Monte dei Paschi: latest capital raising tests shareholder mettle

Monte dei Paschi di Siena was a glorious bank in the 15th century. Things have gone downhill since. Ill-conceived acquisitions, truly terrible loans and a host of other mishaps mean that, over the past 14 years, MPS has raised more than €23bn of equity — yet its market cap is basically zilch.

So it is no wonder that investors are looking at its most recent €2.5bn capital increase with scepticism, to put it mildly. The stock is down some 60 per cent since the bank announced it was ready to pull the trigger.

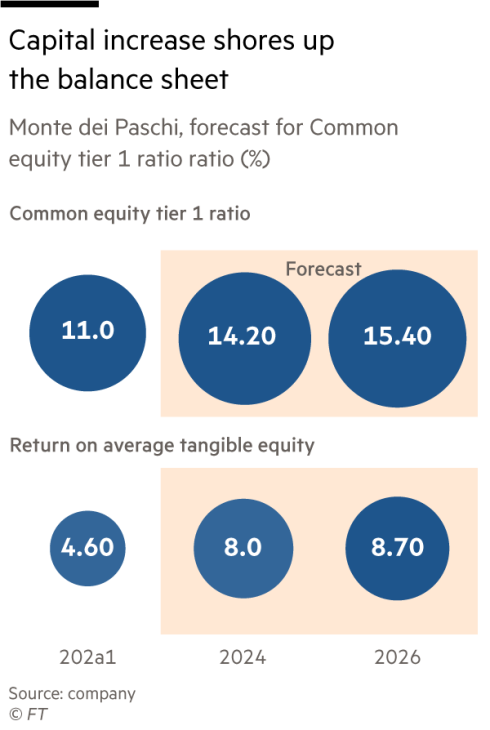

If one believed MPS’s turnround plan, a €2.5bn post capital-increase market valuation wouldn’t be unreasonable. It equates to some 0.34 times net tangible book value — on a return on equity that would hit 8 per cent if MPS met 2024 targets. Or, to put it another way, if new boss Luigi Lovaglio delivers on his promises, the stock would trade on a price/earnings ratio of 4 times two years hence.

There are two issues with this, however.

This story originally appeared on: Financial Times - Author:Tax Cognition