The majority of state budgets for roads and infrastructure in the United States are financed by gasoline taxes. The historical justification for this makes sense. Since more people use public roadways, they need more gasoline, the gas tax is a wisely constructed user fee.

A fixed tax per gallon is frequently applied to the gas tax. The volume basis for the tax and the general reliance of individuals on gas for transportation have made the gas tax a reliable source of money for roads, even if the commodity price of oil can change dramatically. In addition to discouraging driving, gas taxes also have the side effect of reducing pollution and traffic congestion.

The gas tax's capacity to finance infrastructure improvements and reduce traffic congestion, however, is diminishing as the number of electric vehicles (EVs) on the road rises. Despite the growing demand for road infrastructure investments, real tax revenue per vehicle mile traveled at the federal and state levels has been steadily declining for decades. This has left a fiscal deficit for road spending.

Compared to conventional cars with combustion engines, EVs emit fewer emissions. State governments have responded with a range of tax measures, combining the budget deficit with a desire to encourage lower-emission automobiles.

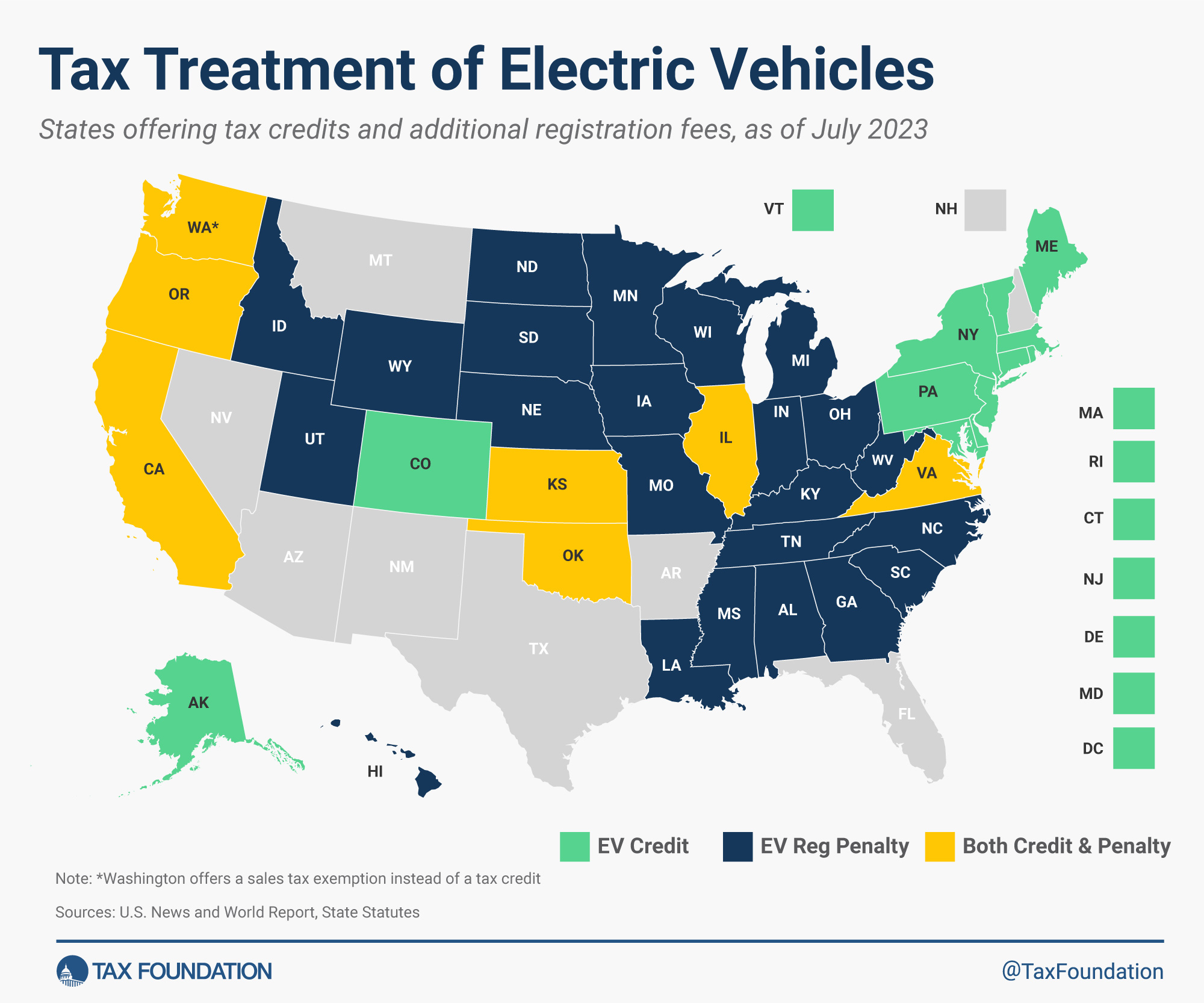

The various strategies used by states to encourage the adoption of electric vehicles and to impose higher registration fees on EV owners are shown in the accompanying map.

For approved EV purchases, residents of all states are entitled for a $7,500 federal tax credit. Beyond the federal credit, nineteen states provide extra incentives ranging from $1,000 in Alaska and Delaware to a $7,500 credit in California, Connecticut, and Maine.

In contrast to a tax credit, 24 states levy a higher annual vehicle registration cost on EVs and some hybrid vehicles to compensate for lost gas tax revenue. Fees in Hawaii and South Dakota range from $50 to $200, whereas in Ohio, West Virginia, and Wyoming they are $200.

Five states provide an incentive to buy an EV and charge a higher registration cost for EVs than for combustible-engine automobiles. The table below outlines the specifics of these policies.

