The tax map from last month shows how different U.S. states tax smoking and electronic nicotine delivery systems (ENDS). When vaping and ENDS goods are taxed more, smokers are less likely to switch to them.

Since vaping hit the U.S. market about 20 years ago, it has become a well-known product category and a good option to smoking. Vaping goods have been taxed as of now by 31 states and the District of Columbia.

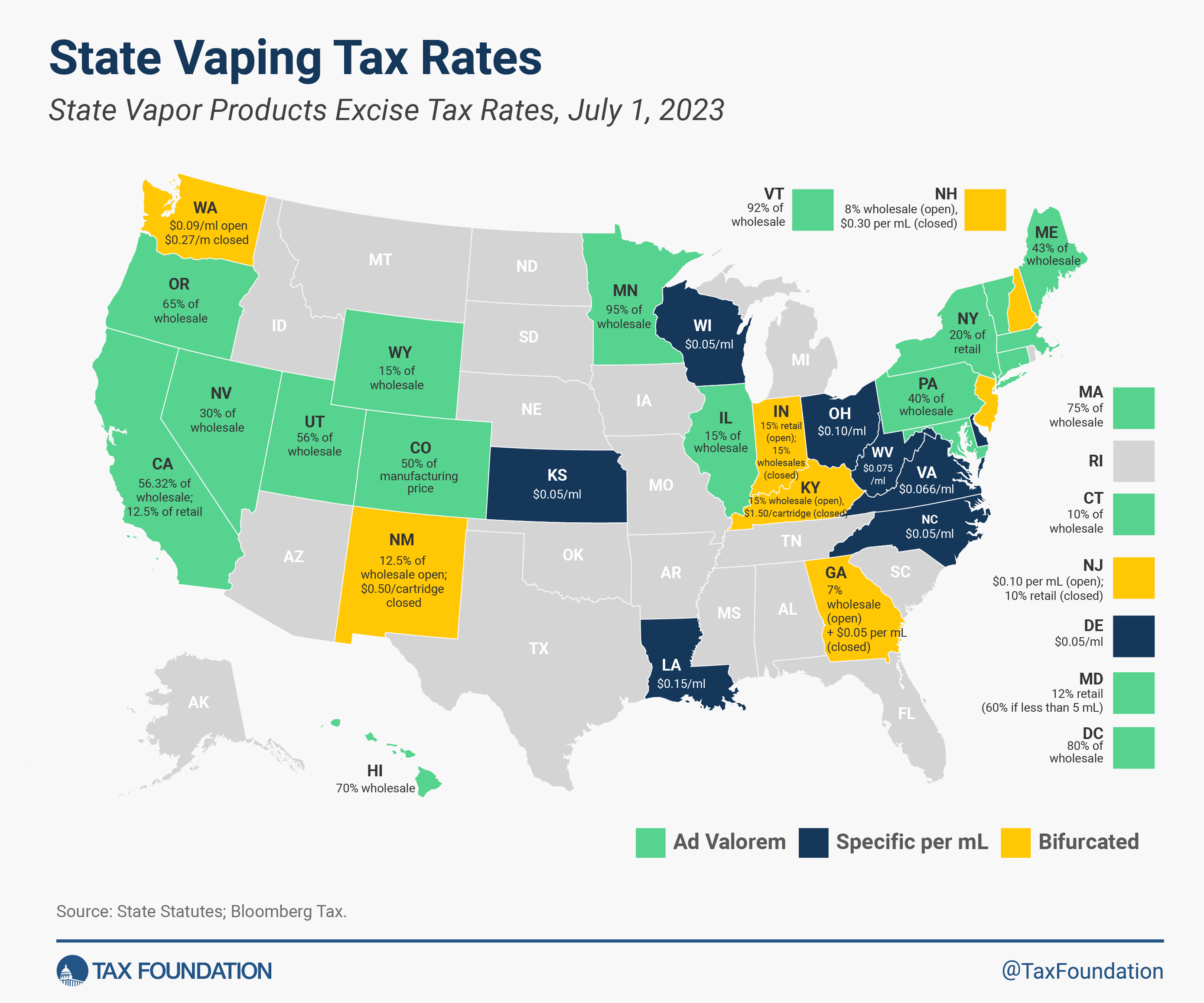

Different ways exist to tax vapor. Taxes are based on the cost to the maker, wholesaler, or retailer (ad valorem), the amount (specific), or a two-part system with different rates for open and closed tank systems.

