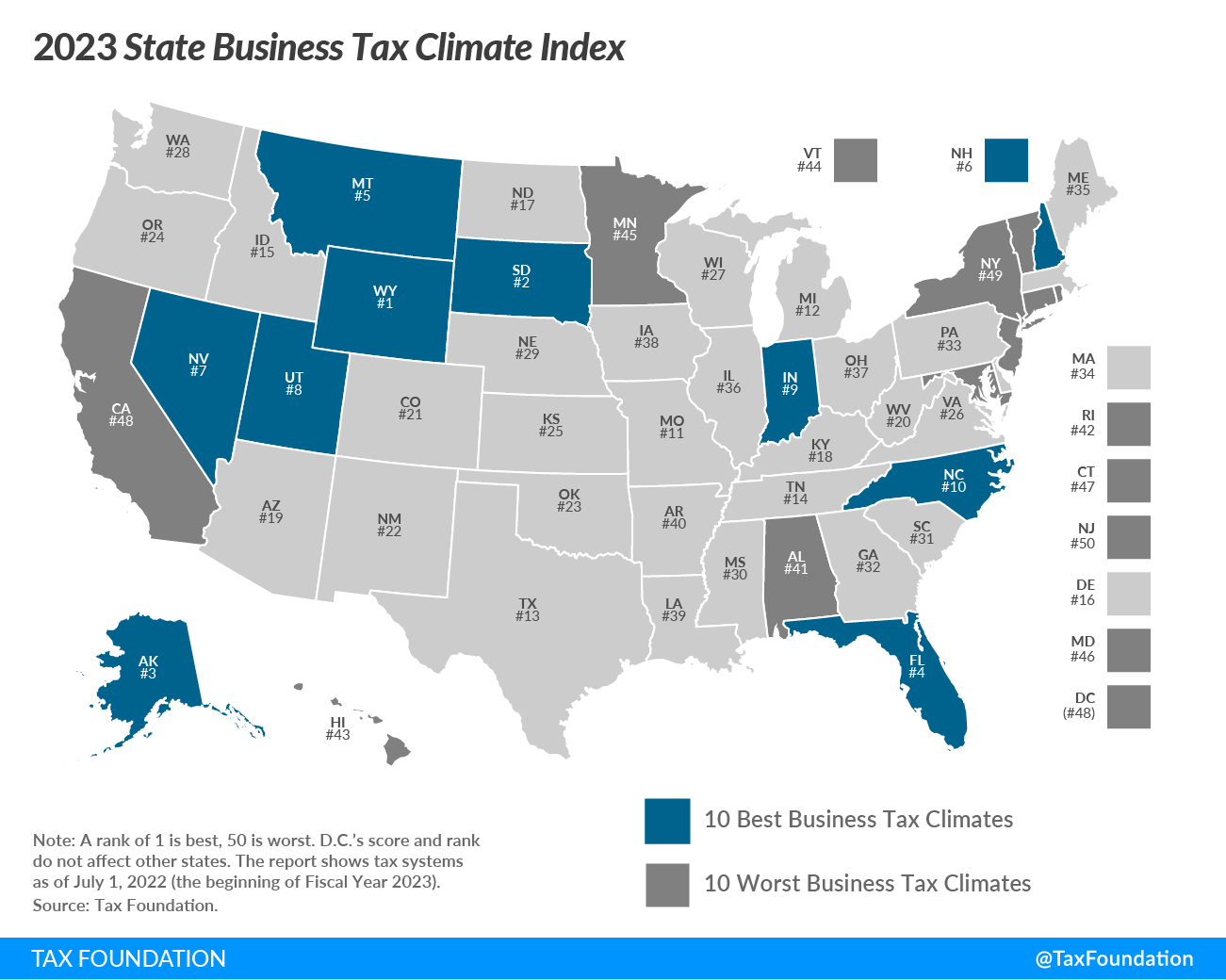

This week, we released our yearly State Business Tax Climate Index, which looks at how taxes are set up. Readers can compare state tax systems across more than 120 factors, making it a very useful diagnostic tool.

