The federal deficit this year is the biggest in U.S. history, excluding years when there were pandemics.

The Congressional Budget Office (CBO) says that the federal deficit grew to about $2 trillion in fiscal year (FY) 2023. This is about $1.1 trillion more than the previous year, when the effects of the administration's plan to cancel student loans that the Supreme Court threw out in June are taken into account. The only years with bigger deficits were 2020 and 2021, with $3.1 trillion and $2.8 trillion, respectively.

From FY 2022 to FY 2023, Social Security payments went up 11%, from $1.2 trillion to $1.3 trillion. Medicare payments went up 18%, from $751 billion to $846 billion, and Medicaid payments went up 4%, from $592 billion to $616 billion. From $534 billion in FY 2022 to $711 billion in FY 2023, interest payments on the debt rose by 33%. From $727 billion to $774 billion, defense spending went up by 7%. Next year, interest on the debt will be higher than spending on defense if this rate of growth keeps up.

It took in $4.4 trillion in taxes in FY 2023, which is $455 billion less than the record $4.9 trillion it took in the previous year. The biggest drop was in individual income taxes, which went from $2.2 trillion to $456 billion, or 17%. This was mostly because capital gains taxes went down as the stock and home markets crashed. "Higher-than-anticipated claims" of the Employee Retention Tax Credit are another issue brought up by CBO. This is a program from the pandemic era that started a small industry until the IRS stopped new claims last month because of a lot of fraud. This year, people got $129 billion more in income tax returns than last year, which is a 52% rise.

Payroll taxes, on the other hand, rose by 9% to $1.6 trillion in FY 2023, which was due to more jobs and higher wages.

Even though the new minimum tax on book income and the stock buyback tax were put in place as part of the Inflation Reduction Act (IRA) last year, corporate income taxes stayed about the same, going down by $5 billion, or 1%, to $420 billion. The Joint Committee on Taxation (JCT) said the new taxes would bring in about $40 billion in FY 2023, but the IRS has put off enforcement until more information is made public because of problems with execution. The IRA also gave 22 green energy tax credits, and some of them can be claimed by businesses. According to the most current estimates from JCT, these credits will cut tax revenue from both businesses and individuals by about $15 billion in FY 2023.

In FY 2023, other income dropped $124 billion, or 35%, to $232 billion. The main reason for the drop is that the Federal Reserve sent almost no money back (from $107 billion in FY 2022 to less than $1 billion in FY 2023) because higher interest rates meant that the central bank had to pay more in interest than it earned (the Federal Reserve pays interest to banks and other institutions on their reserve balances). Because fewer goods were coming in, customs fees also went down by $20 billion.

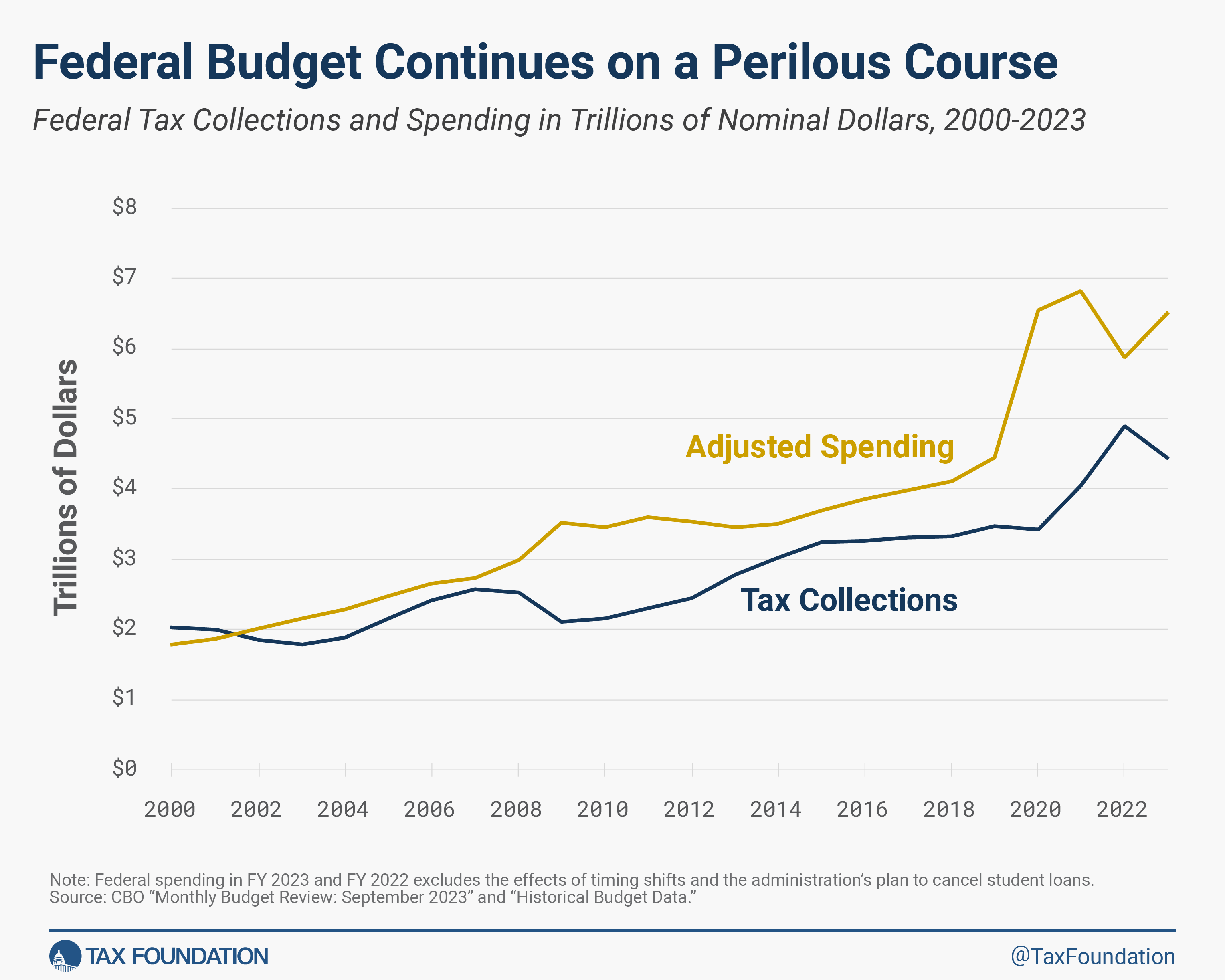

In conclusion, the government budget is still going in a bad direction. Since 2019, before the pandemic, tax revenue has gone up about 28%, but spending has gone up about 46%, and the debt has more than doubled to $2 trillion. Over the next few years, annual deficits will get close to $3 trillion, and interest costs will take up a bigger and bigger chunk of the government budget. This fiscal year, interest costs have already reached the highest amount since 1996: 16% of all money brought in. The bond market is sending signals that interest rates could go up a lot, which would make paying off debt much more expensive than ever before. Our leaders should come up with a clear plan for how to deal with the debt issue right now, before it turns into an emergency.