Can a group really be called a 'nonprofit' if it makes money most of the time? Also, if that group's main source of income is 'business income,' can it still be called a 'charity'?

These are the questions that politicians should ask the more than 218,000 groups and organizations that have been named 501(c)(3) tax-exempt nonprofits.

(And that comes from a nonprofit group; Tax Foundation is set up as a 501(c)(3).)

According to the IRS, tax-exempt 501(c)(3) nonprofits have never been in better financial shape than they are now. According to the most recent data, gifts to charity brought in a record amount of money in 2019. This was true both in nominal terms and when inflation is taken into account.

Total income, which includes government funds and program service income, also hit all-time highs. Now, all the money that nonprofits make adds up to 12% of the GDP.

According to statistics from the IRS, the nonprofit sector has only had one year of deficits in the 31 years between 1988 and 2019. That year was 2008. Over the last 30 years, sector balances have been an average of $110 billion per year when inflation is taken into account.

And the number of tax-exempt nonprofits has slowly grown over the last 30 years, rising from 124,233 in 1988 to 218,516 in 2019. That's an increase of almost 100,000 new organizations. It's clear that the business seems to be very strong.

TCJA Did Not Cause a Slump in Charitable Giving

Some members of Congress and leading charitable organizations want an above-the-line charitable deduction because they think that the 2017 Tax Cuts and Jobs Act (TCJA) took away the tax benefits of giving to charity. This is despite the fact that nonprofits have been making record amounts of money and "profits" lately.

Supporters say that the nearly doubling of the standard deduction by the TCJA has made people less likely to give to charity. The number of taxpayers who had to itemize their taxes dropped from 38 million in 2017 to 15 million in 2018, a 60% drop. This was because the standard deduction became more valuable. Supporters are worried that because fewer people file their taxes, fewer people are motivated to give to charity by the tax break.

IRS statistics shows that this is not true. In numbers that take inflation into account, the table next to it shows that both total donations to charity and total income from nonprofits were higher in 2018 and 2019 than they were in 2016. Some might point out that people gave less to charity in 2018 than they did in 2017. But 2017 was different because a lot of people gave more to charity to take advantage of the higher income tax rates before the TCJA lowered them the next year. At most, 2017 shows a change in giving from the future to the present. It's not a point of comparison for gifts made after the TCJA.

A more true comparison would be to 2016, the year before the TCJA was made law. In fact, donations to charities in 2019 are 11% higher than they were in 2016. This definitely isn't a drop in donations because the standard deduction went up.

Key Financial Data for 501(c)(3) Nonprofit Organizations: Before and After the 2017 Tax Cuts and Jobs Act

| (in Billions of Constant 2021 Dollars) | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| Total Revenues | $2,419 | $2,569 | $2,532 | $2,608 |

| Government Grants | $204 | $207 | $204 | $240 |

| Charitable Contributions | $275 | $290 | $279 | $305 |

| Program Service Revenue | $1,747 | $1,831 | $1,838 | $1,846 |

| All Other Revenues (Rents, Interest, Investments, etc.) | $193 | $242 | $210 | $216 |

| Total Expenditures | $1,747 | $1,831 | $1,838 | $1,846 |

| Surpluses (+)/Deficits (-) | $126 | $183 | $124 | $152 |

Source: IRS, https://www.irs.gov/statistics/soi-tax-stats-charities-and-other-tax-exempt-organizations-statistics. Author adjusted figures for inflation using CPI-U.

