Cerberus in line for historic windfall from Albertsons supermarket deal

Broadening scrutiny of a US supermarket megamerger is standing in the way of billions in additional profits from what has already been a highly lucrative investment for a group led by Cerberus Capital Management.

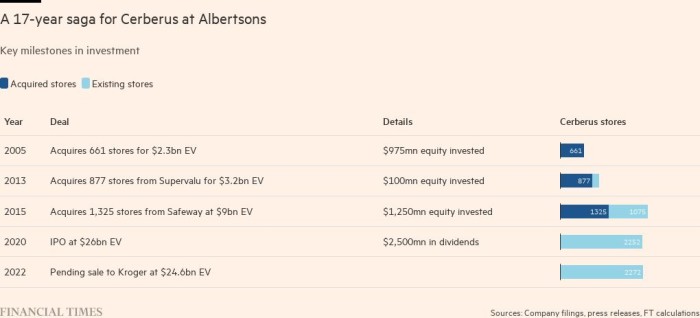

The Cerberus group has earned $4bn from its stakes in Albertsons, the supermarket chain that last month agreed to sell itself to rival Kroger. Completing the $24.6bn sale would yield another $12bn in cash payouts, according to Financial Times calculations.

The deal to create a nationwide chain of nearly 5,000 stores is now encountering pushback from labour unions and some national and state politicians who warn it will lead to higher grocery prices, closed stores and job cuts.

The investor group quickly earned four times its original equity investment through dividends and sales of assets. The divestitures included more than 400 stores sold to rival chains such as Publix, according to a person familiar with Cerberus’s returns.

The grocery chain has maintained that it has primarily spent yearly cash flow cutting debt from its balance sheet. As such, Albertsons has said it will still have $500mn in cash and $2.5bn of borrowing capacity after the dividend is paid with manageable debt ratios.

If the deal closes as planned, Albertsons shareholders would also receive shares in a new spun-off company of roughly 300 stores to be divested to ease competition concerns. Industry insiders said that Cerberus, after profiting from Albertsons, could use these properties as building blocks for another grocery empire.

This story originally appeared on: Financial Times - Author:Antoine Gara