nebraska tax reform choices guide, and it reduces Nebraska's four marginal individual income tax rates to three starting in 2026.

If everything goes as planned, Nebraska's top marginal business income tax rate will have been cut by almost half in six years, and its top marginal individual income tax rate will have been cut by almost 42 percent in five years.

North Dakota

After lawmakers looked at a number of different plans to lower individual income tax rates, Gov. Doug Burgum (R) signed H.B. 1158 into law on April 28. This bill makes a number of changes to taxes, the most important of which is lowering North Dakota's individual income tax rates. In particular, H.B. 1158 changes the current five-bracket system for the individual income tax, which has a top rate of 2.9%, into a more streamlined system with a top rate of 2.5%, a lower middle rate of 1.95 %, and a large zero bracket. These changes go back to the first of January 2023.

Oklahoma

On May 26, two important structural tax changes went into effect in Oklahoma even though the governor did not sign them. As of July 1, 2023, House Bill 1039 gets rid of the state's business franchise (capital stock) tax. House Bill 1040 gets rid of the marriage penalty in Oklahoma's individual income tax brackets. It does this by raising the bar for the top marginal rate to $14,400, which is twice what it is for single filers.

South Dakota

South Dakota, which doesn't have an income tax on individuals or businesses, passed a law this year to lower its sales tax rate. New Mexico did the same thing in 2022. H.B. 1137, which was signed into law on March 21, lowers South Dakota's state sales tax rate from 4.5 percent to 4.2 percent on July 1, 2023. This rate cut is unusual in that it is only temporary and only lasts for four years. It is set to end on June 30, 2027, but backers hope to make the provisions permanent before then.

South Dakota, like New Mexico and Hawaii, has a sales tax base that is too broad and includes too many things other than consumer goods and services. Because of this, consumers and companies will save money on all their taxable purchases thanks to this rate cut.

Some people in South Dakota, like the Republican governor Kristi Noem, wanted to create a sales tax exemption for groceries. However, lawmakers rejected this idea and instead voted for a rate cut that would help all taxable purchases. This was seen as a more neutral policy solution. But people who want groceries to be exempt from sales tax have already started collecting signatures to put the question on the ballot in November 2024 in the form of an initiated constitutional amendment and an initiated measure. To read about the economic and distributional arguments in favor of sales tax rate reductions over grocery exemptions, see our analysis here.

Tennessee

On May 11, Gov. Bill Lee (R) signed H.B. 323, which makes changes to the way taxes are set up. In particular, the law makes Tennessee the same as 168(k) as of January 1, 2023. This section gives firms that spend in qualified machinery and equipment bonus depreciation. From 2018 to 2022, the provision allowed full expensing, which is 100% bonus depreciation. However, starting this year, the provision is being phased out by 20% each year until it ends in 2027. As a result, Tennessee should think about making a fixed full expensing rule that is different from the one the federal government has.

Also, the new law raises to $50,000 the amount of business income that is not subject to the corporate income tax, which is called the excise tax in Tennessee. For the excise (corporate income) tax and the franchise (capital stock) tax, the new law moves away from a three-factor model with a triple-weighted sales factor and instead uses a single sales factor. In 2025, the change to a single sales factor will be complete. The franchise tax in Tennessee is based on a business's net worth or the book value of its real or personal property, whichever is higher. Under the new law, a company will not have to pay taxes on the first $500,000 worth of its real or tangible personal property when it is taxed based on the book value of its real or tangible personal property.

The law also reduces the number of companies that have to pay the statewide gross receipts tax, also known as the business tax, by raising the exemption threshold to $100,000 and lowering Tennessee's top business tax rate from 0.3 to 0.1875 percent.

Utah

Utah is another state that cut its income tax rates in 2022 and has now passed a law to cut them even more. S.B. 59 was signed into law in February 2022. It changed the income tax rates for both individuals and businesses in Utah from 4.95 percent to 4.85 percent, starting on January 1, 2022. This session, on March 22, 2023, H.B. 54 was signed into law, lowering both rates to 4.65 percent, starting on January 1, 2023.

West Virginia

After the House, Senate, and governor talked about tax reform for several years and for decades, H.B. 2526 was signed into law on March 7. It lowered all five of West Virginia's individual income tax rates, including lowering the top marginal rate from 6.5 percent to 5.12 percent. These rate cuts go back to January 1, 2023, and this is the first time since 1987 that West Virginia has cut individual income tax rates. The law also set up a set of events that, depending on how much money is available, could lower rates even more in the years after 2025.

Notable State Tax Reforms Still Under Consideration

Louisiana

Senate Bill 1, which was passed by both chambers on June 6, would gradually get rid of Louisiana's company franchise tax, which is a capital stock tax that hurts the economy. It would do this by building on a franchise tax cut that went into effect in 2021. In particular, beginning with the tax year 2025, the tax would go down by 25% every year that certain income goals are met. Here is more study of this plan by the Tax Foundation. The governor has to decide what to do with the bill.

