Inside Blackstone’s ‘beloved’ $126bn crown jewel

Blackstone has emerged as a real estate juggernaut over the past decade, amassing America’s biggest private property empire. But one of the fastest-growing, most lucrative corners has become a quiet concern to some investors and analysts.

Only launched in 2017, Blackstone Real Estate Income Trust (or BREIT) has grown rapidly. Its net asset value hit $70.4bn at the end of September, according to a filing made earlier this week, thanks to a series of acquisitions, robust performance and wild inflows from income-hungry investors. Add in a decent dollop of leverage and its overall assets have soared to $126bn, a separate fact sheet indicates.

The success of BREIT is a matter of some pride inside 345 Park Avenue. Here’s what Blackstone’s chair and CEO Steve Schwarzman said at the end of Blackstone’s second-quarter earnings call with Wall Street analysts, after detecting a whiff of concerns over the trust.

“I was someplace on Sunday and somebody walked up to me and he said, ‘I’m a BREIT investor. In fact, it’s the biggest thing in my portfolio and I love you people. This is so amazing. All of my friends are losing a fortune in the market and I’m making money.”

It’s a simple story. I’ve been listening to the BREIT discussion and Jon’s laid out our wares pretty well, I think. But the reason we have optimism, where apparently that’s not broadly shared, is that we’re providing enormous value to people who are investors who remember it, and they appreciate the firm. That builds our brand. That helps us raise money. It helps us do our function, which is to underwrite risk and put really good products out, unlike other people where that isn’t the case.

And we’re doing it throughout our asset classes. It’s really exciting to be able to outperform markets by thousands of basis points. And if you don’t think that’s a reason for optimism, then I find that odd. And I think that’s a base that we will be building upon.

Cornball anecdotes aside, BREIT has smashed it, returning on average 13.3 per cent annually net of fees since its birth — including a 9.3 per cent gain in rate-wracked 2022 — and amassed a real estate portfolio that any Gulf royal family would envy.

Goldman’s report came out this summer, so its numbers go up to the end of the first quarter (plus its forecasts for the next two years). But we checked the third-quarter results that came out yesterday, and BREIT now represents about 10 per cent of Blackstone’s entire pool of fee-earning assets under management.

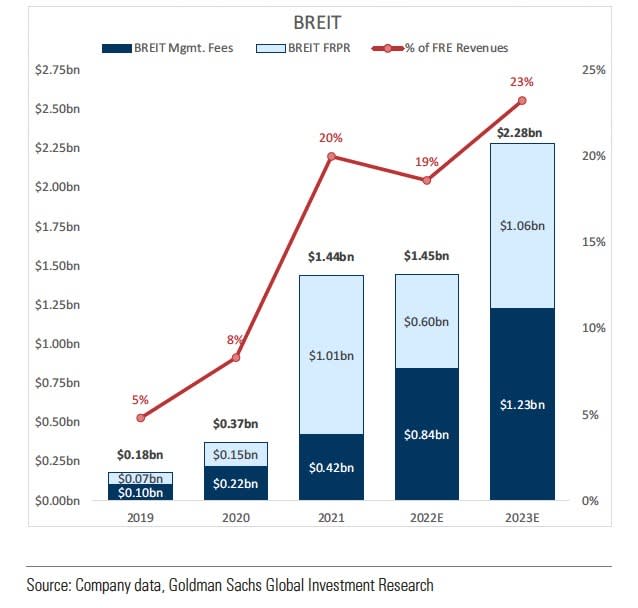

Even BREIT’s size actually underplays its rising financial importance to Blackstone. The trust charges a 1.25 per cent annual management fee based on its NAV, and a 12.5 per cent performance fee on its annual total return, (subject to a 5 per cent annual hurdle and a high water mark). Given its swelling heft and returns, the trust has become a gold mine for Blackstone.

Last year BREIT threw off $1.44bn in fees and alone accounted for about a fifth of Blackstone’s overall fee revenues, according to Goldman Sachs (Blackstone doesn’t seem to break out its fee revenues from BREIT). Goldman forecasts that this could rise to $2.3bn and 23 per cent of Blackstone’s fee revenue by the end of 2023.

By almost any measure, BREIT is an incredible success story for Blackstone (one that rival executives talk enviously about). It’s no surprise that photos of the company’s president Jonathan Gray are plastered over BREIT’s website and investor documents.

After all, it’s the kind of big win that makes Wall Street careers — perhaps even solidifying a candidate as Schwarzman’s heir apparent. Here’s Gray talking about his “beloved BREIT” earlier this year.

The heir apparent

“Our thought was ‘what if we took the most successful largest real estate investment business in the world and delivered it to individual investors and charged essentially what we charged institutional customers? Wouldn’t that be a tremendous product?’ And that was the basis for BREIT.”

However, FT Alphaville cannot help but wonder if BREIT might be facing a far less hospitable environment over the next few years. In fact, it looks downright nasty. And the trust is now so big that any setback would be meaningful for Blackstone more broadly.

This story originally appeared on: Financial Times - Author:Robin Wigglesworth

The heir apparent

The heir apparent