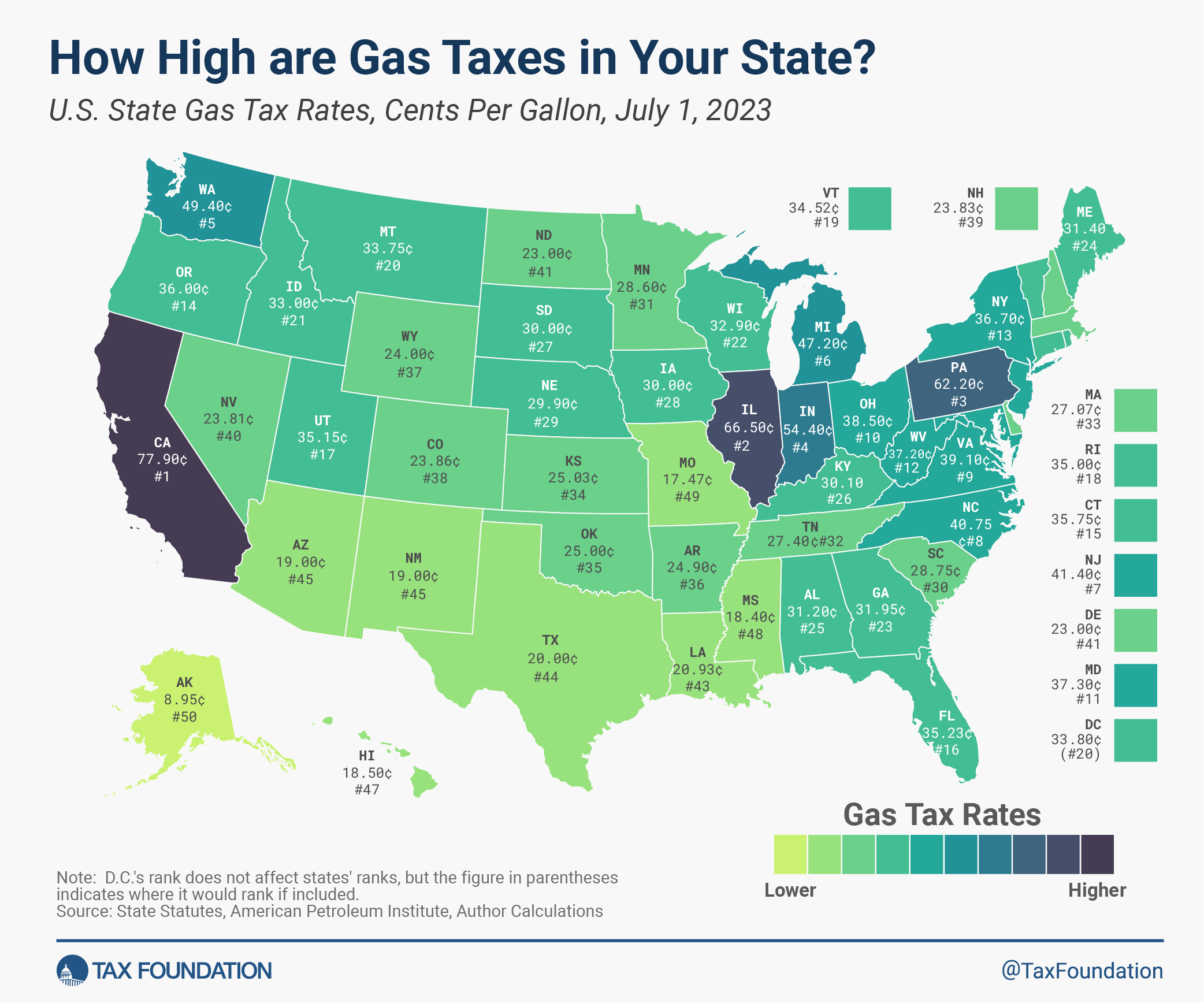

Many Americans notice fuel taxes during the hot summer driving season. This map shows how much each state will charge for gas in July 2023.

States tax fuel in a number of ways, including sales taxes, per-gallon excise taxes collected at the pump, taxes on wholesalers (which are passed on to consumers in the form of higher prices), and a number of operational taxes, such as fees for underground storage tanks, that are often charged to the retailer.

We add up all of these taxes and fees (except for carbon fees) to figure out how much gas costs in each state as a whole. The map below shows how different the tax rates are in each U.S. state.

At 77.9 cents per gallon (cpg), California has the highest gas tax rate in the country. Illinois (66.5 cpg) and Pennsylvania (62.2 cpg) are next on the list. At 9.0 cents per gallon, Alaska has the lowest gas tax rate of any state. Missouri is next at 17.5 cents per gallon, and Mississippi is last at 18.4 cents per gallon.

Even though most people don't like paying fuel taxes, these methods work well as "user fees." This idea in public finance is a fee that the government charges to cover the cost of the services it provides. In general, drivers gain from the things that their gas taxes pay for, such as building, maintaining, and fixing roads. Gas taxes make drivers aware of how much it costs to keep roads in good shape. This makes people use the roads more efficiently, which helps reduce traffic and the wear and tear that comes from too much use.

But many states haven't adjusted their rates for inflation. This means that the real value of gas tax money isn't keeping up with what the country needs to spend on infrastructure. Gas taxes also have a smaller base because cars use less gas and more people are driving electric cars. One long-term answer would be to tax vehicle miles traveled (VMT) so that drivers pay for the roads they use. All 50 states have VMT pilot projects that are still going on.