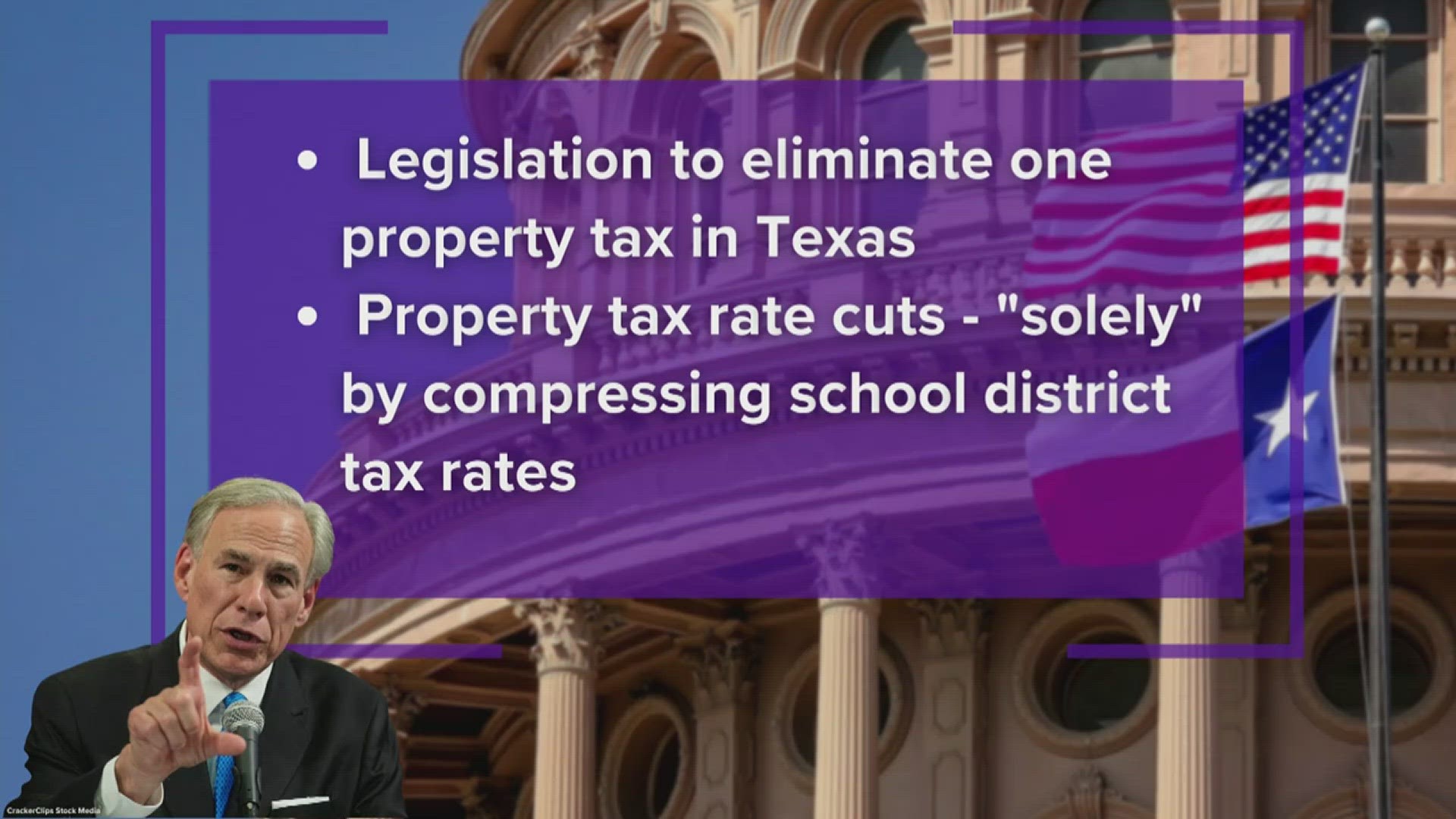

Texas still has a lot of money coming in, and cutting property taxes is a top goal for the Lone Star State. But the most recent legislative session finished in a stalemate because the Senate and the House of Representatives couldn't agree on how to lower property taxes. The current special sitting of the legislature seems to be stuck as well.

Because Texas has a lot of extra money, it could use state funds to cut local property taxes. But it's still important for lawmakers to take a principled approach to rate compression instead of just passing a plan that shifts the tax load in ways that aren't fair.

Homeowners in Texas can get a homestead exemption, which lowers the taxable value of their main home and the amount they have to pay in property taxes. The state's homestead exemption was recently raised a lot, from $25,000 to $40,000. The Senate is now looking into a further rise, to $100,000. Over time, this strategy shifts more of the property tax burden to commercial property owners, which raises costs for businesses that already pay a disproportionate share of Texas's taxes.

This is also bad news for renters, since business real estate includes properties with more than one rental unit. Even though the owner of the rented property pays the tax, most of the economic impact is felt by the renter, who has to pay more rent. A homestead exemption doesn't help renters with their property taxes, and if property tax rates ever go up, renters will have to pay a bigger share of the higher cost of occupancy than owners.

As we've written before, homestead benefits not only mess up the economy, but they also make it easier for the government to raise property taxes. Voters want to keep property taxes low when these taxes are neutral and homeowners pay the same property taxes as owners of other types of land or people who rent them. But when homestead properties get special treatment, they are more likely to support tax hikes that hit business and rental properties more than homestead properties.

When it is set up well, a property tax is usually good for the economy and easy to understand, especially when it is used to tax land and buildings that can't be moved. Most of the time, these taxes don't have much of an effect on whether or not someone works or invests, but they can change where a person or business is located.

It would be a bad deal for both residents and business owners if the way taxes are set up shifted the load so much that more harmful taxes were needed to keep helping homeowners with their property taxes. This can happen when the strategy is not good. The goal of lowering property taxes is a good one that will help the economy grow, but reforms should be neutral. They should prefer rate compression for all types of property over homestead breaks or other policies that favor certain types of property. They should also make sure that the relief is durable and doesn't force the state to raise taxes in other areas (which could be worse for the economy) to pay for the local offsets. Texas has all the money it needs to help people with their property taxes. Both owners and renters must now hope that they do the right thing.