If the Supreme Court ruled that the Department of Education is inherently unconstitutional, that would be the only way they could put an end to forgiveness.

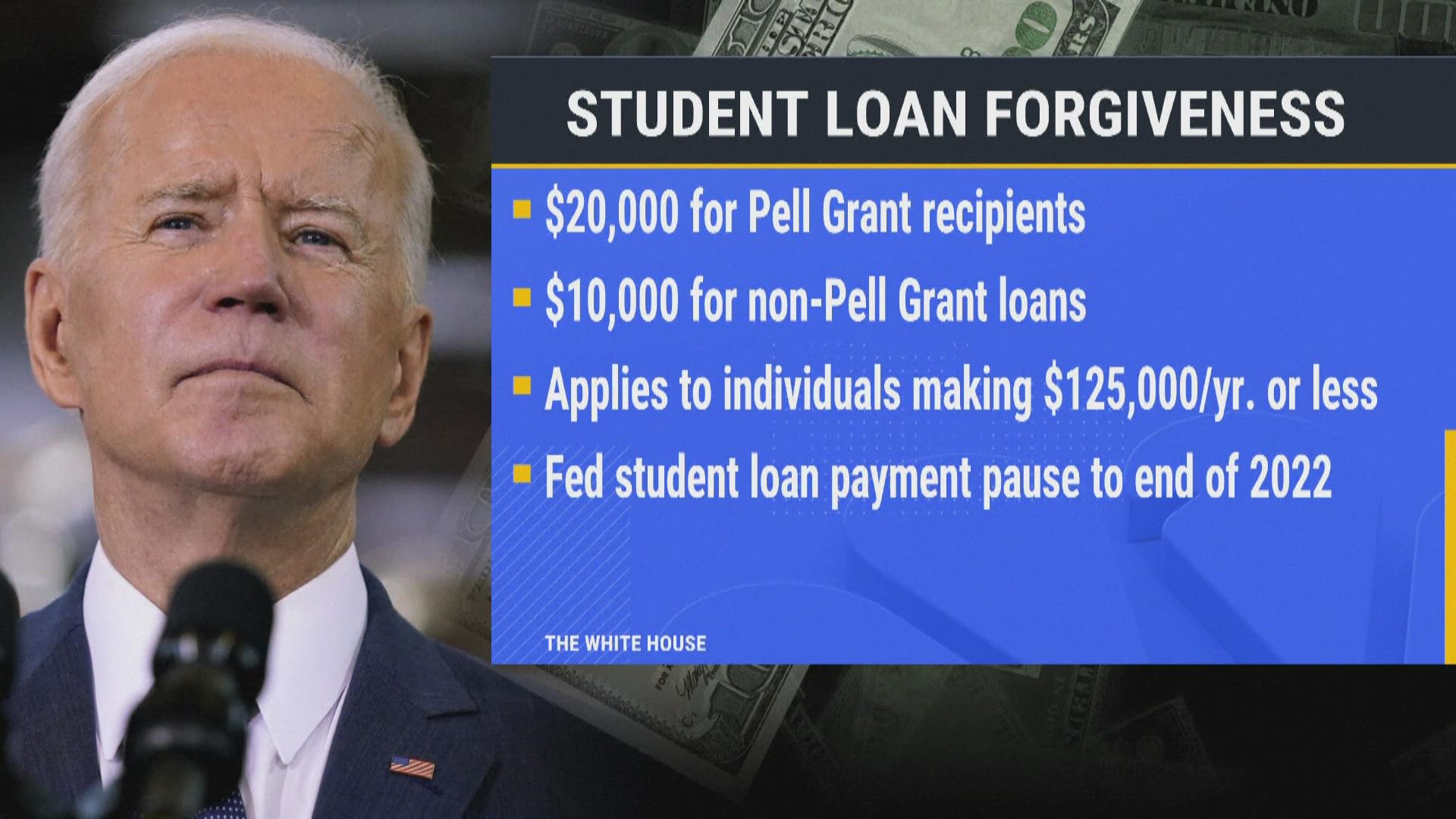

The Supreme Court rejected the Biden administration's plan for student loan forgiveness last week, which called for the forgiveness of $10,000 to $20,000 in loans for each borrower. However, the battle for loan forgiveness isn't going away.