This study is different from most because it focuses on how to raise money instead of how much to raise. This is because there are better and worse ways to do it. But when the Index comes out, it always brings up some questions. For example, why aren't more companies moving to the Black Hills if Wyoming and South Dakota are at the top of the list?

A lot of the time, tax competition is like WAR—not war, but Wins Above Replacement. The word comes from baseball, where it is used as a sabermetric measure to see how many more wins a team can get because of a certain player than a replacement-level player would help them win. In the same way, a well-structured tax code won't turn the Wyoming Basin into a city, and a badly structured tax code won't turn Manhattan into a ghost town. But tax system does have an effect on how well or how poorly a state's economy does, and it's often a big one. A simple, fair, clear, and growth-friendly tax system can help every state.

There are five main parts of the Index that give each state a score. These are business taxes, individual income taxes, sales and excise taxes, property and wealth taxes, and unemployment insurance taxes. Each sub-index isn't given the same amount of weight; instead, its weight is based on how different states are in each category. This gives more weight to areas where states have more opportunities to fight.

Of course, it's hard to find problems with a tax that you don't have, which is why some states score perfectly on a sub-index or part of one by not having an income tax, a business income tax, or a sales tax. This is the reason why states that don't have income taxes, like South Dakota and Wyoming, do so well on the Index. If a state doesn't have to charge one or more of the major taxes, it may have to rely more on other major taxes (which can mean lower rankings on those factors), run on tighter budgets, use natural resources like oil and gas to their advantage, or have a population (like Florida) that makes other taxes bring in a surprising amount of money.

This means that the Wyoming model might not work in some states, but the models for Utah, North Carolina, and Indiana do.

In this year's Index, those three states came in at numbers 8, 9, and 10. All three also have all three of the big taxes, but they are all set up in pretty good ways and at moderate rates. Over the past 15 years, each state's tax code has been updated in a big way: Utah starting in 2006, Indiana starting in 2011, and North Carolina starting in 2013. These changes are still being made. For example, this year Indiana lowered its rates even more gradually. And North Carolina made changes to its income tax system that will make it more competitive for individuals and get rid of its corporate income tax completely in the long term.

The Index is a good place for people to start learning about how their state stacks up against others. But for policymakers and others who want to improve their state's tax code, it's more than that. It's a useful diagnostic tool, with tables that let readers compare their state to its peers on issues like throwback rules, how net operating losses are handled, and whether the individual income tax has a recapture provision, whether the tax brackets are indexed, and whether the state allows split-roll property taxation.

South Dakota would have a hard time if it had to follow New York's tax rules. There is no doubt that people are ready to pay more to live in New York. This is true for taxes, real estate, and consumer goods. There are, however, boundaries, and a system that works fine in Manhattan might be a lot harder to deal with in Syracuse. And, as New York's governor has said many times, tax loads and tax structures do matter, even in states like New York—and maybe even more so in states like New York right now, as the economy recovers from the pandemic. New York actually did much better in the corporate part of the Index a few years ago, thanks to real corporate tax reforms that were passed by both parties.

Yes, we have heard your questions about whether we are really saying that companies would rather be in Mitchell, South Dakota than Manhattan or Sioux Falls than San Francisco. It's clear that location choices are based on a lot more than just taxes, rates, or structure. Taxes, on the other hand, are something that lawmakers can change, and there are good and bad ways to raise taxes within a certain revenue goal.

Businesses care about a lot of things besides tax structure, but the Index only looks at tax structure. It doesn't look at things like an educated workforce, quality of life, proximity to important markets, or even the weather. Some of these things have trade-offs. And taxes are a big part of the mix. Bringing a state's tax system up to date helps it get ready for growth. The tax codes of states that do better on the Index are better organized, and states that have better organized tax codes get First Place.