Big government means higher taxes and slower economic growth for all Americans.

The IRS expects to get more than 168 million individual tax returns this year, which will take all Americans about 2 billion hours to fill out. As we do our taxes, it's natural to wonder where the $4.9 trillion the government got last year and what it was used for came from.

Based on information from the government, the federal tax system is very progressive. The Americans with the highest incomes pay a bigger share of income taxes than they should and have the highest average tax rates for all federal taxes. We are also lucky to live in a country with low taxes, but Congress keeps spending way more than it can afford. If spending keeps going the way it is, interest on the debt and other required programs, like Social Security and health care, will use up every dollar of income by 2031.

Income taxes are highly progressive

The primary tax system Americans interact with each year when they file their taxes is the income tax. The latest Internal Revenue Service (IRS) data on income taxes for the 2020 tax year shows that the federal income tax system is highly progressive and has become more progressive over time.

Half of Americans with the lowest incomes paid an average income tax rate of 3.1%, while the top 1% of earners paid a rate of 26%. The average rate of income tax paid by all taxpayers was 13.6%.

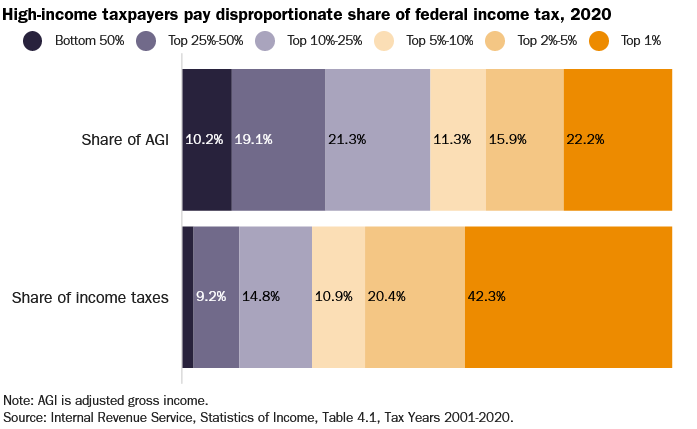

High-income earners also pay a bigger share of income taxes than they should based on how much money they make. Figure 1 shows that, as a percentage of their adjusted gross income (AGI), 97.7 percent of federal income taxes were paid by the top half of earners. The top 1% of earners brought in 22.2% of all income and paid 42.3% of all income taxes. The top 10 percent earned 49.5 percent of the income and paid 73.7 percent of the income tax.

Since 2001, which is the first year for which we have reliable IRS data, the average income tax rate for all five income groups has gone down. Those with the lowest incomes have seen the biggest drop in rates, from 4.9% in 2001 to 3.1% in 2020. The average tax rate for the top 1 percent went down from 27.6 percent in 2001 to 26.0 percent in 2020. During the same time period, the share of income taxes paid by the top 5% went from 52.2% to 62.7%, while the share paid by everyone else went down.

Total federal taxes are also highly progressive

Every year, Americans pay more in payroll taxes than income taxes, except for the top 10% of earners. Since the payroll tax rate is a flat 15.3 percent on wages up to a limit of $147,000 and is split evenly between the employee and the employer, it helps to balance out the fact that the income tax system is very progressive.

A little more than half of the federal government's money comes from income taxes, about 30% from payroll taxes, and 10% from the corporate income tax. The rest of the money comes from things like estate taxes, tariffs, and excises.

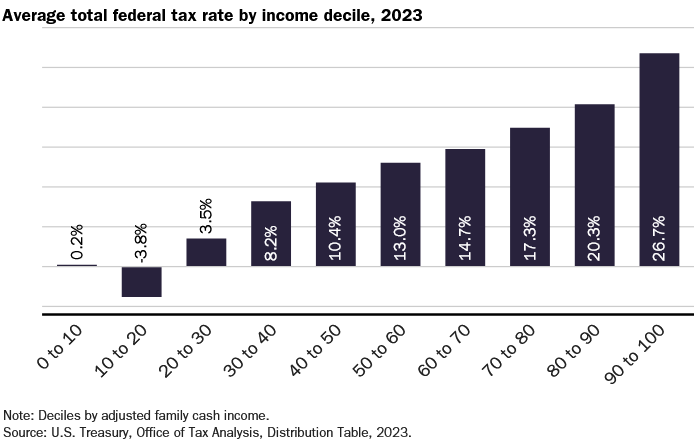

Even after payroll, corporate, and other taxes are taken into account, the U.S. Treasury's Office of Tax Analysis thinks that the entire federal tax system is highly progressive. Figure 2 shows that as incomes rise, so do average tax rates. Based on adjusted family cash income, the average tax rate for the bottom 20% of earners is either negative or close to zero. A negative tax rate means that the taxpayer is a net beneficiary of the tax system. They probably get refundable tax credits like the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC).

The top 10 percent of income earners pay an average tax rate of 26.7 percent. Treasury also breaks the higher income earners into even narrower slices, showing that as incomes rise, so do tax rates, even at the very top of the income distribution. The highest earning 0.1 percent, pay an estimated average tax rate of 32.4 percent.

Spending is the real tax rate

Compared to similar countries around the world, the United States has low taxes. Low taxes are good for both workers and employers in the United States. In 2019, I thought that a worker making about $40,000 in the United States would pay $6,000 more in taxes if he moved to the average European country, where higher taxes are needed to pay for bigger welfare systems. Lower tax rates help the economy in more ways than just putting more money in your pocket. They encourage innovation, raise living standards, and create more job opportunities.

If you only look at current taxes, it's hard to see that the U.S. federal government has had a budget deficit every year since the early 2000s. This is because government spending is always higher than tax revenue, which is paid for by borrowing money. Even after the tax cuts from 2017 end at the end of 2025 and revenues stay well above the historical average, it is expected that the gap between taxes and spending will continue to grow as spending on retirement and health care grows at unsustainable rates. The Congressional Budget Office recently predicted that spending on interest and other mandatory programs will be more than what is brought in by taxes in 2031. This means that Congress will have to take on more debt to pay for all other spending.

At some point, either taxes will have to go up or spending will have to go down. But the current system can't keep going because the top 10% of earners pay 60% of all federal taxes. No other large welfare state like the US can afford to spend as much as it does without raising taxes on middle-class people. If Americans keep asking for a lot of government spending, politicians should make it clear that more government means higher taxes and slower economic growth for everyone.