In a previous piece for FEE, I discussed how the president Trump's freeze on interest accumulation has led to the beginning and acceleration of student debt forgiveness. The real cost of taking out a loan decreased, despite the fact that this may not be as obvious as a $10,000 lesser balance or frozen interest.

This brings to light a straightforward truth about student loan forgiveness: the Biden administration has already done so and can do so going forward. They even have plans in place to execute it.

The Biden administration made their response known almost immediately after the Supreme Court's judgment was made public.

The launch of a new student loan repayment plan, the SAVE plan, was arguably the Department of Education's most significant news.

The present REPAYE scheme has been modified by the SAVE plan. These two programs are regarded as income-driven repayment (IDR) programs.

Although IDR plans are complex, they effectively set a monthly payment cap based on a borrower's income. The calculations for the payments are based on how close to the poverty line the borrower's income is.

According to Fox Business, someone earned 225% of the federal poverty level will now have their income totally protected from payments under the Department of Education's new regulations. Therefore, borrowers making $32,805 per year or a family of four making $67,500 per year will be forced to make 0 payments.

Even borrowers who qualify for a SAVE plan and earn more than those amounts will experience decreased payments.

But hold on, won't low or nonexistent payments result in these loans' interest rates spiraling out of control? Nope. For the purpose of preventing rising loan balances, the administration has set an interest rate cap. How much could someone anticipate to pay on a student loan with a $0 minimum payment and no interest accruing? It is clear that this is merely shadow forgiveness.

Also, it doesn't end here. Borrowers who made payments for 20 to 25 years were already eligible for loan forgiveness under IDR policies. Accordingly, borrowers under Biden's new SAVE plan who have a tiny payment will gradually see their amounts go away based on the current regulations.

Therefore, if a borrower is approved for a $100 monthly payment and makes payments for 20 years, the total repayment would be $24,000 (even if the present value were to be ignored). Therefore, if a person had a $50,000 student loan, they would have received a $26,000 forgiveness. That dwarfs Biden's pledge of a $10,000 forgiveness, which was quashed by the courts.

Furthermore, if borrowers work for the government or a nonprofit organization, they may be eligible for even greater forgiveness. After just 10 years of payments, the Public Service Loan Forgiveness (PSLF) program forgives loans for those who hold eligible positions in the public and nonprofit sectors. That would boost forgiveness to $38,000 of the $50,000 in the prior scenario.

The Cost of Our Student Loan System

The expense of this complicated shadow forgiveness mechanism ought to be kept to the amount of the forgiveness (which is eventually covered by taxpayers). However, that is not the complete price.

This system's distortion of the incentives that influence career decisions for future generations may be its worst flaw. The Biden Administration's new initiatives will further worsen the current system, which encourages and rewards people for taking on large student loan debt to pursue low-value careers.

Even worse, the new repayment structure worsens the usage of PSLF, which pushes workers to pursue wealth-extracting public sector positions rather than value-creating private sector jobs.

What world-improving products would have been produced if people had been allowed to pay for their own education? These gains will mostly go unnoticed, à la Bastiat.

However, many people will receive clear, immediate benefits from these initiatives, making it difficult to terminate them.

Therefore, while some have hailed the Supreme Court ruling as finally putting an end to loan forgiveness, I'm not nearly that bullish. Loan forgiveness is but a few administrative tweaks away as long as the Department of Education retains administrative control over the nation's student loan system.

The Department of Education itself being deemed unconstitutional at this stage would be the only route for the Supreme Court to take action. But I don't think this will ever occur. Regrettably, the administrative state always seems to get away with it.