Thirty Years of Nonprofit Growth

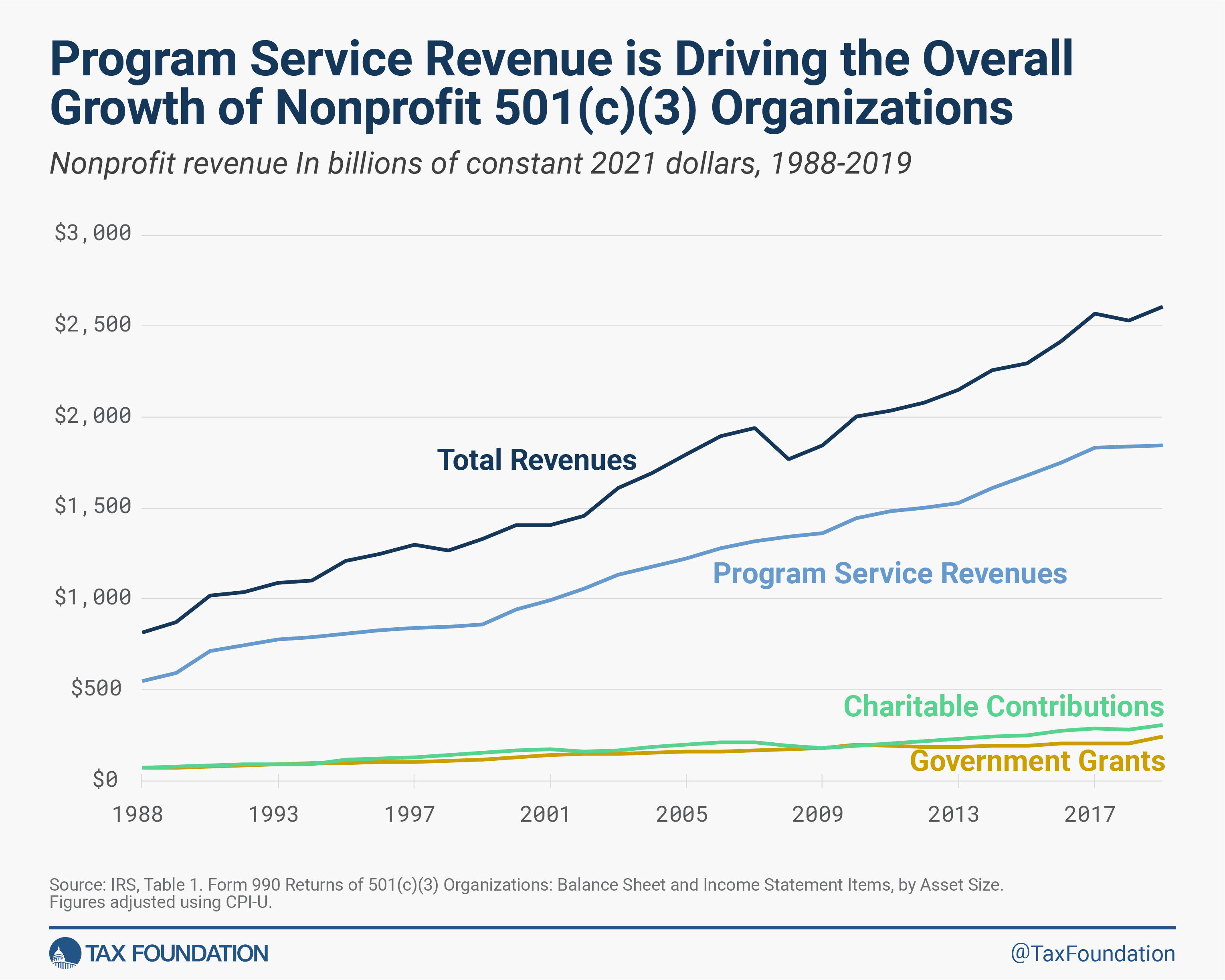

IRS records show that groups that don't have to pay taxes have done very well over the last thirty years. The chart below shows that between 1988 and 2019, real donations to charities grew by more than 300 percent, from $74 billion to $305 billion. This was more than three times the growth in government funds. Over the years, charitable donations have gone up and down with the market, but the trend has been upward, even though the tax code has changed a lot during that time.

The graph clearly shows that total donations to nonprofits have also grown over the past 30 years, going from $812 billion in 1988 to more than $2.6 trillion in 2019, which is a 221% rise. In terms of both nominal and inflation-adjusted numbers, 2019 is by far the best year for nonprofits to make money in the last thirty years.

The Real Story is Growth in Program Service Revenues

When people argue about the charity deduction, one thing that supporters forget to mention is how little money nonprofits get in donations compared to how much they depend on program service fees.

