It's not a secret that people who make a lot of money try to hide it from the IRS. How and where they do it, though, is often a secret.

Playing hide-and-seek with Uncle Sam

No one likes to pay taxes. So, no matter how much money you make, it can be a good idea to look for new tax breaks. But sometimes, people who are very rich go to great lengths to avoid paying taxes. Lawrence Summers, a former secretary of the Treasury, and Natasha Sarin, a professor of finance, just put out a research paper with some surprising claims. Summers and Sarin say that between 2020 and 2029, the top 1% of taxpayers will avoid paying more than $5 trillion in taxes. Rich people use legal ways to cut their taxes, so it makes sense to look into them and use them when you can. But it's not a bad idea to learn about the illegal ways as well, so you can stay away from them and the problems they might cause.

Business deductions

Rich people often try to lower their tax bills by starting a business (or several businesses). But Jon Dulin, who started Money Smart Guides, says that you don't have to be rich to use this method. This could be a good choice if you've been thinking about starting your own business or making a side gig official. You have to go through the right channels first, though: Most of the time, all you have to do to make a legal business entity is go to the websites of your Secretary of State and the IRS.

When you start your own business, one of the benefits you may be able to enjoy is tax breaks. Dulin says, "First, you can write off the business's early losses and then use business expenses to offset business income to lower your taxable income." "You can also put money into tax-deferred accounts like solo 401(k) plans, which let the business owner save a lot more than traditional 401(k) plans because you contribute as both the employer and the employee."

Hiring family members

Getting the family involved is another way the rich try to keep their income from being taxed. If you have a business, you can also use this strategy to your advantage by hiring your spouse or your children and paying them a salary. The IRS even says that hiring family members is one of the perks of running your own business. So, how exactly does this help you? Dulin says, "Your business gets a write-off, and [your spouse or child] can put the money into accounts that let them pay taxes later." These accounts may help keep the money from being taxed even more." Just make sure to follow the rules, like taking out any payroll taxes that you need to.

Vacation homes

Realtor and founder of Bucks & Cents Bryan Vance says that vacation homes are another way that rich people may choose to hide money from Uncle Sam. Vance says, "Now that the standard deduction has gone up, a lot of homeowners no longer itemize common expenses like mortgage interest on their main home." If you choose to itemize, you can only claim up to $10,000 in state and local income taxes and property taxes. "But that's not the case if you choose to rent out your vacation home," says Vance. If you rent out your vacation home for less than 14 days a year, you usually don't have to pay taxes on the rent you get. If you rent the house out for more than 14 days a year, you can write off some of the costs (mortgage interest, property taxes, maintenance, depreciation, etc.).

Real estate tax deferment

Rich people may use another tool to help them pay less to the IRS when they sell an investment property, like a vacation home. Jim Wang, the founder of Best Wallet Hacks, explains how a 1031 Exchange may help you put off paying capital gains taxes when you sell an investment property. Wang says that if you buy a "like-kind" property, you can put off capital gains from the sale of investment real estate. "This delay makes sense because you're trading one investment for another, so the IRS lets you put off the gains."

If you don't want to pay taxes on your gains right away, you'll need to do a 1031 Exchange. "Eventually, you will have to realize those gains, but until then, you can keep exchanging and growing your real estate portfolio without having to pay taxes after every sale," Wang says. At the moment, you can take advantage of this special tax break as many times as you want.

Life insurance

Permanent cash value Rich people also put their money in life insurance, like whole life insurance or universal life insurance. Chris Abrams, who started Abrams Insurance Solutions, says that life insurance is a great way to avoid the tax and market risk that comes with other assets or investments. "The government does not set limits on contributions, like they do with 401(k)s and other qualified plans," Abrams says. He also says that if you take money out of your life insurance policy, you can do so as a tax-free loan against the death benefit of your policy. "Since it is a life insurance policy, if something unexpected happens, there is still a death benefit."

