How to make free money less attractive in a credit crunch

The European Central Bank’s quarterly Bank Lending Survey this week failed to attract much attention, which is no surprise. Headline findings — that European lenders expect to tighten credit access this quarter as higher interest rates weigh on demand — were hardly shocking news.

But take a dig through the details and it becomes obvious how rapidly credit conditions are deteriorating, which makes predicting one aspect of Thursday’s ECB meeting unusually tricky.

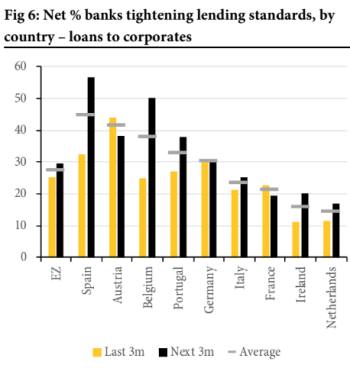

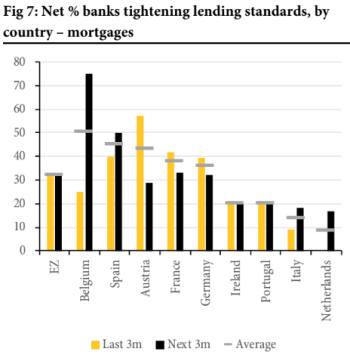

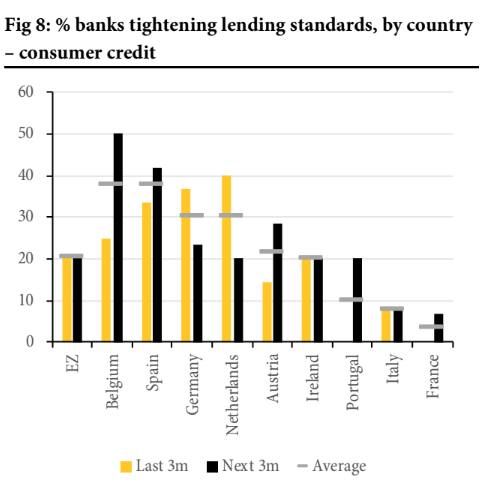

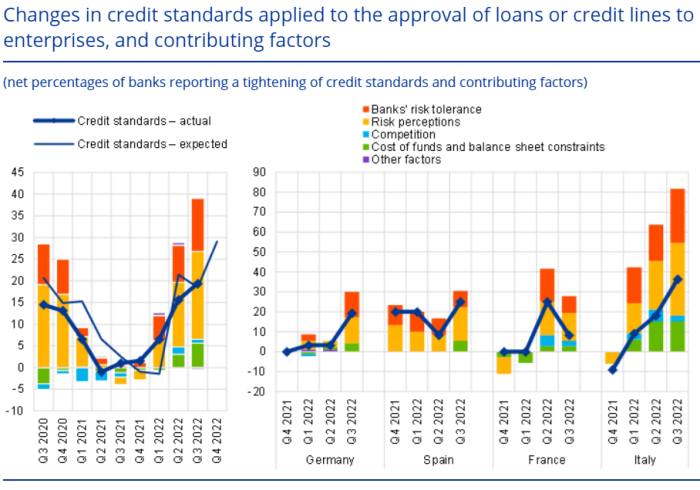

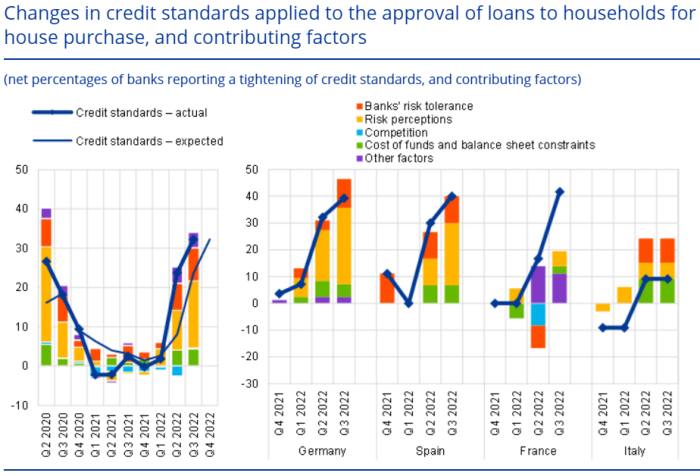

Lending standards for European non-financial corporations have returned to peak eurozone-crisis levels, with Italian borrowers hardest hit. Mortgage lending and consumer credit are as tight as they were in 2008, led by a squeeze in Spain and Germany.

