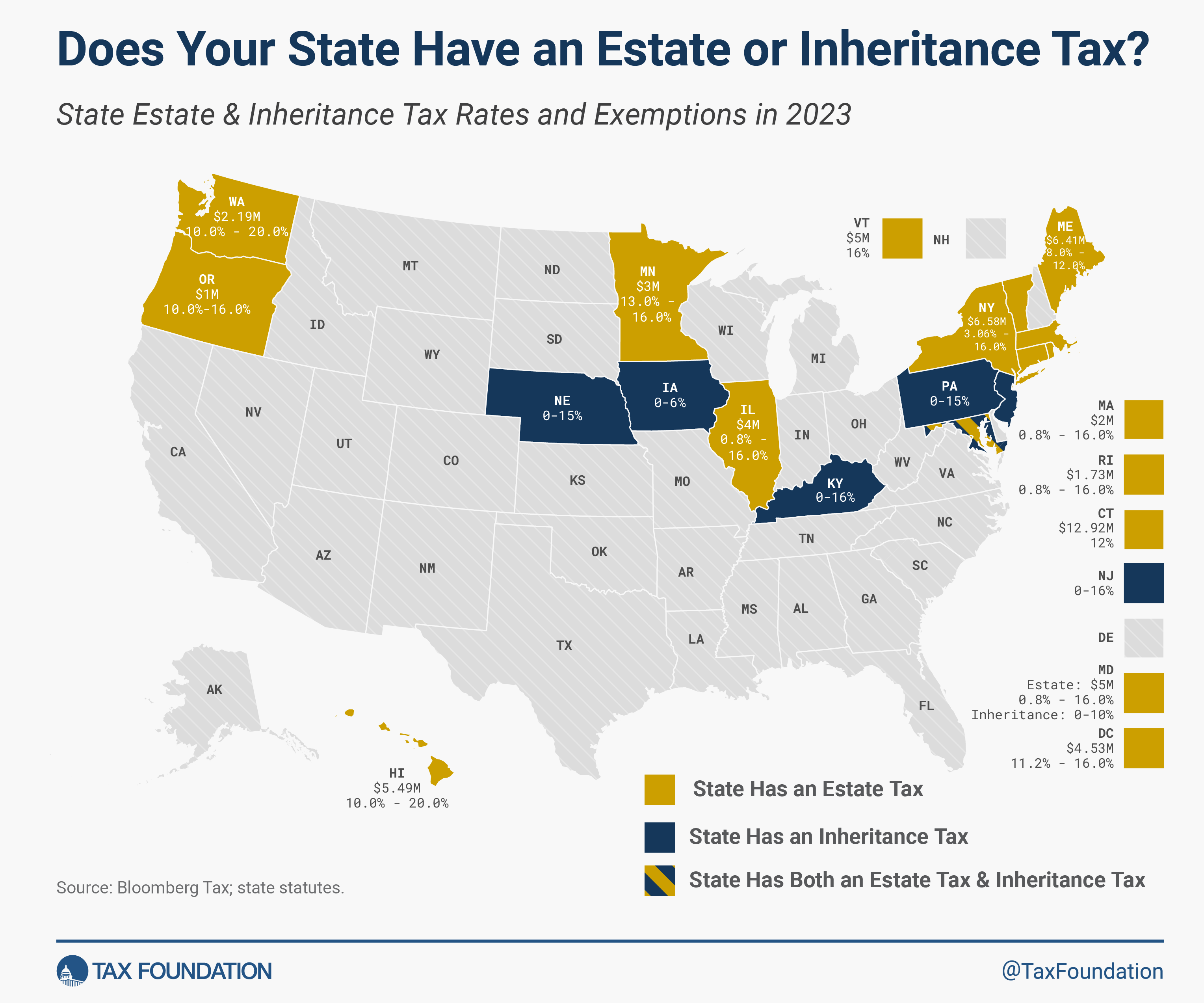

Some states also have their own estate taxes or transfer taxes on top of the federal estate tax, which has a top rate of 40%. There are estate taxes in 12 states and the District of Columbia, and transfer taxes in 6 states. Maryland is the only state that has both a succession tax and an estate tax.

Estate taxes are put on the total amount of an estate because they are paid by the estate before any assets are given to heirs. Inheritance taxes are paid by the person who receives a gift, so they are based on how much money was given to each beneficiary.

Most states have progressive estate taxes, which means that the tax rate goes up as the amount of the estate goes up. Only Connecticut and Vermont have a flat estate tax, which means they only charge one tax rate. At 20%, Hawaii and Washington have the highest top rates in the country. The next top rate is 16% in eight states and the District of Columbia. All fifty states have allowances that keep smaller estates from having to pay these taxes. The exemption amount in Massachusetts is only $1 million, while the exemption amount in Connecticut is $12.92 million.

