The possible effects of a central bank digital currency (or CBDC) are just too big to leave up to unelected bureaucrats at the Fed or the Treasury.

Every day, there is more evidence against central bank digital currencies (CBDCs). Senator Mike Lee (R-UT) introduced the No Central Bank Digital Currency Act, or No CBDC Act, just a few weeks after Representative Tom Emmer (R-MN) introduced a similar bill in the House.

CBDCs threaten the future of financial privacy, freedom, and markets, and these bills would give the United States much-needed protections against issuing a CBDC. For example, Senator Lee's bill would set clear limits for both the Federal Reserve (Fed) and the Department of the Treasury (Treasury). Fed Chair Jerome Powell and former Vice Chair Lael Brainard have avoided answering questions about whether or not the Fed has the power to issue a CBDC. In the same way, it seems like the Treasury has been in charge of moving CBDCs forward during the Biden administration. From what's happened so far, it's clear that Senator Lee's approach is correct.

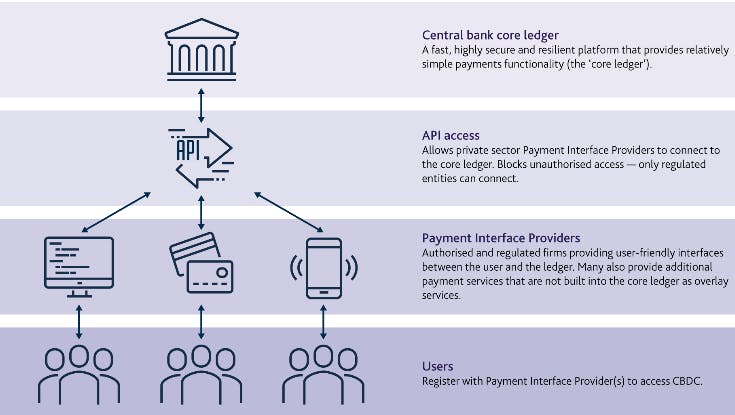

Like Representative Emmer's bill, Senator Lee's bill would stop the Fed from giving out a retail CBDC without the approval of Congress. But Senator Lee's bill would also make it clear that the Fed can't issue an intermediated CBDC. Since the Fed released its first CBDC discussion paper, this idea has been getting more attention. In fact, the bill makes it possible to get rid of wholesale CBDCs as well.

For those who don't know about these rather technical differences, a retail CBDC is a CBDC that is sold directly to individuals by the Federal Reserve. Since this idea would be so different from the current financial system, the Fed said it would prefer an intermediated CBDC as a kind of compromise or middle ground. In short, for an intermediated CBDC, the Fed would hire commercial banks to keep track of the digital wallets and accounts that CBDC owners use. One step further would be taken away from a wholesale CBDC, so that it could only be used by financial institutions to settle with other financial institutions.

Both Senator Lee's and Representative Emmer's bills would also make it illegal for the Fed to use a CBDC to carry out monetary policy as described in Section 2A of the Federal Reserve Act. In practice, this check means that a CBDC couldn't be used for negative interest rate charges, stimulus payments, or other attempts to "fine-tune" the rates of inflation and unemployment.

But Senator Lee's bill would do more than just set up checks and balances on the Fed. The bill also points out that the Treasury could use its power to give out a CBDC, so the same checks are also put on the Treasury. In a working paper I wrote with Norbert Michel last year, we said that the Fed has been the center of attention for a long time, but the Treasury is just as important to talk about when talking about CBDC. For example, in September of last year, undersecretary Nellie Liang announced at the Brookings Institution that the Treasury would be leading a CBDC working group to "promote further work on advancing a CBDC."

These bills would give the federal government some much-needed checks on its plans to start a CBDC. The possible effects of a CBDC are just too big to leave up to unelected bureaucrats at the Fed or the Treasury. It should be up to Congress to decide what to do.

Do you want to know more about the risks that CBDCs pose? Check out our new page that explains what CBDCs are, why they shouldn't be used, and who is speaking out against them.