There is always a chance of something going wrong. If you die while still owing money on a loan you took out against your life insurance policy, the insurance company will take the amount you still owe out of your death benefit before giving the rest of the money to your beneficiaries. Also, if you borrow more than you paid in as premiums, you may have to pay income tax on that money.

Offshore accounts

Offshore bank accounts in places like the Cayman Islands, Switzerland, and Singapore are well-known ways for the rich to hide their money. Pedro Nicolaci da Costa wrote for Business Insider that the ultra-rich are hiding around 10 percent of the world's GDP (gross domestic product) in offshore tax havens. These tax havens, which often let the rich avoid paying their fair share of taxes, can make income inequality worse in the U.S. and around the world. And here's something that should make you think: By 2017, the difference between rich and poor in the United States was about the same as it was during the Great Depression. Offshore accounts are not illegal in and of themselves, but they become illegal when they are used to avoid paying taxes.

Shell companies

You've probably heard of "shell companies," but what exactly are they? A "shell company" is a business that doesn't do anything or have any big assets. Even so, shell companies are sometimes legal, even though they are shady. For example, if an American company wants to run factories in another country, it might set up a "shell" company. But they often step over the line. With something like an anonymous shell company, a business or person can hide their assets from the IRS, law enforcement, a spouse, creditors, and more. Americans for Tax Fairness, a non-profit group, says that shell companies and other tax loopholes help U.S. companies avoid paying up to $90 billion in taxes to the IRS every year. People can get into trouble with the law because of taxes.

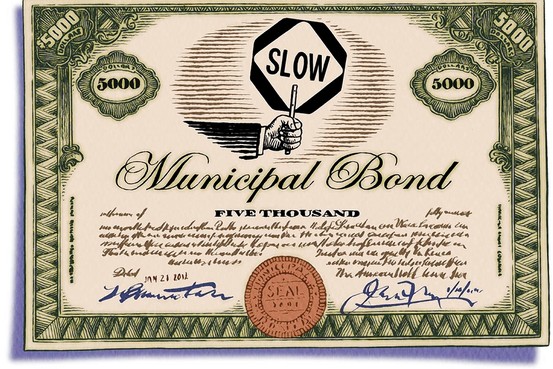

Municipal bonds

Even if you don't believe it, buying government bonds is a common and legal way for the rich to avoid paying taxes. "Local, state, and federal governments all sell municipal bonds to pay for big projects like building a new school, highway, or public park," says Drew, the founder of SimpleMoneyLyfe.com. "Municipal bonds are safe investments that pay a good interest rate. However, the very wealthy often buy them because the interest they earn is almost never taxed by the federal government." Municipal bonds can also be bought by people with lower incomes and net worths, but most of the time it's better to find a taxable bond with a higher return rate. If you have questions about how to invest your money, talk to your financial advisor.

Sparkling assets

Natalie Pine, a certified financial planner and managing partner at Briaud Financial Advisors, explains how some dishonest rich people try to cheat the IRS by using a shady method. The first step in this illegal plan is to buy expensive jewelry. Pine says, "I've heard of people buying diamonds and giving them to their children without filing a gift tax return or an estate tax return." "They are small things that can be moved without being noticed. There are no specifics on the list that the IRS could use to dispute it, unless they audit the person or couple." Of course, Pine would never tell anyone to break the law in this way to avoid paying taxes. "Let me be clear," she says, "we have never done this, and we do not suggest that you do."

Donor-advised funds

People know that giving to charity can help others and lower your taxes at the same time. Donor-advised funds (DAFs) are a more advanced way to give to charity that can give you even better tax breaks. "Donor-advised funds are like a personal savings account for charity that the rich use," says Scott Henderson, who created SimpliFinances and is a certified financial counselor. "The money you put into a DAF is tax-deductible, and it has to go to a charity at some point. For instance, you could put $10,000 into a DAF this year and get a tax break right away. But you could leave the money there until 2030 and then give it to a charity of your choice. When you put money into a DAF, it no longer belongs to you. But it has the chance to grow over time, which could make it possible for you to give even more in the future.