This month, House Republicans put out a big plan to change taxes that would temporarily cut taxes for both businesses and people. The House GOP tax plan is meant to get businesses to spend and help people and families deal with inflation. It does neither of these things well, but some of its rules are a step in the right direction.

What Does the Plan Do Well?

Businesses would be able to get back some of the money they spent on investments thanks to the deal.

Why does this matter? In general, making it easier for people to spend helps the economy grow, creates more jobs, and encourages new ideas.

Imagine that a company that makes medical devices spends $1 million to create new technology. Under the bill, they would be able to deduct the whole $1 million from their taxed income this year instead of spreading it out over multiple years and losing money because of inflation and the time value of money. This lets the company make more investments, which helps the business grow and makes goods that are both better and cheaper.

Also, the House GOP tax plan would make Opportunity Zones, a scheme to encourage investment in poor areas, more accountable by setting better reporting standards.

What Does the Plan Do Poorly?

The main problem with the plan is that it only lasts for two years. Both the business and individual rules will end in 2025, so it won't help the economy, wages, or jobs in the long run.

By raising the standard deduction, the bill tries to help individuals and families, but this isn't the best way to help people who are having trouble with inflation. In fact, it helps low-income families less or not at all, even though they need help the most, because many of them already have little or no taxed income.

The bill also changes business deductions in a way that affects the past. This cuts the amount of money the government gets without helping the economy (since businesses can't go back in time and spend more).

The plan is about revenue neutral, which means that the total amount of money gathered stays about the same even though the way it is collected changes. This is true because the changes are only limited (which is bad) and because it cuts spending on other things (which is good).

And the plan would make Opportunity Zones bigger before the results of the new reporting rules are in, which means before we know if they work or not.

How Would It Affect Me?

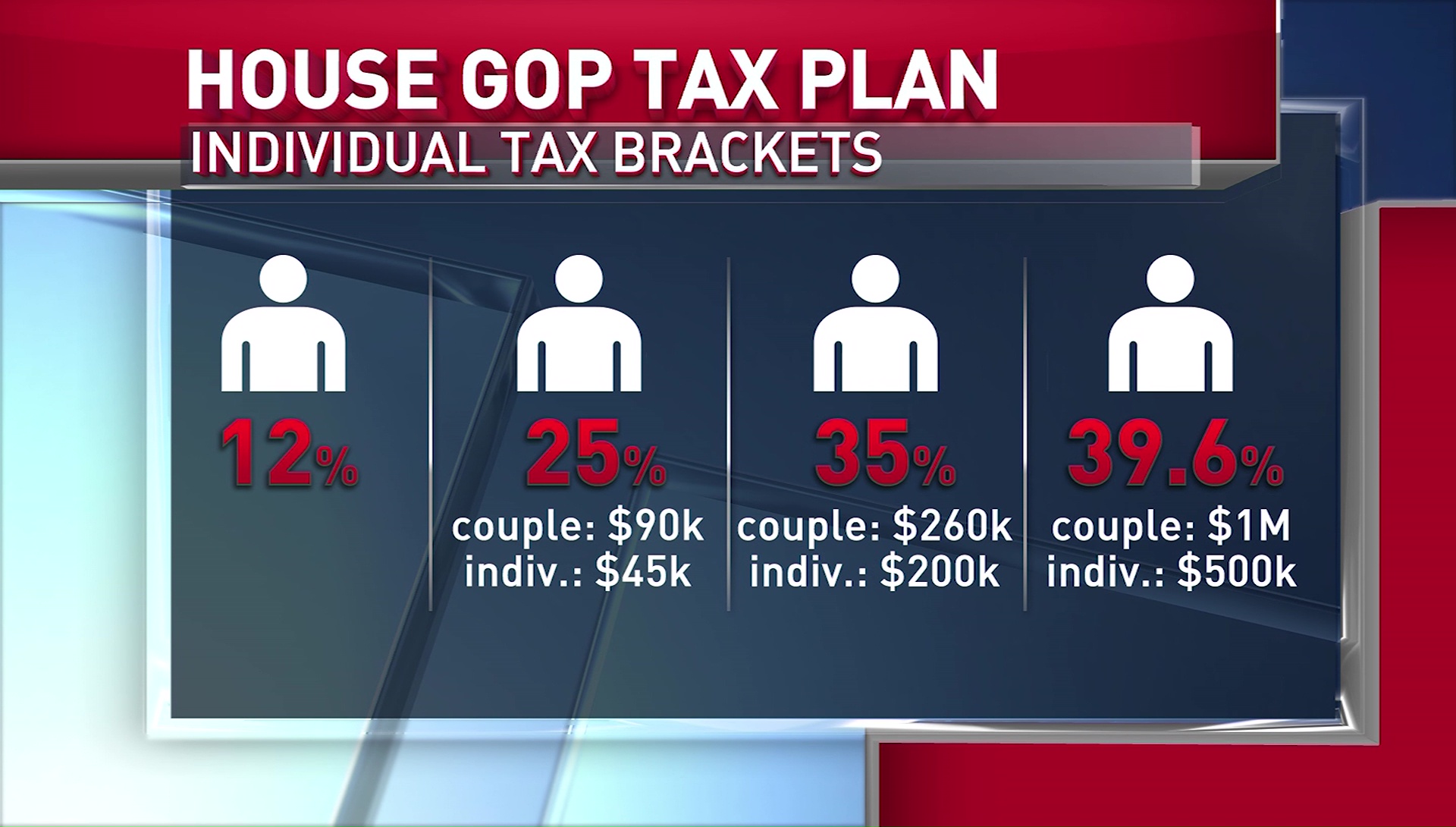

If you pay federal income taxes, you'll probably pay a little less no matter what tax rate you're in, and you might even end up in a lower tax bracket. The owners of businesses would also be able to claim the full cost of their investments until 2025. But the benefits are small, and most of them go to people in the middle and high middle classes.

The changes would help the economy for a short time, but once the policies were over, things would go back to normal.

Would the Tax Cuts Pay for Themselves?

No.

When people say that a tax cut pays for itself, they usually mean that the growth in the economy caused by the cut, such as new jobs and taxes paid on higher wages, brings in enough extra money over time to make up for the initial losses. For the GOP tax plan to pay for itself in this way, the economy would have to grow enough to make up for the money lost from the tax cuts.

The reform package's tax cuts don't pay for themselves, but they are paid for because they are temporary and because the plan cuts spending in other areas.

Why Does This Matter?

A big fight about tax policy is coming. Many of the changes made by Republicans to the tax law in 2017 will end in 2025. If Congress doesn't move, everyone's taxes will go up a lot. This package shows the goals of the Republicans in the House.

Even though the House GOP tax plan moves in the right way, it could be better. For example, lawmakers should let businesses deduct the full cost of their investments permanently. This is a strategy that has a lot of economic "bang for its buck."