House Bill 631 would get rid of Louisiana's complicated and bad for the economy throwout rule on January 1, 2024. This bill was passed unanimously by both houses and is now on the governor's desk. Lastly, Senate Bill 2, which is still in the Senate, would get rid of the unfair inventory tax over a period of five years, starting in 2024.

Massachusetts

Governor Maura Healey's (D) budget proposal for fiscal year 2024 includes a number of structurally sound tax reforms that would help the state regain some of the competitiveness it lost when Question 1 was passed in November 2022 and made the top marginal income tax rate for individuals 9 percent, which is one of the highest in the country. In particular, the governor wants to lower the income tax rate on short-term capital gains from 12 percent to 5 percent, making it the same as the rate on long-term capital gains and the rate that applies to most ordinary income. He also wants to make the estate tax less of a burden by raising the exemption and making a new estate tax credit to reduce the amount owed. Further analysis of these proposals is available here.

New Hampshire

Senate Bill 189, which has been approved by both houses, would separate the New Hampshire tax code from the federal net interest limitation in IRC 163(j). This would let businesses deduct all of their interest costs in the same year they happen. As part of the 2017 tax reform law, the federal limit on how much business interest can be deducted was put in place. This wasn't because Congress thought it was the best tax policy, but because it was a fair way to raise money to help pay for the 168(k) 100% bonus depreciation allowance. In an ideal world, states would let businesses subtract all of their costs in the year they happen.

The state budget (H.B. 2), which is waiting for a full vote from the Senate, also includes a faster phase-out of New Hampshire's tax on interest and bonus income, so that the tax will be gone by January 2025 instead of 2027.

New Jersey

Several pro-growth tax changes that would lower business taxes in the Garden State are being considered this session. Two similar bills, S. 3737 and A. 5323, would make a number of changes, including lowering the tax rate on Global Intangible Low-Taxed Income (GILTI) in New Jersey from 50% to 5%, as many other states have already done. In his budget proposal, Gov. Phil Murphy (D) said that the state's temporary 2.5 percent business tax increase should end as planned at the end of 2023. However, Senate President Nick Scutari (D) has said that he wants to keep it in place.

North Carolina

Both the House and the Senate have passed budgets with important tax changes. House Bill 259, which was passed on April 6, 2023, would cut the individual income tax rate to 4.5 percent on January 1, 2024, instead of the planned 4.6 percent. This bill would also add $250 to the standard deduction for single filers and $500 to the standard deduction for couples filing jointly. Earlier versions of the budget bill cut the franchise (capital stock) tax and got rid of the professional luxury tax. The Senate's plan would speed up cuts that have already been made, bringing the individual income tax rate down from 3.99 percent to 2.49 percent by 2027. The spending bill is in conference right now so that the gaps between the chambers can be worked out.

Rhode Island

This session, a bill is moving forward to make the Ocean State's taxes on physical personal property easier to pay. Senate Bill 928 would create a $100,000 exemption. Taxpayers with $100,000 or less in taxable tangible personal property would no longer have to file and pay these taxes, and businesses with more than $100,000 in qualifying property would no longer have to pay property taxes on the first $100,000 of taxable tangible personal property value. If it became law, about 85% of Rhode Island businesses wouldn't have to file and pay taxes on physical personal property anymore.

Wisconsin

As lawmakers work on the budget for the next two-year period that starts on July 1, it is expected that Wisconsin will end the current fiscal year with a budget surplus of $6.9 billion, which would be the biggest in the state's history. Because of this, tax cuts are likely to be a big part of the budget. However, the Republican-controlled senate and the Democratic governor, Tony Evers, have different ideas about how to cut taxes. Republican lawmakers have spent most of this session promoting different plans to phase in a single-rate individual income tax structure, starting with lowering each of the current rates. Gov. Evers, on the other hand, has said that he doesn't like the idea of a flat tax and instead wants to change some tax credits.

Also, after almost getting rid of the state's tangible personal property tax in 2021, lawmakers on both sides of the aisle seem determined to do so this session. Assembly Bill 245 was approved on May 17, 2023, and is now waiting for the Senate to look at it. This bill would get rid of all remaining taxes on tangible personal property starting with the property tax assessment on January 1, 2024.

Conclusion

The list of rate cuts and changes here is by no means complete. For example, several states, including Iowa, have passed laws to help keep property taxes from going up too much. Many states have also added exemptions, raised deductions, or made other policy changes that may help lower taxes. For states that are still in session, only a few pending proposals were highlighted because the future of many bills is unclear. For example, in Pennsylvania, the acceleration of corporate net income tax rate reductions and the improvement of net operating loss carryforwards are two bills that have uncertain futures. This look at the political scene does, however, cover the most important changes made this year and the most promising changes that are still in the works.

Tax reform will move at different speeds, and lawmakers' ability to lower rates will rest on how much money they bring in and how much they spend, but there will always be room for structural changes. In a time when more people work from home and have more freedom at work, more states should focus on policies that encourage investment, like permanent full expensing, and that make life easier for people who don't live there, like raising the filing and withholding levels. The work isn't done yet, but the changes made in 2023 show that lawmakers know what's at stake and that tax reform and tax relief are still high goals.