Bank man, fried

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. As of filing time, the results of the US midterm elections were up in the air. As noted a week ago, should the Democrats lose control of congress, the crucial effect will be a decline in deficit spending and therefore (over time) corporate profits. Split government and lower spending would be anti-inflationary, too, and should contribute to lower interest rates, supporting stocks. But the big story will remain how companies wean themselves off government largesse, which has been an absolute bonanza. Email us: [email protected] and [email protected].

FTX/Binance

Ooof:

The digital assets industry has been shaken by the near-collapse of Sam Bankman-Fried’s FTX, one of the largest crypto exchanges, which clinched a rescue deal with arch-rival Binance after a surge in customer withdrawals sparked a liquidity crisis.

How did Sam Bankman-Fried go from crypto industry saviour to the one in need of saving? As far as we can tell, it went down something like this:

Last Wednesday, CoinDesk published an article with information about Alameda, a crypto hedge fund and market-maker owned by Bankman-Fried. The article said that Alameda’s $14.6bn of assets included $5.8bn of a crypto token called FTT.

FTT is the in-house currency for trading on FTX. Customers who use FTT as their medium of trade receive discounts on exchange fees and other goodies; for the company, FTT encourages trading, which means more fee revenue. Think of carnival tickets, but without a fixed exchange ratio. Instead, FTX supported the price of FTT with weekly buybacks.

Alameda’s holdings of FTT are troubling for three reasons.

First: The tokens seemed to represent the majority of Alameda’s equity (the fund contested this, saying the balance sheet was from a subsidiary). A hedge fund’s solvency should not depend on a carnival ticket that was invented to facilitate, and which derives all its value from, trade on an exchange that is owned by the same person as the hedge fund. This is circular and creepy and probably not sustainable.

Second: $2.2bn of Alameda’s FTT was pledged as collateral against loans (again, Alameda contests). Carnival tickets designed to facilitate commerce on an exchange should not be pledged as collateral.

Third: Most importantly, the market value of FTT tokens that are actually used for trade is $3bn or so; Alameda’s holdings were much bigger than the entire traded market. And on top of that, the market looks thin. Just a couple hundred crypto addresses actively trade FTT, according to crypto data company Messari. The upshot is that Alameda could not conceivably sell $2.2bn of FTT, or even a significant fraction thereof, without blowing up the market. Under these circumstances, a big margin call can be fatal.

On Sunday morning Changpeng “CZ” Zhao, the head of Binance, tweeted that “due to recent revelations . . . we have decided to liquidate any remaining FTT on our books”. Was CZ being prudent, or trying to drive a rival into the dirt? Unclear.

Soon thereafter Alameda’s CEO Caroline Ellison responds by tweeting that the fund is willing to defend FTT’s price by buying it at $22 per token. FTT holds at that level through Monday night.

At the same time, though, the noise about Alameda and FTT seems to be scaring FTX customers. They start withdrawing money, and FTT falls to $17 late on Monday. SBF reportedly tells employees FTX had seen $6bn in net withdrawals in three days; tens of millions a day is the norm. Early on Tuesday morning, FTX seemed to have paused withdrawals. FTT began to collapse immediately thereafter; it is now at $5.

By 11am Tuesday morning, it was all over. Bankman-Fried tweeted that selling to Binance “will clear out liquidity crunches; all assets will be covered 1:1”. Binance is making FTX customers whole, in return for the company.

Late on Tuesday, CZ tweets: “Two big lessons. 1: Never use a token you created as collateral. 2: Don’t borrow if you run a crypto business. Don’t use capital ‘efficiently’. Have a large reserve.” A victory lap? Maybe. More likely an effort to distinguish himself from a peer company that collapsed, without warning, in less than a week.

We wouldn’t be surprised if this summary turns out to require serious amendment. Many critical facts are either missing or hard to definitively confirm. Several big questions linger:

What kind of “crunch” was this, exactly? On Monday, Bankman-Fried tweeted that “FTX has enough to cover all client holdings. We don’t invest client assets (even in Treasuries). We have been processing all withdrawals, and will continue to be . . . We have GAAP audits, with > $1bn excess cash.” The tweets have been deleted. But if FTX had enough cash, why did it have to sell? Were the tweets untrue? Maybe it didn’t have enough, or what it had was not in cash. Or, as Bloomberg’s Matt Levine has suggested, might it be that FTX had more liabilities than just customer deposits, and those got called in? Offering leverage to customers, as FTX does, often means doing some borrowing of your own. If those loans all get called at once, you’re in trouble.

Who are Alameda’s counterparties? According to the balance sheet seen by CoinDesk, the hedge fund had $7.4bn in loan liabilities. A good chunk of the collateral held against those loans was in the form of FTT — which has now lost 80 per cent of its value. Binance did not bail out Alameda. Is there a lender out there nursing some big losses, and who is it?

Will Binance plug the hole in FTX’s balance sheet? If this were fiscally impossible, Binance wouldn’t have offered to rescue FTX. But the acquisition offer gives Binance optionality. It can back out if it judges FTX too insolvent to save. In June, when it was busy rescuing distressed crypto groups, FTX passed up acquiring Celsius for exactly this reason: the $2bn hole in its balance sheet was just too big.

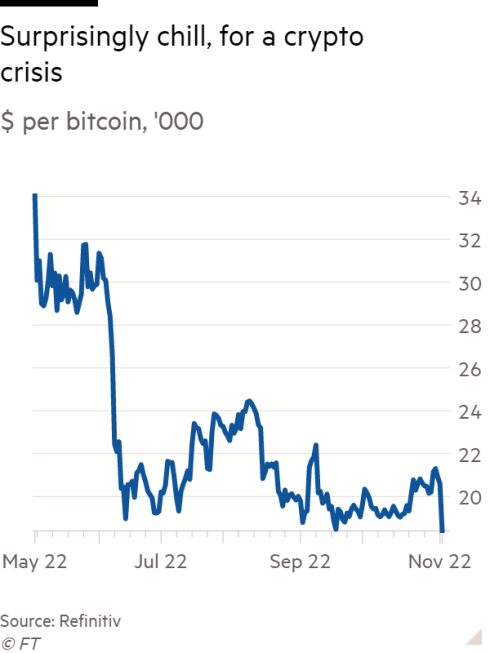

How much will this matter for crypto prices? Bitcoin tested new lows yesterday and was down 11 per cent around publication time, breaking it out of the eerily stable range it has kept since June. Still, though, the longer-term price chart looks OK-ish:

The bigger picture is that crypto’s most regulator-friendly leader has been knocked off his pedestal. His deposal leaves Binance — a company the Department of Justice is investigating for weak money-laundering safeguards — the last man standing. Regulators may look at FTX’s unforeseen failure as a lesson that even crypto groups that appear well-run and responsive are liable to implode.

This story originally appeared on: Financial Times - Author:Robert Armstrong