Could the LDIbacle happen in the US?

Phoebe White, Jay Barry and the rates strategy team at JPMorgan published an interesting note over the weekend looking at the US defined-benefit pension landscape and its use of liability-driven investing.

The tl;dr is that despite some similarities (like in the Netherlands), US pension plans are less exposed to the kind of margin call doom loop that enveloped UK plans in recent weeks.

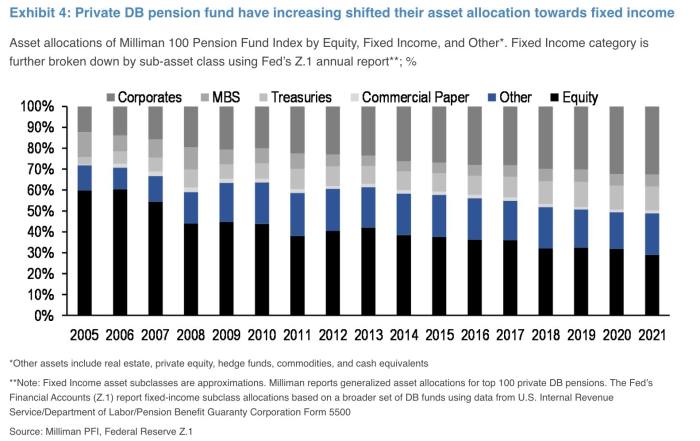

Just like their international peers, the roughly $3.2tn worth of private American DB funds have been tilting heavily towards fixed income in recent years as they try to de-risk by matching their assets to their liabilities. Here is an estimation of their average asset allocations and how they’ve evolved since 2005.

That US plans are well-funded — the average funding ratio of assets to liabilities currently stands at about 114 per cent, according to JPMorgan — is little consolation.

This story originally appeared on: Financial Times - Author:Robin Wigglesworth