Thematic fund resilience and inflows confound critics

Niche thematic funds, often dismissed as gimmicky fads, are proving more resilient than more mainstream funds, even as markets turn against them.

The funds — which invest in anything from clean energy and artificial intelligence to robotics and the metaverse — have higher survival rates than other equity funds, which are more likely to be closed down, according to analysis by Morningstar.

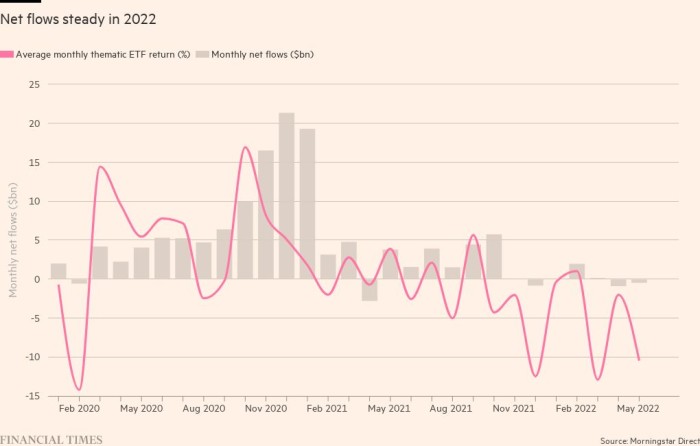

They have also seen proportionately stronger inflows this year than more mainstream equity funds, despite their tilt towards technology and other growth stocks often translating into larger losses, with total assets falling from a peak of $849bn at the end of last year to $618bn as of June 30.

Peter Sleep, senior portfolio manager at 7 Investment Management, agreed that flows had remained resilient, with the likes of Ark Invest still gathering assets despite dire performance.

“I think there is a bit of muscle memory going on,” said Sleep.

Howie Li, global head of index and ETFs at Legal & General Investment Management, a big provider of thematic funds, said there “hasn’t been much panic selling, as we saw in 2020 when the pandemic struck.

“A lot of our clients are multi-asset investors, they are asset allocators. That’s where we have seen interest in our thematic strategies.”

Li believed that thematic investing had, to a degree, supplanted the more established concept of sector-based investing — buying, say, financial or energy stocks.

This is partly because sectoral funds, which typically utilise large-cap stocks, duplicate the exposures an investor has in their mainstream global or regional allocation, whereas thematic investing often introduces a new palette of holdings.

The bigger trend, though, may be that perceptions have changed.

“Increasingly, investors understand that disruption is taking place and new industries are emerging. They have the potential to evolve into sectors,” argued Li, citing robotics and cyber security as early examples.

“These can be long-term investment opportunities. We have seen investors carve out a portion of their portfolio dedicated to themes, typically a 5-10 per cent permanent allocation. You buy into it and leave it.”

As for the (relative) longevity of thematic ETFs, Li said LGIM would only launch a fund if it believed there was a “growth opportunity lasting into the next decade”.

“The last thing we want to do is to put together something that is just a short-term fad,” he said.

Sleep was unconvinced that thematic funds’ survival rate would continue to be better than for equity vehicles at large, however.

“We are just at the end of a bull market for growth. I’m going to put a lot of money on it that the conclusion in 18 months’ time will be very different,” he said.

This story originally appeared on: Financial Times - Author:Steve Johnson