Tax cuts were passed in 43 states in 2021 or 2022, and often in both years. Of these, 21 states cut their income tax rates. It's a very interesting trend that is being driven by strong state revenues and a more competitive tax situation. But many people thought this trend couldn't or shouldn't last until 2023.

It can. It ought to. Yes, it will.

Lawmakers in more than a dozen states are seriously thinking about cutting income taxes for individuals in 2023. In many states, these plans would either speed up rate cuts made in the last two years or add to them. Not all, though. Kansas, North Dakota, Virginia, and West Virginia could join the group. This could mean that in three years, half of the states (and 25 of the 43 that tax some kind of income) will have cut their individual income tax rates.

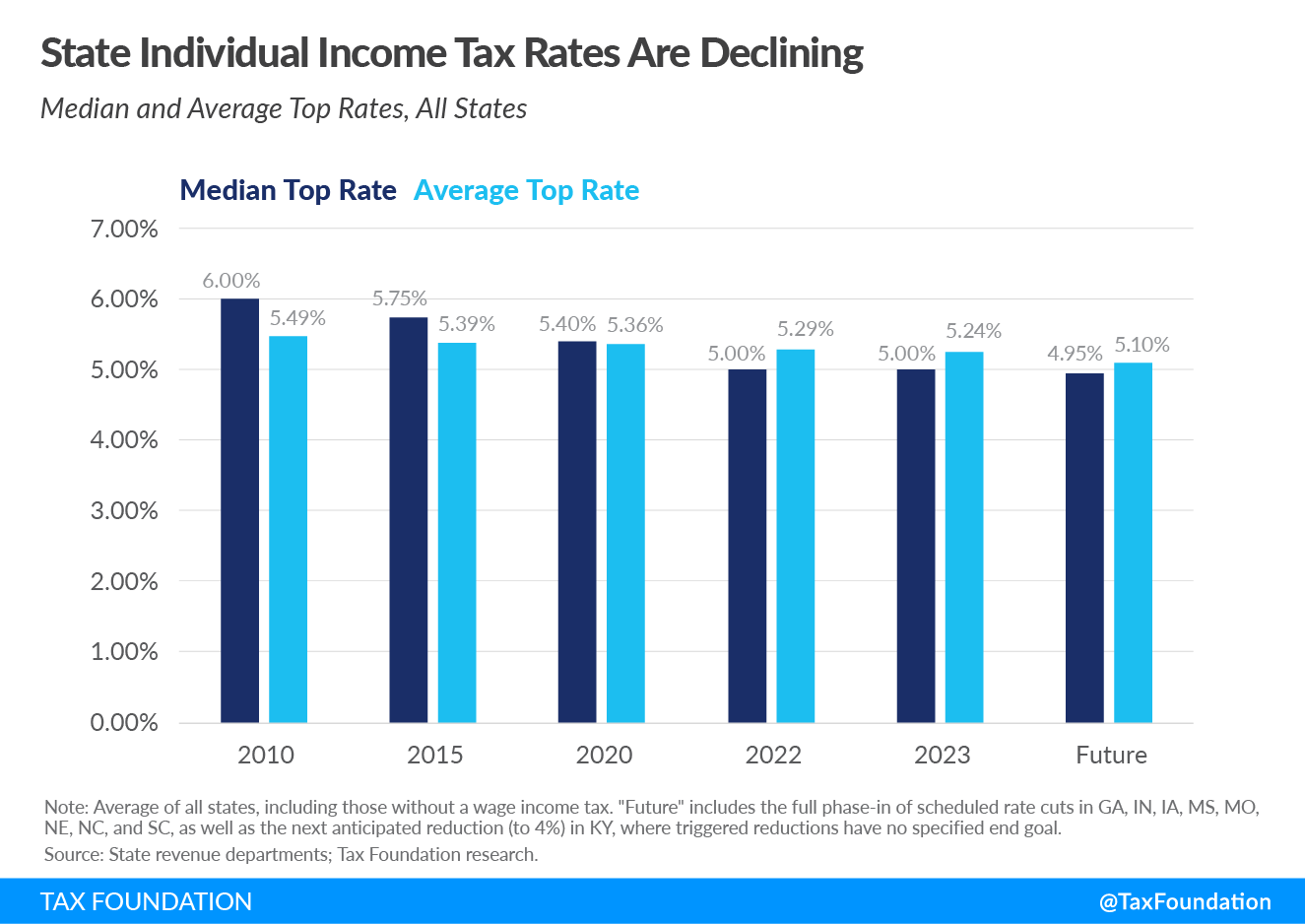

After accounting for inflation, state tax collections were 9.3 percent higher in 2022 than they were in 2017. This was true even though the top income tax rate in 17 states was lower in 2022 than it was in 2017, not to mention that other state taxes and business income taxes were also cut. (Four had higher top individual income tax rates in 2017.) The top individual income tax rate in the middle state went from 5.5 percent in 2017 to 5.0 percent in 2022. At the same time, real tax collections went up by 9.3 percent.

These are taxes collected by the state, not money made by the state. During the pandemic, the federal government helped some state governments, but that help is not included in the list. Indirectly, though, the unique circumstances of the pandemic did raise state tax revenues. This was because consumer behavior changed—sometimes temporarily, but not always—and because businesses and people who got help from the federal government did more taxable things. States have been smart in figuring out how much of their own-source revenue growth is reliable and can be used to lower taxes. They have also been right to realize that some of their own-source revenue gains are temporary.

But it would be wrong to think, as some people do, that the bigger tax collections were just a fluke. They had been going up for a long time before the pandemic, and most experts say that states have more money coming in now than they did six years ago. The Tax Cuts and Jobs Act (TCJA) increased domestic spending and made it easier for people to pay their taxes. Most of the big changes in the economy over the past few years have led to higher taxes. And, sadly, and unfairly, inflation has made taxes more expensive, not just in nominal terms but also in real terms.

