The Internal Revenue Service (IRS) has published a feasibility assessment on the viability of a government-run direct file program for taxpayers, ahead of the agency's anticipated launch of a Direct eFile pilot program in the approaching 2024 tax filing season.

The IRS estimates that filers spend around 13 hours filing a return at a cost of $250, totaling $339 billion in annual compliance expenditures. A prefilled tax return allows taxpayers to pay their taxes without having to file a tax return, with the purpose of decreasing taxpayer compliance burdens, boosting tax compliance, and rewarding taxpayers to file their forms electronically.

Prefilled returns can be completed using either an exact withholding system (EWS) or a tax agency reconciliation system (TARS). The government attempts to withhold the correct amount of tax payable over the course of the year through an EWS by asking the taxpayer to supply information to their employer or tax agency at the start of the year. The government would use third-party information, such as that from a taxpayer's bank and employment, to compile a return for the taxpayer under a TARS. The taxpayer would double-check the return for accuracy before paying any taxes owed or receiving a refund.

According to the IRS direct file research, such a system would cost between $64 million and $249 million per year, depending on usage and scope. The IRS now struggles to deliver good customer service, which would account for the majority of the expense. Before implementing a direct file program, the IRS would need to fix its current, long-standing operational shortcomings and figure out how to coordinate with state and local filing requirements.

Furthermore, the Internal Revenue Service Electronic Tax Administration Advisory Committee (ETAAC) report "recommends that the IRS and Congress evaluate making improvements in the communication, marketing, and accessibility of existing free tax filing programs before investing in the development and implementation of an IRS Direct eFile platform." The paper emphasizes how taxpayers significantly underutilize the current IRS Free File program, which allows taxpayers to file tax returns for free in collaboration with filing software providers. Less than 3 million of the 104 million eligible taxpayers used the IRS Free File program to file their 2017 federal income tax return. The IRS's Direct eFile program may face similar issues and require large promotional spending to entice taxpayers to use it.

Prefilled tax forms are not a feasible alternative for various reasons, according to a prior Tax Foundation blog post:

- It’s more likely to result in overpayments.

- It separates taxpayers from their liability.

- It means surrendering a great deal of privacy.

- It requires a simpler tax code.

- American taxpayers haven’t embraced the idea.

Prefilled tax returns may encounter the most challenge due to the complexity of the US tax system.Benefits programs for healthcare, housing, childcare, energy, and other services are included in the x code. The deductions and credits taxpayers are entitled to cannot even be accurately determined by an IRS-designed software platform since they depend on particular circumstances for which no third-party data is available.

Prefilled tax returns have been tested in 36 nations worldwide, including in the United States, California launched a trial program called "Ready Return" in 2005; however, the initiative has since been canceled. Such methods produce a variety of outcomes; they may place an unfair burden on small enterprises and frequently require taxpayers to submit their own returns if their circumstances are more complicated.

In an attempt to model the impacts of prefilled tax forms, Miguel Fonseca and Shaun Grimshaw of the University of Exeter discovered that there was little to no gain in compliance and that there might even be a negative impact on compliance if taxpayers encounter obstacles while trying to alter wrongly completed information.

