Ping An calls for ‘aggressive’ cost cuts as it pushes for HSBC break-up

HSBC’s largest shareholder, Ping An, has called on the bank to be “much more aggressive” in reducing costs by cutting jobs and warned that its board lacks experience in Asia, as it pushes the lender to spin off its Asian business.

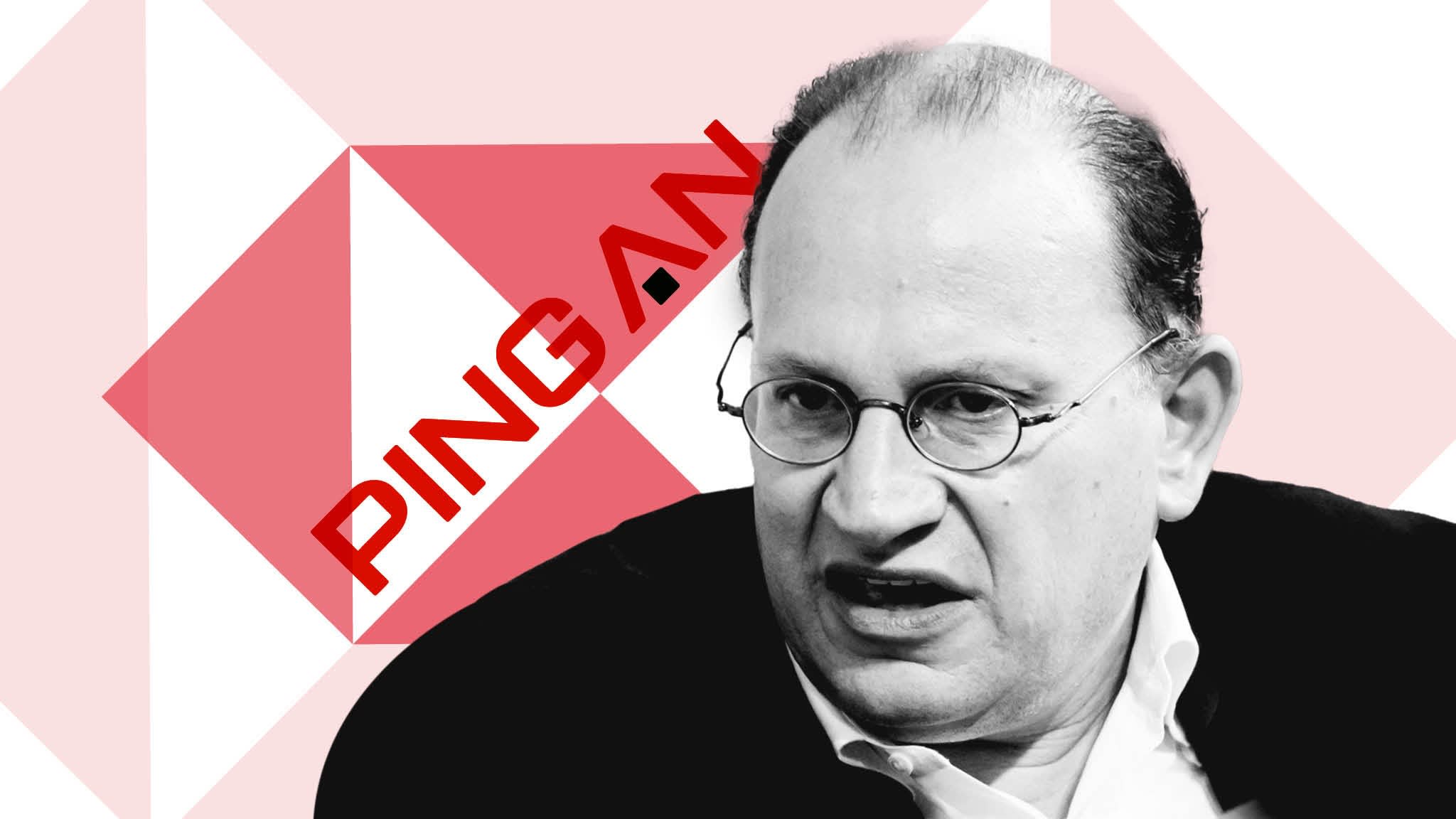

Michael Huang, chair of Ping An Asset Management, told the Financial Times it was “urgent” that HSBC goes further on cost cutting to bring down its expenses, which it said are far higher than its rivals, and said a number of senior bankers do not have sufficient experience of working in Asia.

Huang’s comments mark the first time the Chinese insurance company has spoken publicly about HSBC since it emerged earlier this year that it had privately urged the bank to hive off its Asian operations to boost returns. Ping An has a stake of more than 8 per cent in the bank.

HSBC also said in April 2021 that it would move four of its most senior bankers to Hong Kong. These included: Greg Guyett, who was at the time co-head of global bank and markets; Nuno Matos, chief executive of wealth and personal banking; Barry O’Byrne, chief executive of global commercial banking; and Nicolas Moreau, head of asset management.

However, Huang said “this move has not been completed”. Three of the bankers have moved but Guyett has decided to stay in London.

“To our understanding, three out of HSBC’s four global business line CEOs only have one year’s work experience or less in Asia,” he added.

This story originally appeared on: Financial Times - Author:Emma Dunkley