There are estate taxes in six states. The top rates in Kentucky and New Jersey are the highest, at 16%. Iowa is slowly getting rid of its inheritance tax. It will be gone completely in 2025, and the highest amount of the tax will be 6% in 2023. Spouses are exempt in all six states, and some states exempt close cousins in whole or in part. See below for a list of state estate tax rates and state transfer tax rates.

The federal government started giving a big federal credit for state estate taxes in 1926. This meant that people paid the same amount in estate taxes whether their state had an estate tax or not. This made estate taxes a good choice for states. When the federal government ended the state estate tax credit completely, some states stopped collecting estate taxes automatically because their laws were linked to the federal credit. Other states, in response, got rid of their tax by passing a law.

The federal government raised the estate tax exemption from $5.49 million to $11.18 million per person as part of the Tax Cuts and Jobs Act of 2017. It has since started to increase this amount to inflation, and in tax year 2023, it will be $12.92 million. However, this change will no longer be made after December 31, 2025. At first, some states agreed to this higher exemption, but all but Connecticut have since broken away from it, giving fewer exemptions than the federal government allows.

Most states have either gotten rid of estate or transfer taxes or raised the amount of money that is not taxed. This is because these taxes make states less competitive and give people, especially rich people, reasons not to pay them. Delaware got rid of its death tax at the start of 2018. At the same time, New Jersey ended phasing out its estate tax. It now only has an inheritance tax. Vermont finished gradually raising the allowance in 2021, raising it from $4.5 million in 2020 to $5 million that year. Maine raised its estate tax exemption from $6.01 million to $6.41 million in 2023, while Connecticut finished moving in an increase to its exemption, bringing it in line with the federal estate tax exemption, and switched to a flat tax rate at the same time.

Iowa is getting rid of its estate tax slowly by lowering its rates by an extra 20% each year from the base rates until 2025, when the tax will be gone for good. In 2020, the highest rate was 15%. In 2023, it will be 6%, a 60% drop. Beginning in 2023, Nebraska lowered its estate tax rates and raised exemption amounts for different types of heirs. The top rate dropped from 18% to 15%.

In the District of Columbia, the estate tax deduction went from $5.8 million to $4 million in 2021, but the bottom rate went from 12 percent to 11.2 percent at the same time. After taking inflation into account, the limit was raised to $4.53 million for 2023. Massachusetts most recently passed a law on October 4th that, among other things, raises the state's estate tax exemption from $1 million (which was tied with Oregon for lowest) to $2 million starting in 2023 and going forward.

It is also possible for other states to make changes. Several plans have been put forward in Oregon and Illinois to raise the estate tax limit to $12 million or more. This conversation is likely to go on.

It's hard to pay estate and transfer taxes. They make investments less likely and can push wealthy people out of the state. In addition, they lead to estate planning and tax avoidance plans that don't work well for individuals or the economy as a whole. The few states that still have them should think about getting rid of them gradually or at least matching the federal levels of immunity.

Does Your State Have an Estate or Inheritance Tax?

State Estate & Inheritance Tax Rates and Exemptions in 2023

| State | Estate Tax Exemption | Estate Tax Rates | Inheritance tax Rates |

|---|---|---|---|

| Connecticut | $12,920,000 | 12% | |

| Hawaii | $5,490,000 | 10.0% - 20.0% | |

| Illinois | $4,000,000 | 0.8% - 16.0% | |

| Iowa | 0-6% | ||

| Kentucky | 0-16% | ||

| Maine | $6,410,000 | 8.0% - 12.0% | |

| Maryland | $5,000,000 | 0.8% - 16.0% | 0-10% |

| Massachusetts | $2,000,000 | 0.8% - 16.0% | |

| Minnesota | $3,000,000 | 13.0% - 16.0% | |

| Nebraska | 0-15% | ||

| New Jersey | 0-16% | ||

| New York | $6,580,000 | 3.06% - 16.0% | |

| Oregon | $1,000,000 | 10.0%-16.0% | |

| Pennsylvania | 0-15% | ||

| Rhode Island | $1,733,264 | 0.8% - 16.0% | |

| Vermont | $5,000,000 | 16% | |

| Washington | $2,193,000 | 10.0% - 20.0% | |

| District of Columbia | $4,528,800 | 11.2% - 16.0% |

Notes: Exemption amounts are shown for state estate taxes only. Inheritance taxes are levied on the posthumous transfer of assets based on the relationship to the decedent; different rates and exemptions apply depending on the relationship. CT's exclusion now matches the federal exemption. Iowa is phasing out its inheritance tax, with full repeal scheduled for 2025.

Sources: Bloomberg Tax; state statutes