Early property taxes were generally paid by farmers and were imposed mostly on land throughout the medieval era. These days, property taxes are also imposed on assets such as real estate, and they are paid periodically by individuals or organizations.

When property taxes are high on both land and buildings and structures, businesses may not want to invest in infrastructure because they will have to pay more taxes on it. This is why companies might choose to move away from places with high property taxes.

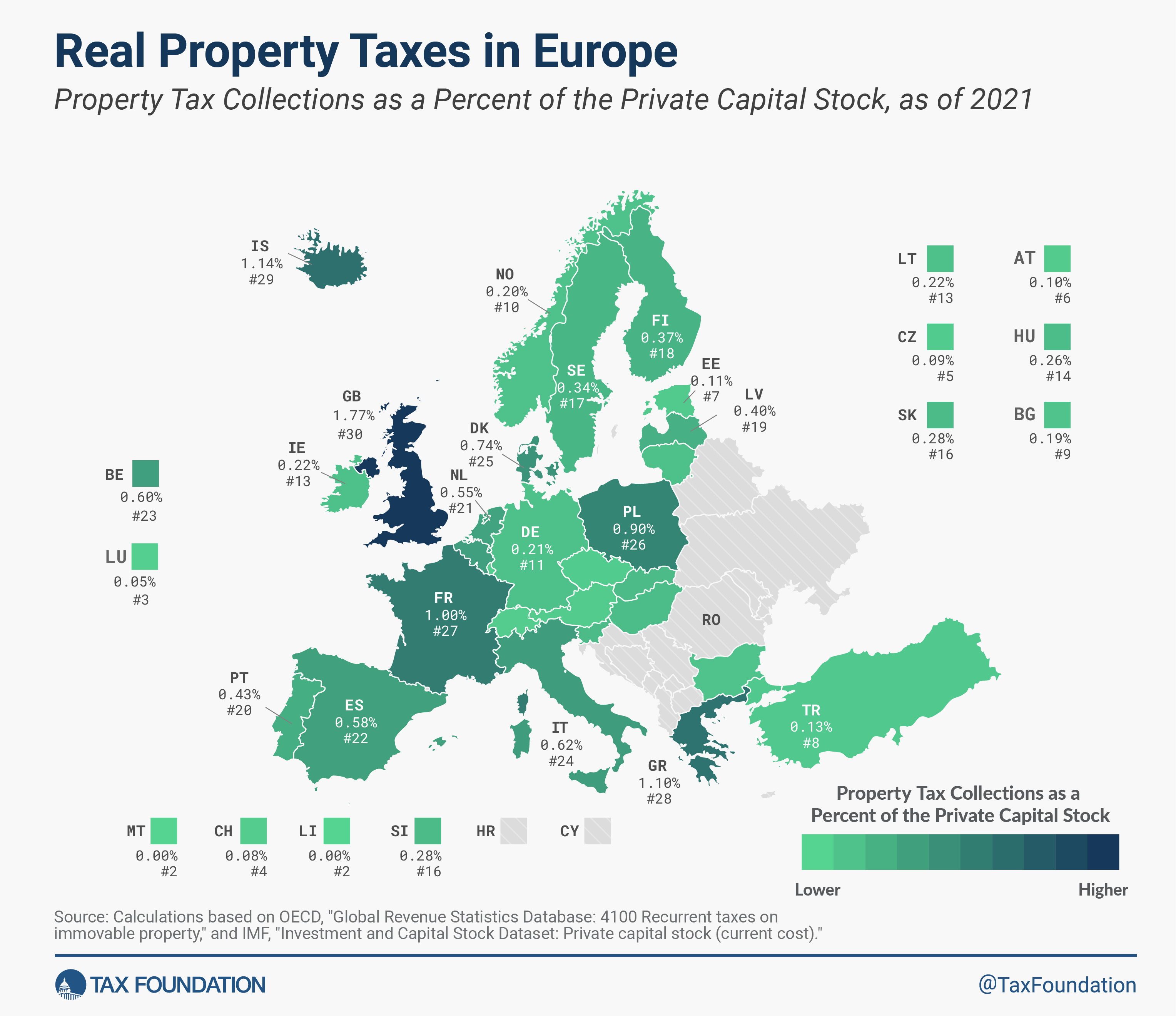

Liechtenstein and Malta are two of the 30 European countries that are talked about here that do not charge any ongoing property taxes. The only country on this map that taxes only land is Estonia. This means that its real property tax is the best.

23 of the 28 countries that tax property let businesses deduct property or land taxes from their corporate income. This lowers the tax burden and makes businesses more likely to spend.

Luxembourg has the least amount of property tax money coming in as a percentage of its private capital stock, at 0.05 percent. With 0.08%, Switzerland has the second-lowest share, and the Czech Republic is third with 0.09%. With 1.77 percent of private capital stock, the UK has the biggest property taxes. Iceland comes in second with 1.14 percent, and Greece comes in third with 1.1%.

Real Property Taxes in Europe, as of 2021

Notes:

(a) Tax on the imputed rent of properties. Applies to machinery.

(b) Levied by state governments. Some states do not tax capital improvements.

Source: Calculations for "Property Tax as Share of Private Capital Stock" are based on 2021 data from OECD, "Global Revenue Statistics Database: 4100 Recurrent taxes on immovable property," last updated August 2023, https://stats.oecd.org/Index.aspx?DataSetCode=RS_GBL; and IMF, "Investment and Capital Stock Dataset: Private capital stock (current cost)," https://www.imf.org/external/np/fad/publicinvestment/#5. For the type of property tax and whether it is deductible, see PwC, "Worldwide Tax Summaries," https://taxsummaries.pwc.com/ (2023 data).