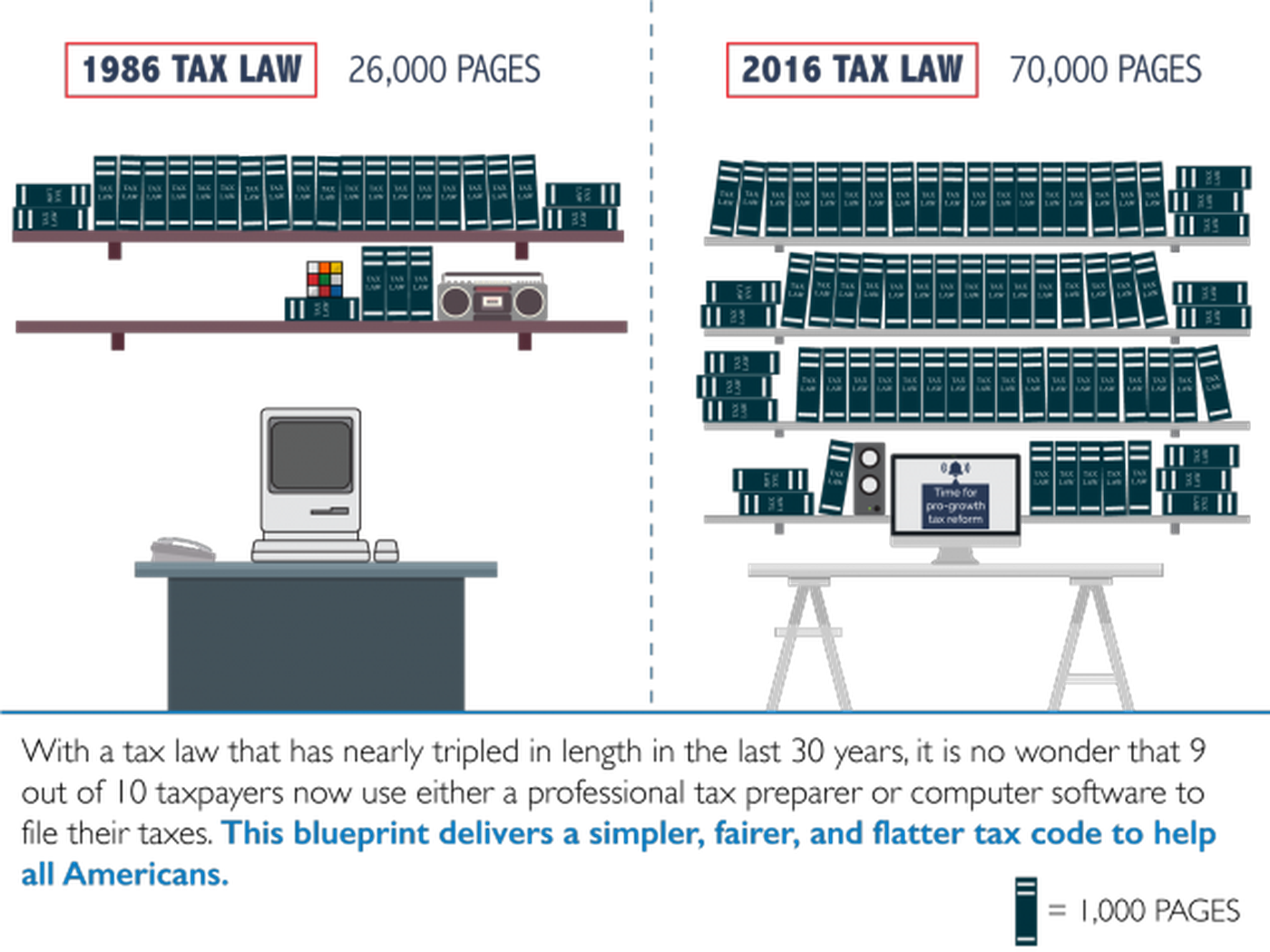

On the other hand, Estonia is a case study of a nation where prefilled tax returns have been successful because of how straightforward their flat 20% individual income tax system is. Due to the prefilled tax forms' simplicity, taxpayers may file their taxes in roughly three minutes after the tax agency gathers information about them from banks and employers. Recent research by the Tax Foundation found that altering the U.S. tax code to be more like Estonia's would increase GDP by 2.5 percent over the long run and save more than $100 billion in compliance costs yearly.

Given the complexity of the current U.S. tax system, it is challenging to fathom how the IRS Direct e-File Program might function without any issues. Instead, politicians have to start by addressing the more important issue that aggravates taxpayers: our exceedingly complex tax system.