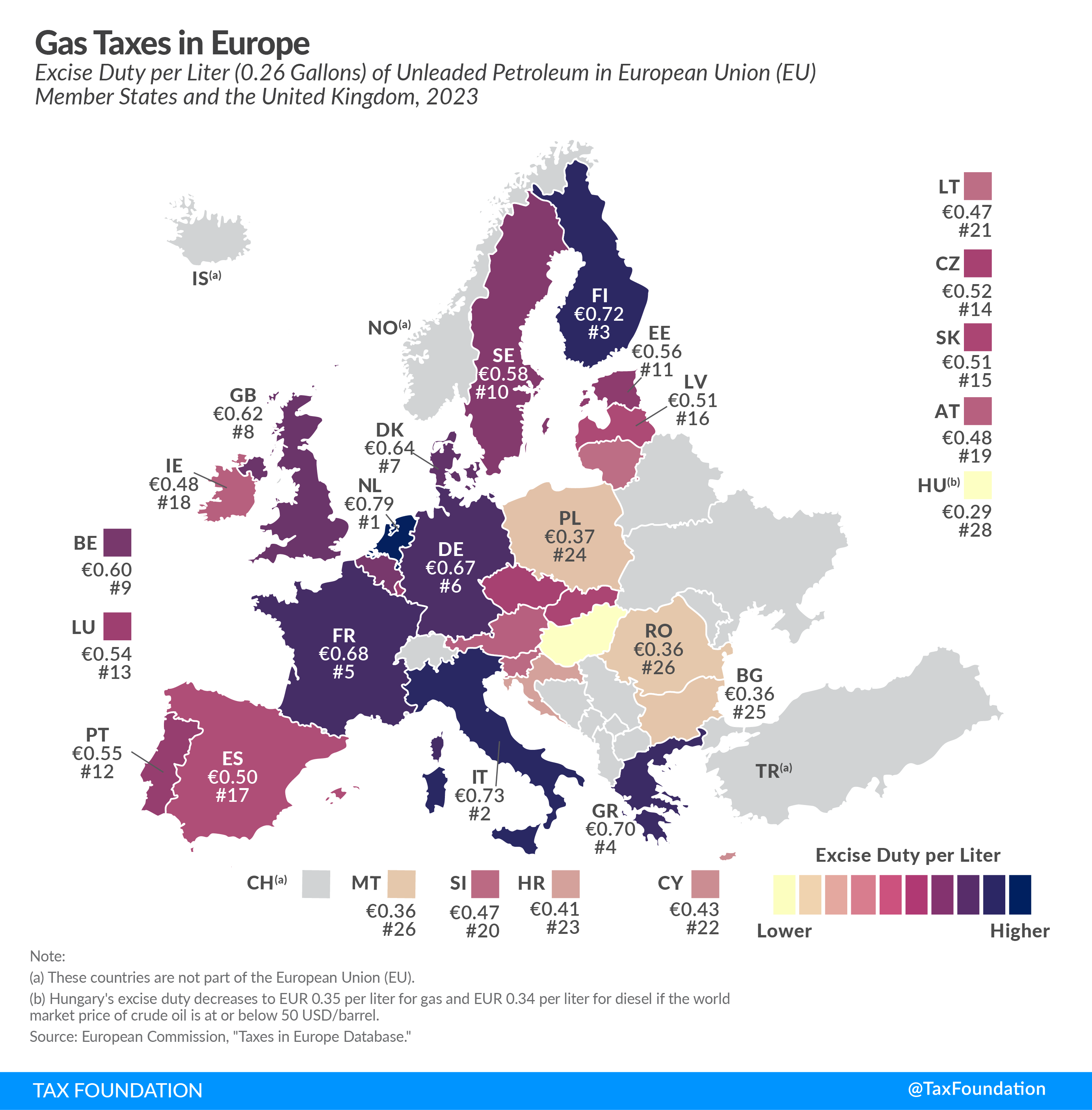

Many European governments granted temporary gasoline tax reductions in reaction to a year of high energy price hikes in 2022. By 2023, European gas and diesel taxes had essentially returned to pre-Russia-Ukraine war levels. The European Union (EU) mandates member states to impose a minimum excise duty of €0.36 per liter ($1.55 per gallon) on gasoline (petrol).

According to today's map, only Bulgaria, Hungary, Romania, Malta, and Poland adhere to the minimal rate, while the rest of the EU imposes higher excise duty on gas. Hungary has the lowest gas tax, at €0.29 per liter ($1.21 per gallon), since the Hungarian rate is set in its own currency, the forint, resulting in an average rate that is somewhat lower than the EU minimum after exchange rate changes. Following currency rates, Bulgaria, Malta, and Romania have the lowest rates at €0.36 per liter ($1.48 per gallon).

At €0.79 per liter ($3.25 per gallon), the Netherlands has the highest gas tax in the EU. The second-highest rate is €0.73 per liter ($3.00 per gallon) in Italy, followed by €0.72 per liter ($2.98 per gallon) in Finland.

Diesel vehicles account for roughly 30% of new passenger vehicles in the EU. As a result, many European consumers must pay excise duty on diesel rather than gasoline. The EU imposes a somewhat lower minimum excise duty on fuel of €0.33 per liter ($1.36 per gallon).

