The Inverse Cramer ETF might soon be a thing

Need a hedge against Jim Cramer? Going by the SEC filing that landed on Wednesday evening, it might soon be possible.

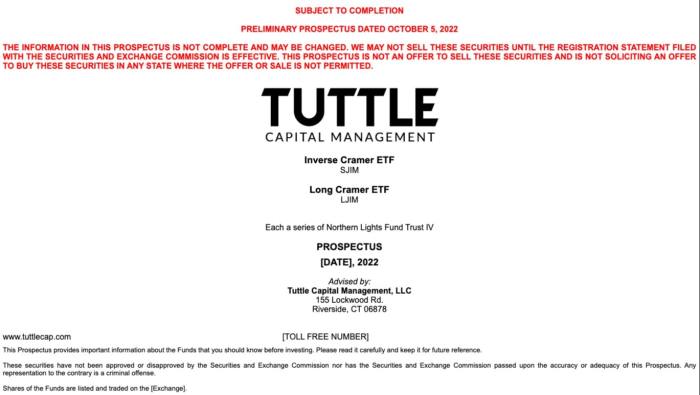

Tuttle Capital Management has filed to launch two exchange traded funds that trade on the stock tips of the CNBC personality and Alphaville reader, one that goes long and one that goes short. The mooted tickers are LJIM and SJIM.

The concept is similar to Tuttle’s inverse-ARK ETF, which is now a $343mn fund that has gained 56 per cent this year by betting against Cathie Wood’s flagship investment vehicle.

This story originally appeared on: Financial Times - Author:Bryce Elder