In the president's plan, there are new and higher taxes on employers, investments, and pay, as well as higher taxes on employers.

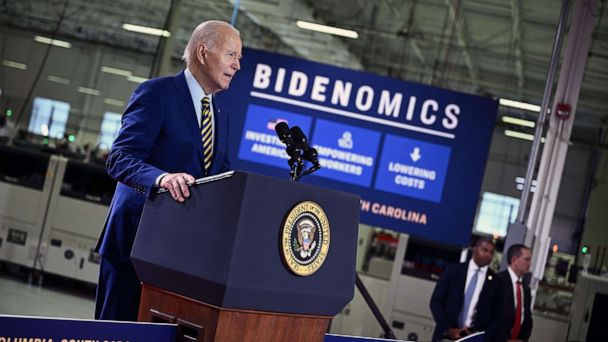

"Bidenomics" is the new name that President Joe Biden gave to his plan for a more involved federal government that wants to have a bigger say in private business decisions, training for the workforce, and consumer choices.

"Our plan is working," he said, pointing to recent strong job growth, constantly low unemployment, and progress on bringing inflation down from its highs in 2022. Some of this power is being exaggerated. Still, the growth of the economy has so far surprised many experts.

No matter what you think about the current economy and what caused it, the unsaid truth of Bidenomics is that the part of his plan that's "working" is all the alcohol (more than $5 trillion in new deficit spending) and none of the hangover. Biden's plans to raise taxes by $4.7 trillion are nowhere to be found.

We can't judge Bidenomics without taking into account how much the president's tax hikes cost. The new and increased taxes would slow down the progress that has been made since the pandemic and add to the other costs of active industrial policy that have been known for a long time.

In the president's plan, there are new and higher taxes on employers, investments, and pay, as well as higher taxes on employers.

A key part of Bidenomics is raising the company income tax rate by seven points, to 28%. This would undo the historic progress made when Congress cut America's business tax rate from the highest in the developed world to a bit above average. After the tax cut, investment, wages, and jobs all went up. If businesses have to pay more in taxes again, it will slow down investment and job growth.

When state taxes are taken into account, Bidenomics would mean that the highest business tax rate in the U.S. would be about 32%. The average rate in the Organization for Economic Cooperation and Development, which includes some of the United States' biggest trade partners, is 23%. In China, it's 25%.

Most of the cost of a rise in company taxes is usually passed on to workers in the form of lower wages, not to investors or consumers. Less investment and slower growth in output cause wages to go down.

Bidenomics also calls for raising the top income tax rates and doubling the taxes on capital gains. These higher taxes are aimed at the money that successful entrepreneurs make when they take risks to build high-return businesses that give us everyday ideas that we often take for granted.

If capital gains were taxed at the suggested higher wage tax rate of 39.6% and the Obamacare investment tax was raised from 3.8% to 5%, the top combined state and federal capital gains rate in the U.S. would be above 50%. That's more than twice as high as the rate that maximizes income and more than 30 points higher than the OECD average (19%).

These estimates don't include taxes on top of the already high rates, like a 4% stock buyback tax, a new unrealized capital gains tax on millionaires and estates, new taxes on investment managers, limits on retirement accounts, higher taxes on real estate investments, new taxes on cryptocurrencies, and higher taxes on businesses that compete abroad.

Even though the president's budget is based on optimistic assumptions about the economy, his tax hikes are still not enough to stabilize the amount of government debt as a share of the economy. Automatic spending programs like Medicare, Medicaid, and Social Security will continue to grow at a rate that can't be kept up for the next few decades. Even with the president's tax plan, the debts would reach 9% of the gross domestic product by 2053, which is only 1% less than what they are now.

Bidenomics would fall apart after the most active parts of the economy were hit with tax hikes that had never been seen before. Slower growth, less economic innovation, fewer jobs, and rising government debt will not bring back the American dream. Instead, they will lead to financial ruin.

-------