© ECB

© ECB

© ECB

© ECB

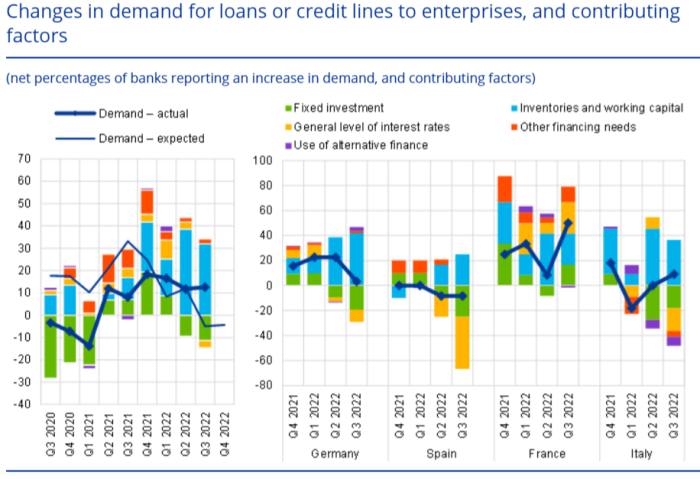

Corporate loan demand has been kept artificially high this year by slow supply chains and rising production costs. That effect now looks to be fading . . .

© ECB

© ECB

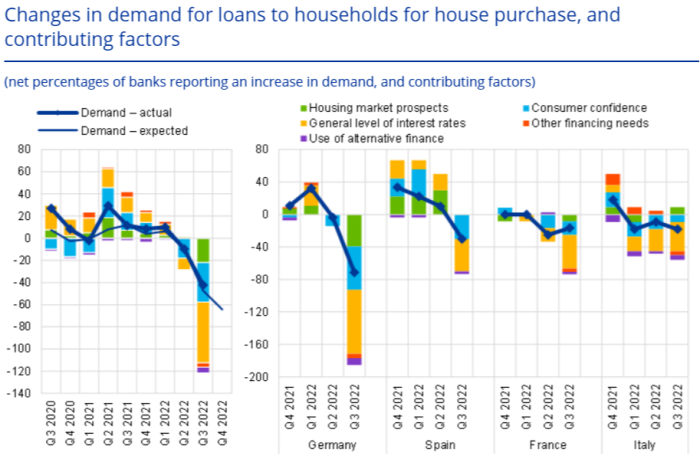

... but for households the crash in demand looks well advanced:

© ECB

© ECB

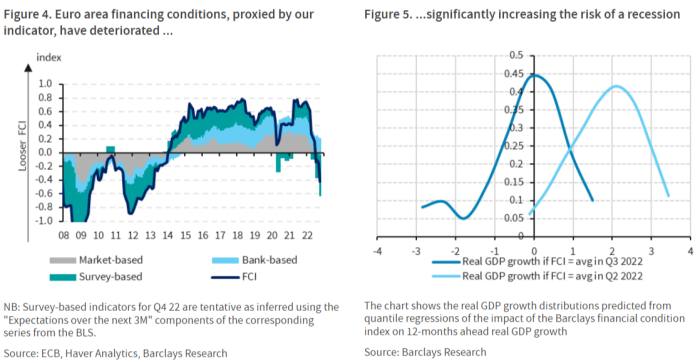

The ECB lenders’ survey typically foreshadows downstream credit supply by about a year. The pace of withdrawal seen since June, when the ECB flagged the end of negative rates, “corroborates our view that the euro area is headed towards a sharp recession”, said Barclays.

© Barclays

© Barclays

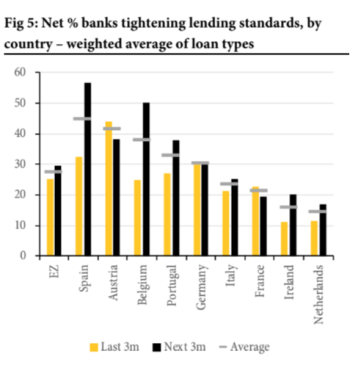

Because lending standards vary between countries — shaped by employment markets and sovereign-bank relationships — the financial-industry response has been uneven. Lenders in Spain, Austria and Belgium have been tightening credit much more than those in the Netherlands, Ireland and France. Charts via Redburn:

A worsening macro environment with higher rates (hence refinancing challenges for borrowers) suggest a European bank cost of risk that’s more than double the 0.40 basis points currently assumed by the market, Redburn estimates.

This story originally appeared on: Financial Times - Author:Bryce Elder