When it comes to states that tax wholesale prices, Minnesota has the highest tax at 95%, followed by Vermont at 92.5%. On the other end of the scale, Connecticut has a wholesale tax of 10 percent and Wyoming has a wholesale tax of 15 percent.

At $0.05 per milliliter (mL), Delaware, Kansas, North Carolina, and Wisconsin all have the lowest rates. After doubling its rate from $0.05 per mL to $0.15 per mL in 2023, Louisiana now has the highest rate per mL in the country.

This map shows where vapor taxes are in each state as of July 1, 2023.

Vapor goods can give you nicotine, which is what makes cigarettes so addicting, without the smoke and tar that come with smoking. Even though more study needs to be done on how vapor products might reduce harm, most people agree that they are less harmful than traditional tobacco products that are burned. The English Ministry of Health's Public Health England says that vapor products are 95% less dangerous than smokes.

Because the amounts of harm are different, it is important to understand the idea of harm reduction and how it applies to taxes on vapor products. Even though vaping goods are unhealthy on their own, they are very appealing as a way to quit smoking. After all, the fact that nicotine is addicting is a big reason why smokers find it hard to stop. Harm reduction is the idea that it is better to try to lessen the bad effects of using certain goods than to try to get rid of them completely through bans that don't work or high taxes that hurt people.

Because nicotine-containing products are economic substitutes, protecting access to vapor goods that reduce harm is tied to tax policy. Low tax rates on vaping make people more likely to switch from smoking. High excise taxes on vapor goods that make smoking less harmful could hurt the public's health by making vapers go back to smoking. A recent study found that a 95 percent excise tax on vapor products made it harder for 32,400 users in Minnesota to give up cigarettes.

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design. For more discussion on the ideal design for vapor taxes and other alternative nicotine products, see our recent report.

Vaping Tax Rates by State, 2023

| State | Vape Tax Rates |

|---|---|

| Alabama | No Tax |

| Alaska | No Tax |

| Arizona | No Tax |

| Arkansas | No Tax |

| California | 56.32% of wholesale; 12.5% of retail |

| Colorado | 50% of manufacturing price |

| Connecticut | 10% of wholesale price |

| Delaware | 0.05 per mL |

| District of Columbia | 80% of wholesale |

| Florida | No Tax |

| Georgia | 7% wholesale (open) + $0.05 per mL (closed) |

| Hawaii | 70% wholesale |

| Idaho | No Tax |

| Illinois | 15% wholesale |

| Indiana | 15% retail (open); 15% wholesales (closed) |

| Iowa | No Tax |

| Kansas | $0.05 per mL |

| Kentucky | 15% wholesale (open), $1.50/cartridge (closed) |

| Louisiana | $0.15 per mL |

| Maine | 43% of wholesale |

| Maryland | 12% retail (60 % if less than 5mL) |

| Massachusetts | 75% of wholesale |

| Michigan | No tax |

| Minnesota | 95% of wholesale |

| Mississippi | No tax |

| Missouri | No Tax |

| Montana | No Tax |

| Nebraska | No Tax |

| Nevada | 30% of wholesale |

| New Hampshire | 8% wholesale (open), $0.30 per mL (closed) |

| New Jersey | $0.10 per mL (open); 10% retail (closed) |

| New Mexico | 12.5% wholesale; $0.50 per cartridge |

| New York | 20% retail |

| North Carolina | $0.05 per mL |

| North Dakota | No Tax |

| Ohio | $0.10 per mL |

| Oklahoma | No Tax |

| Oregon | 65% of wholesale |

| Pennsylvania | 40% wholesale |

| Rhode Island | No Tax |

| South Carolina | No Tax |

| South Dakota | No Tax |

| Tennessee | No Tax |

| Texas | No Tax |

| Utah | 56% of wholesale |

| Vermont | 92% of wholesale |

| Virginia | $0.066 per mL |

| Washington | $0.09 per mL open; $0.27 per mL closed |

| West Virginia | $0.075 per mL |

| Wisconsin | $0.05 per mL |

| Wyoming | 15% of wholesale |

Source: State Statutes; Bloomberg Tax