Program service revenues come from a lot of different places, like tuition, medical bills paid for by Medicare and Medicaid, ticket sales, broadcast rights, meeting fees, and government contracts. Nonprofits don't have to pay federal income taxes on almost all of this kind of money.

Over the past 30 years, nonprofits' overall income has grown from $548 billion to more than $1.8 trillion, which is an increase of 310 percent. The chart next to it shows how the growth in program service revenues has caused this growth.

Seventeen percent of nonprofits' income came from program services in 2019, up from six seven percent in 1988. It was the best year for program service revenues when they made up 76% of all charity revenues in 2008.

In spite of what most people think of as charitable organizations, program service fees, which were once called "business receipts," have been their main source of income for decades. The Government Accountability Office (GAO) looked at the competition between tax-exempt organizations and taxable businesses in 1987. They found that in 1946, "business receipts" made up 46% of all 501(c)(3) organizations' income, while gifts made up 36%.

We don't have comparable data for "business receipts" for the years in between, but other than donations, revenues (mostly program service income) continued to grow into the 1980s, while donations as a share of total nonprofit revenues fell. By 1975, donations were only making up 27% of income, and by 1982, they were only making up 18%. By 2019, donations to charities made up 1 in 4 of nonprofits' income.

Nonprofit Hospitals and Private Universities are Big Businesses

When you look deeper into the numbers, you can see that most of the money made from program services comes from private universities, health care systems, and hospitals that are not for business.

Because the 2019 IRS charity data is available through the Center for Charitable Statistics Data Archive at the Urban Institute, nonprofits can be put into 26 different groups, spanning fields from technology and social science to arts and culture.

By far, the biggest type of charity is a hospital, which made almost $1 trillion in 2019. In addition, health care services brought in a total of $375 billion, and mental health facilities brought in an extra $40 billion. More than half of all charity income came from the health care sector, which brought in more than $1.4 trillion. In 2019, the sector had a net income (profits after taxes) of more than $62 billion.

About 90% of the health care sector's income came from program services, which brought in almost $1.3 trillion. If these groups were for-profit businesses, they would have to pay 21% tax on every net dollar they make.

In 2019, private colleges made more than $294 billion in sales. Almost 70% of that was from program service sales like tuition, tickets, and other business-like income. This doesn't include the more than $3 billion that college sports leagues like the National Collegiate Athletic Association (NCAA) and the Big 10 Conference bring in. These groups get almost all of their money from selling broadcast rights to TV and radio networks. If these groups were for-profit businesses, these profits would be taxed.

The Issue: $2.6 trillion in Mostly Untaxed Income

Of course, some nonprofits say they don't make any money like businesses do and only get money from gifts. That being said, even this income is not taxed because the tax code gives a deduction to the donor and doesn't tax the money the group gets. It's called "double non-tax income" in the tax world because the money isn't taxed at either the person or the business level.

The Urban Institute's dataset also lists a number of big groups, some with incomes of more than $1 billion, that do research, consulting, and analysis for both government agencies and for-profit businesses. This income is also not taxed because the companies' payments for services are tax-deductible as business costs and are not taxed at the level of the group. The government doesn't have to pay taxes on its money, of course.

A small amount of a nonprofit's income is taxed if it has nothing to do with its main goal. This is known as "unrelated business income." But the rules for what counts as "unrelated business income" are so strict that not many charities actually pay it. The most recent data we have shows that about 40,000 501(c)(3) organizations recorded gross unrelated business income of $10.5 billion in 2017, but only net income of $1.7 billion. After taking out costs, only about 24,000 groups paid about $469 million in taxes on that money.

We need to rethink everything about the 501(c)(3) nonprofit industry. First, the figures show that the sector is doing well financially, which makes the case that it needs a bigger tax break for giving to charity less strong. Second, letting nonprofits make billions of dollars in income without paying taxes while competing with for-profit businesses is unfair and changes what it means to be a charity. That's not at all what Congress meant when it made the nonprofit label in the first place.