China property crisis spoils Communist party’s moment of triumph

As China’s Communist party congress meets this weekend to celebrate its achievements over the past five years, economists will be watching for how Beijing plans to confront its most momentous economic challenge.

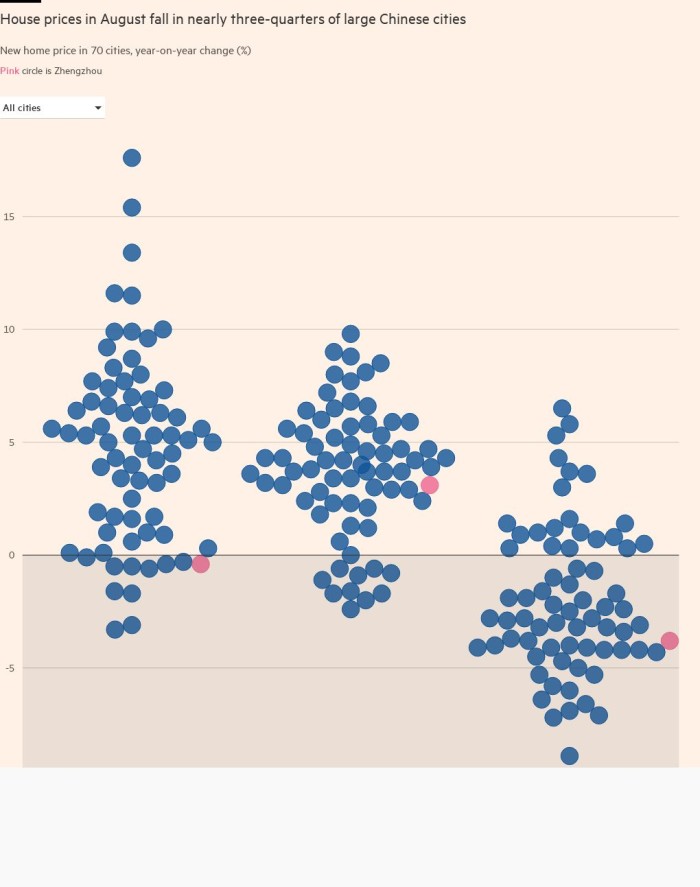

A crisis in China’s real estate sector has been gaining momentum since Evergrande, one of the country’s largest property developers and the world’s most indebted, failed to make bond payments last year.

The shock wiped out billions of dollars lent to the company and its peers, crippling construction and leaving swaths of unfinished housing across the country, and prompting mortgage boycotts from angry homebuyers.

Meanwhile, the CCP congress could reveal high-level plans to address some of the issues driving the property crisis. Xiangrong Yu, chief China economist at Citi, said that the government’s efforts had “somewhat underdelivered this year”. But he suggested that a new economic team, which is expected to be introduced at the meeting, could lead to better co-ordination between central and local governments.

On top of anaemic growth expectations, policymakers must confront a sharp fall in the value of the renminbi, which last month hit its lowest level in more than a decade.

Beyond the currency, decisions announced at the congress or thereafter are likely to be constrained by the government’s cautious approach to debt. Casanova said that stimulus efforts had been “incremental at most” because of a desire not to “overstimulate the economy”.

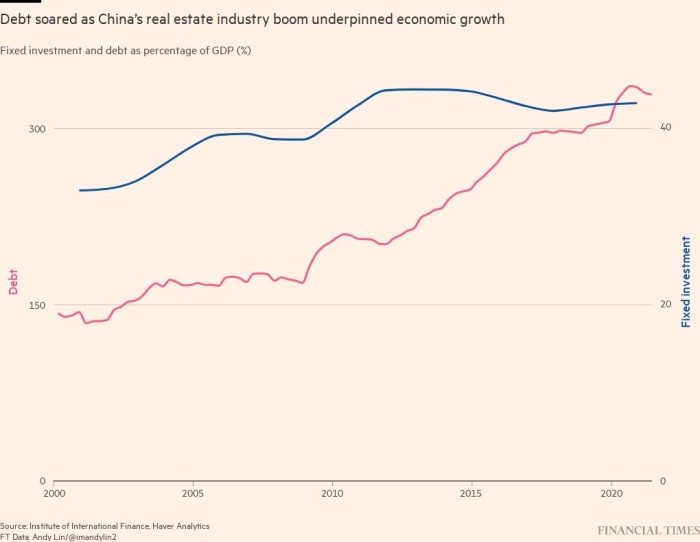

Attempts to reduce debt at real estate developers from the middle of 2020 onwards coincided with the emergence of the property crisis and sparked fears over the companies’ inability to access funding. For now, the question is whether Chinese policymakers will signal that they are sticking to that principle for the next five years.

Over the past five years, deleveraging has “probably been the most important thing”, Hu said.

“It’s hard to imagine a significant stimulus without leveraging up the economy”.

Video: Is China's economic model broken?

This story originally appeared on: Financial Times - Author:Thomas Hale