![List of states by income tax rate - See all 50 of them [with interactive map]](/uploads/2023/04/11/states-income-tax-rates.png)

In other words, most states have enough money to cut taxes. And in a world where people are becoming more flexible and have more options than ever before about where to live and work, some can't really afford not to.

No one knows for sure if a recession is coming, but we do know that states are making more money than they used to. Also, the states that didn't take advantage of tax cuts aren't just sitting on their money. They've just decided to put the extra money they make into new (often recurring) spending projects instead of giving some of it back to taxpayers.

In total, the 12 states that are known to be thinking about cutting income taxes this year, including the eight that have already done so, expect that this coming fiscal year's tax collections will be 9.1% greater (when adjusted for inflation) than they were before the pandemic. Some states, like Utah (32.3%), Idaho (24.2%), and Arkansas (18.7%), are looking at especially big wins. Even so, FY 2025 might be better. Some of these states haven't released their forecasts for FY 2025 yet, but for those that have, real tax income is expected to have grown by 11% since before the pandemic.

The states' "rainy day" funds, on the other hand, have never been better stocked, and many states have big reserves. Idaho, for example, expects to have a surplus this year that is equal to 40 percent of its yearly tax collections before the pandemic.

So it makes sense that Arkansas, Georgia, Idaho, Indiana, Kansas, Kentucky, North Dakota, Oklahoma, Utah, Virginia, West Virginia, Wisconsin, and possibly other states are thinking about lowering income taxes.

And it's even more surprising that in a different group of states, the tax talk is about creating new and higher taxes on wealth, investment, and entrepreneurship. These tax proposals don't seem to have anything to do with real or perceived revenue needs, and they usually don't even have anything to do with new spending plans. More and more, states are giving taxpayers and businesses a choice between jurisdictions that see growing revenues as a reason to cut taxes and increase their competitive edge and those that are focused on raising taxes regardless of whether they need to or how much it hurts the economy.

After two years of tax cuts and changes, states seem to be going in different directions by 2023. Their choices will probably make more people move to places with more competitive tax environments and help those states grow their economies faster.