States have also implemented a charge on EV charging stations to compensate for declines in gas tax collections. The following are six recent state laws aimed towards EV charging stations:

Georgia will require stations to track kilowatt-hour usage and collect a tax for every 11 kilowatt-hours (effective January 2025). Iowa imposes a $0.026 per kilowatt-hour tax on public EV charging stations (effective July 2023). Kentucky will impose a tax of $0.03 per kilowatt hour on electric vehicle power distributed by an electric power dealer (effective January 2024). Montana imposes a tax of $0.03 per kilowatt hour or its equivalent on electric current from public electric vehicle charging stations (effective July 2023). Public charging stations already in operation have until July 2025 to install meters to collect the tax. To relieve the tax burden on in-state electric vehicle owners, B. 55 reduces electric vehicle registration fees by 30 percent starting in 2028. Oklahoma will implement an electric vehicle charging tax (effective November 1, 2023). Utah imposes a tax on retail sales of electric current from electric vehicle charging stations (enacted March 2023).

Higher registration costs and EV charging station levies are attempts to better relate vehicle miles traveled (VMT) to transportation and road financing, although they are sometimes put at odds with policies aimed at encouraging EV use. A VMT tax would be a simpler transportation policy approach.

A VMT tax is imposed on the number of miles driven by a single vehicle. While the administration of the tax raises privacy problems, it has the potential to directly correlate kilometers driven to public road and infrastructure spending.

The Surface Transportation System Funding Alternatives Program (2015) and the Infrastructure Investment and Jobs Act (2021) both granted funds for states to launch VMT pilot programs. Utah has already implemented an annual per-mile road usage tax for EVs in lieu of the EV registration fee, and Hawaii will do so in July 2025.

The expanding transportation sector and the pressing need to address both fiscal shortages in road funding and environmental issues are reflected in the state EV taxation scenario. As the EV market evolves and technology progresses, these tax policies are expected to shift as well.

State Electric Vehicle Tax Credits and Registration Fees, in US Dollars

| State | EV Purchase Tax Credit | Additional EV Annual Registration Fee | Additional Hybrid Annual Registration Fee |

|---|---|---|---|

| Alabama | 0 | 200 | 100 |

| Alaska | 1,000 | 0 | 0 |

| Arizona | 0 | 0 | 0 |

| Arkansas | 0 | 200 | 50-100 (a) |

| California | 750-7,500 | 108 | 0 |

| Colorado | 5000 | 51.88 | 0 |

| Connecticut | 750-7,500 | 0 | 0 |

| Delaware | 1,000-2,500 (b) | 0 | 0 |

| Florida | 0 (c) | 0 | 0 |

| Georgia | 0 | 213.7 | 0 |

| Hawaii | 0 | 50 | 0 |

| Idaho | 0 | 140 | 75 |

| Illinois | 4,000 (b) | 100 | 0 |

| Indiana | 0 | 150 | 50 |

| Iowa | 0 | 130 | 0 |

| Kansas | up to 2,400 | 60-70 | 20-30 |

| Kentucky | 0 | 120 | 60 |

| Louisiana | 0 | 100 | 60 (d) |

| Maine | Up to 7,500 (e) | 0 | 0 |

| Maryland | 3,000 (f) | 0 | 0 |

| Massachusetts | Up to 3,500 | 0 | 0 |

| Michigan | 0 | 145 | 52.5 (d) |

| Minnesota | 0 (g) | 75 | 0 |

| Mississippi | (c) | 150 | 75 |

| Missouri | 0 | 105 | 52.5 |

| Montana | 0 | 0 | 0 |

| Nebraska | 0 | 75 | 0 |

| Nevada | 0 (c) | 0 | 0 |

| New Hampshire | 0 (c) | 0 | 0 |

| New Jersey | Up to 4,000 (b) (h) | 0 | 0 |

| New Mexico | 0 | 0 | 0 |

| New York | Up to 2,000 | 0 | 0 |

| North Carolina | 0 | 140.25 | 38.75 |

| North Dakota | 0 | 120 | 50 |

| Ohio | 0 | 200 | 200 |

| Oklahoma | Up to 5,500 | 110 | 82 |

| Oregon | Up to 5,000 (b) (e) | 76-91 | 0 |

| Pennsylvania | Up to 3,000 | 0 | 0 |

| Rhode Island | Up to 2,500 | 0 | 0 |

| South Carolina | 0 | 60 (i) | 30 (i) |

| South Dakota | 0 | 50 | 0 |

| Tennessee | 0 | 100 | 0 |

| Texas | 0 | 0 | 0 |

| Utah | 0 | 130.25 (j) | 56.5 (j) |

| Vermont | Up to 4,000 | 0 | 0 |

| Virginia | 2,500 | 120 (k) | 0 |

| Washington | 0 (l) | 150 | 75 |

| West Virginia | 0 | 200 | 100 |

| Wisconsin | 0 | 100 | 75 (d) |

| Wyoming | 0 | 200 | 0 |

Notes:

(a) There is a $50 fee for standard hybrid, $100 fee for plug-in hybrid.

(b) Offers a rebate, not credit.

(c) There are local credits and/or rebates

(d) For plug-in hybrid vehicles only

(e) Varies by income level

(f) For purchase price under $50,000.

(g) The state offers an E-Zpass incentive (one time credit of $250 for full electric and $125 for plug-in hybrids)

(h) The EV purchase is exempt from sales tax. The rebate is $25 per mile of EPA-rated all-electric range up to $4000.

(i) Biennial supplmental license fees of $120 and $60, respectively.

(j) Instead of the EV fee, users can pay a road usage fee of 1 cent per mile driven.

(k) Fee is a function of average number of passenger vehicle miles driven in state

(l) Purchase is exempt from sales tax.

Source: U.S. News and World Report, State Statutes