Zuck warned you, and you wouldn’t listen

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Amazon’s guidance for the Christmas quarter was below expectations, and the stock got whacked in late trading. At the risk of becoming repetitive, this makes sense to us. As much as we like the risk/reward mix of the big tech companies, we think that recession is probably coming, earnings expectations must fall, and the market has only partly priced this in. Big tech is the first to this party, but the rest of the corporate world is invited too. Think we’ve already hit bottom? Email us your argument: [email protected] and [email protected].

This is exactly what Mark Zuckerberg promised all along

Would Mark Zuckerberg still be chief executive of Meta if he didn’t have voting control of the company? Probably, because things only really started to go off the rails this year. But his job would not be safe. Remember what the bond market thought of Liz Truss’s plans for the UK? The stock market takes a similar view of Zuckerberg’s plans for Meta — only much, much less enthusiastic. The shares are where they were seven years ago, have lost two-thirds of their value in a year, and lost a quarter of their value yesterday.

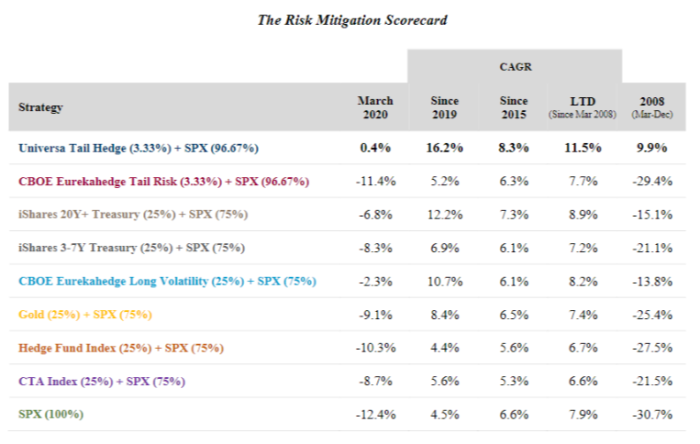

Avoiding big losses is, of course, hard. But Spitznagel argues it’s the entire point of having a tail-risk hedge: to outperform so outrageously that you offset losses in the declining equity portion of your portfolio. How outrageous? Universa reportedly returned 4,144 per cent in the first quarter of 2020 as the S&P fell 30 per cent, leaving a hypothetical 97/3 portfolio (that is, mostly stocks plus a sliver of Universa) about flat. Here, from an investor letter circulated in April 2020, is what overall performance looked like two years ago:

Options wizardry is needed to get results like this, and Spitznagel provides no details about implementation, noting only that Universa’s relationships with options dealers plus the market’s illiquidity help contain costs.

This performance has been flatteringly covered in the press. Unhedged is impressed too, but we wonder about scalability. For every tail hedge bought, there must be someone willing to assume tail risk on the other side. Who are these people? Are they simply bad at math? Are there any derivatives traders out there who haven’t read Taleb’s Black Swan?

In any case, Universa has some $15bn assets under management, and we’d be curious whether its approach would work at $150bn. We’re also curious why, given the reported returns, even more investors have not flocked in. Perhaps the strategy is too hard to understand and most institutional investors simply can’t get comfortable with it. Universa did not say how much of a performance drag a 3 per cent allocation to their strategy is in a year when markets are up. But suppose it is only 1 per cent. In a long bull market, even that could be hard to endure — even if better long-term returns are promised.

For his part, Spitznagel is confident markets’ memories will remain short, and mass inflows will not be forthcoming. “Most people only want [tail risk protection] when there’s a crash”, he told the FT previously.

Spitznagel is more open about what he thinks does not work to mitigate risk: Treasuries. He argues they offer the worst of all worlds, with no equity-like upside in bull markets, no asymmetric upside in bear markets and, as a bonus, exposure to duration risk. In his words:

People are in bonds as a risk-mitigation strategy. With the [sharp increase in interest rates this year], you might’ve lost more in bonds than you did in stocks. Truly the cure worse than the disease! This year is an extreme example of that. In other years it’s more subtle, when you diversify into strategies like fixed income or hedge funds. Their underperformance costs you tremendous wealth over the years.

We tend to disagree. Investors have made great risk-adjusted returns in Treasuries over the last 40 years, and yields are starting to make sense again. But enough investors have been hurt in this year’s bond carnage that Spitznagel’s case might fall on sympathetic ears. (Wu & Armstrong)

One good read

On Tuesday, we wondered why crypto prices have been so stable lately. Louis Ashworth at FT Alphaville writes that the HODLers are simply holding on.

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Swamp Notes — Expert insight on the intersection of money and power in US politics. Sign up here

This story originally appeared on: Financial Times - Author:Robert Armstrong