Diesel is taxed at a cheaper rate in most EU countries than gas. Only Slovenia taxes diesel at a higher rate than unleaded gasoline. Both the United Kingdom, which is no longer a member of the EU, and Belgium levy the same rate on the two fuel types. The average excise duty on gas in the EU is €0.53 per liter ($2.19 per gallon), while diesel excise duty is €0.43 per liter ($1.76 per gallon).

The highest excise duty on diesel is €0.62 per liter ($2.55 per gallon) in the United Kingdom, followed by Italy (€0.62 per liter or $2.54 per gallon) and Belgium (€0.60 per liter or $2.47 per gallon).

The countries with the lowest diesel excise duty include Hungary, which charges €0.28 per liter ($1.16 per gallon), which is again less than the minimum amount due to the exchange rate, followed by Malta, Bulgaria, and Poland, which charge €0.33 per liter ($1.36 per gallon).

Gas and diesel are likewise subject to VAT in all EU nations. The excise amounts displayed on the map only apply to excise taxes and do not include VAT, which is levied on the purchase price of gasoline and diesel.

Gas and diesel taxes continue to be a source of contention in European public policy. These taxes are both apparent and paid by a bigger proportion of Europeans. Expect gasoline taxes to be crucial to any policy debates as the EU seeks huge reforms in public policy as part of its green transition.

| Gas Tax | Diesel Tax | |||||

|---|---|---|---|---|---|---|

| Per Liter in EUR | Per Gallon in USD | Rank | Per Liter in EUR | Per Gallon in USD | Rank | |

| Austria (AT) | € 0.48 | $1.98 | 19 | € 0.40 | $1.63 | 16 |

| Belgium (BE) | € 0.60 | $2.47 | 9 | € 0.60 | $2.47 | 3 |

| Bulgaria (BG) | € 0.36 | $1.49 | 25 | € 0.33 | $1.36 | 25 |

| Croatia (HR) | € 0.41 | $1.67 | 23 | € 0.35 | $1.45 | 22 |

| Cyprus (CY) | € 0.43 | $1.77 | 22 | € 0.40 | $1.65 | 15 |

| Czech Republic (CZ) | € 0.52 | $2.15 | 14 | € 0.34 | $1.42 | 23 |

| Denmark (DK) | € 0.64 | $2.62 | 7 | € 0.44 | $1.82 | 9 |

| Estonia (EE) | € 0.56 | $2.32 | 11 | € 0.37 | $1.53 | 19 |

| Finland (FI) | € 0.72 | $2.98 | 3 | € 0.53 | $2.20 | 5 |

| France (FR) | € 0.68 | $2.81 | 5 | € 0.59 | $2.44 | 4 |

| Germany (DE) | € 0.67 | $2.76 | 6 | € 0.49 | $2.02 | 8 |

| Greece (GR) | € 0.70 | $2.88 | 4 | € 0.41 | $1.69 | 14 |

| Hungary (HU)** | € 0.29 | $1.21 | 28 | € 0.28 | $1.16 | 28 |

| Ireland (IE) | € 0.48 | $1.99 | 18 | € 0.43 | $1.75 | 10 |

| Italy (IT) | € 0.73 | $3.00 | 2 | € 0.62 | $2.54 | 2 |

| Latvia (LV) | € 0.51 | $2.09 | 16 | € 0.41 | $1.70 | 12 |

| Lithuania (LT) | € 0.47 | $1.92 | 21 | € 0.37 | $1.53 | 19 |

| Luxembourg (LU) | € 0.54 | $2.21 | 13 | € 0.41 | $1.70 | 13 |

| Malta (MT) | € 0.36 | $1.48 | 26 | € 0.33 | $1.36 | 26 |

| Netherlands (NL) | € 0.79 | $3.25 | 1 | € 0.52 | $2.12 | 6 |

| Poland (PL) | € 0.37 | $1.51 | 24 | € 0.33 | $1.37 | 24 |

| Portugal (PT) | € 0.55 | $2.27 | 12 | € 0.42 | $1.74 | 11 |

| Romania (RO) | € 0.36 | $1.48 | 26 | € 0.33 | $1.36 | 26 |

| Slovakia (SK) | € 0.51 | $2.11 | 15 | € 0.37 | $1.51 | 21 |

| Slovenia (SI) | € 0.47 | $1.94 | 20 | € 0.51 | $2.10 | 7 |

| Spain (ES) | € 0.50 | $2.07 | 17 | € 0.38 | $1.56 | 17 |

| Sweden (SE) | € 0.58 | $2.39 | 10 | € 0.38 | $1.54 | 18 |

| United Kingdom (GB) | € 0.62 | $2.55 | 8 | € 0.62 | $2.55 | 1 |

| Average | € 0.53 | $2.19 | € 0.43 | $1.76 | ||

| Minimum Rate | € 0.36 | $1.48 | € 0.33 | $1.36 | ||

|

Notes: The excise duties apply to petroleum and diesel with a sulphur content of < 10 mg/kg, RON 95 (gas) and bioethanol content; if applicable, they include carbon taxes and surcharges. The excise duties were converted into USD using the July 2023 USD-EUR exchange rate (0.92) Source: European Commission, “Taxes in Europe Database,” https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html; and HM Revenue and Customs, “UK Trade Tariff: excise duties, reliefs, drawbacks, and allowances,” https://www.gov.uk/government/publications/uk-trade-tariff-excise-duties-reliefs-drawbacks-and-allowances/uk-trade-tariff-excise-duties-reliefs-drawbacks-and-allowances. |

||||||