Charles Ponzi's scheme must have made an impression on policymakers who were coming of age in the 1930s, because they used the same plan for the new Social Security system.

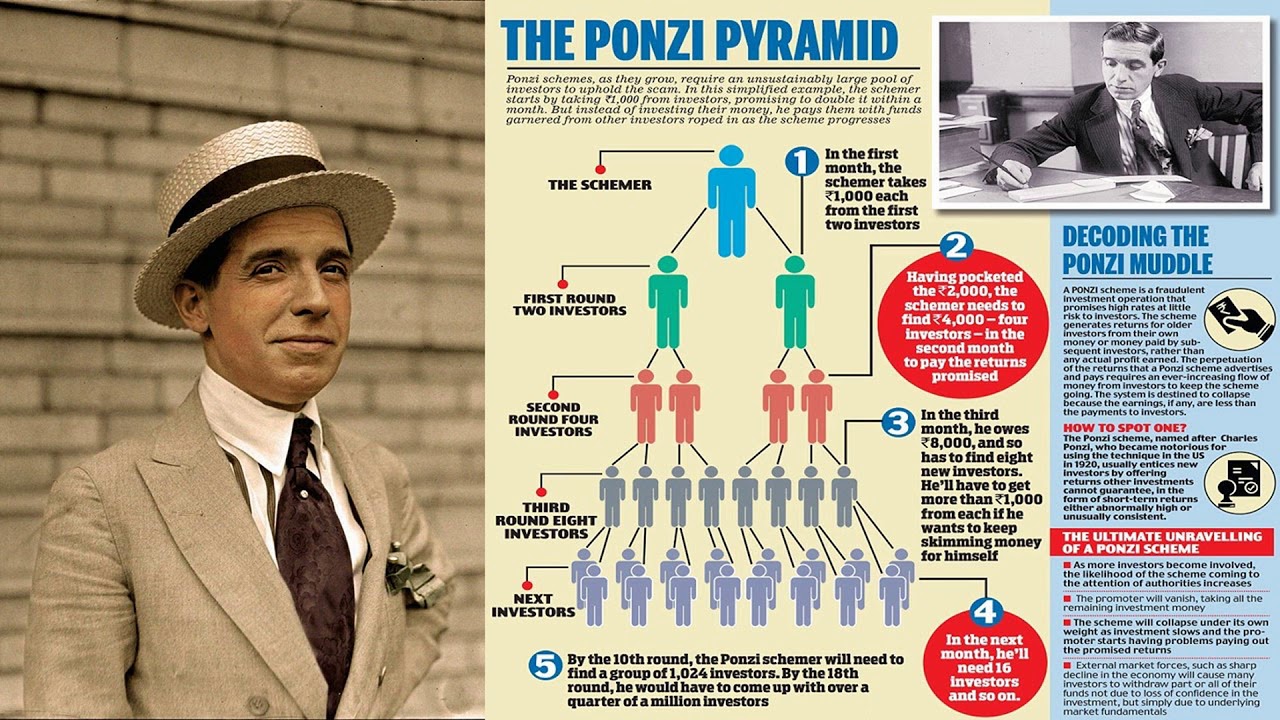

When Charles Ponzi's plan to sell foreign postage stamps as an investment was found to be a scam in 1920, the basic idea would always be linked to his name. A Ponzi scheme tells people they will make a lot of money from an investment that doesn't exist. Instead, old investors are paid with money from new investors, which no one but the person or people in charge knows about. Most of the time, this scheme isn't found out until the day when buyers stop coming in and the money stops coming in.

Ponzi's plan must have made a big impression on the young policymakers of the time, because they used the same structure for the new Social Security system in the 1930s. Employees and companies had to pay into the system starting in 1937, and retirees could start getting benefits in 1940. The amount of money these benefits were worth was much more than what the first seniors had paid in during their working lives. Most of us might think this is wrong, but because far more people put money into the system than took money out, no one seemed to care too much.

Medicare’s Downward Spiral

Social Security was able to work and stay financially sound because there were a lot of babies born after World War II. At first, people were skeptical of the program, but as they gave money, saw other people gain, and then got something out of it themselves, they became more and more interested in it. It was so popular that in 1965, the government chose to offer even more social benefits by putting in place the Medicare system.Medicare was definitely an attempt to solve a real problem that most seniors had with private health insurance, which was that it was very expensive. About three times what a younger person would get. The current Medicare system has four parts, but to keep things simple, we'll just talk about Part A, which is paid for by income taxes like Social Security. Like Social Security, it can't last forever because it's set up like a Ponzi scheme, where new money has to come in to pay the older people who cash out.

There are more ways to get medical help now than there were sixty years ago. This helps people live longer than they did in the past, which also means they use the system more than people did in the past. At the same time, there are fewer workers per person who gets help than there were before. This means that more money is going out than coming in. In a Ponzi plan, things are about to fall apart at this point.

The flaws in these methods have been known for a long time. In fact, the programs themselves give estimates of when they will run out of money. Reform is needed, but most politicians don't want to do it because old investors have a lot of votes and want their guaranteed returns even if their own money is gone and someone else will lose out.

Ponzi Schemes and Federal Fiscal Policy

When you think about it, the phrase "America always pays its bills" doesn't seem to make much sense. When I get my bills for water, electricity, and gas, the amount due is always the current amount, and there are no sums from the past. After I pay my monthly bill, the amount owed goes back to zero every time. This is because I always pay my bills on time, so I don't owe any money.Most Americans have credit cards, and we can use them to get by when money is tight. But a responsible lender wouldn't raise your limit if you've already reached it and haven't done much to bring down your debt. No one would also give you a new account after checking your credit score, because that would hurt your score. There is too much chance that you will not pay.

But these rules seem to go out the window when it comes to the federal government, which is $31.4 trillion in debt and has unfunded bills that add up to an even bigger number. When they say they always pay their bills, even if they have to take on more debt to do so, it seems okay, but if your friend tried to do the same thing, you would think he was a fool.

As we got closer to the deadline for the latest debt cap limit in May 2023, Treasury Secretary Janet Yellin warned the public that if the limit wasn't raised to let us borrow more, we wouldn't be able to pay the old lenders what we owed them, and there would have been a default. In other words, the only way for an old investor to get paid was and is for a new investor with new money to come into the system. The way our government gets money is like a Ponzi scam.

How Long Can It Last?

Even with the deal that puts the debt cap on hold for two years, the real problem is just put off, and no real long-term solutions are found. Spending will keep going up faster than income, and just like Charles Ponzi, Bernie Madoff, and many others before them, the house of cards will get closer and closer to falling down.The United States of America is one of the most important countries in human history. Up until the middle of the 20th century, this place had more wealth and business than anywhere else in the world. But people who live in happy times don't appreciate the wealth that was made by past generations.

We are not nearly as strong economically as we were back then. The only reason it hasn't been too much to handle is that the energy from the past has kept us going. But once that stops, we'll be on our own, because the system will fall apart if the government keeps doing business as usual.

Now, the only thing we can hope for is that we might still be able to change the way we're going.