LDI: where’s the exposure?

We’re all now experts on liability driven investment strategies, of course, so let’s cut to the chase. Where should we be looking for wreckage?

The search so far has been focused on UK life insurers with big asset management divisions, such as Legal & General. That’s in part because figuring out direct individual exposures to gilt-mageddon will have to wait for the next round of annual reports, unless problems are big enough to force pension fund trustees into an early announcement.

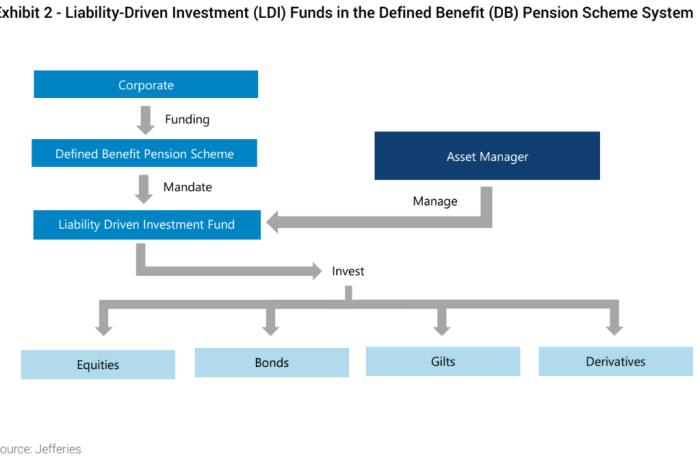

For the insurers, there’s a straightforward read-through via sharply higher bond yields on their collateral requirements for interest-rate derivatives. Jefferies illustrates:

Simple, right? Well, yes and no.

This story originally appeared on: Financial Times - Author:Bryce Elder