The Fourth of July is next week. On that day, we celebrate the birth of our country. Many of us spend the day being patriotic, going to parades, spending time with friends and family, eating BBQ, and drinking good beer.

One might think that the price of grain or hops would have the most impact on the price of beer. But, according to the Beer Institute, "taxes are the single most expensive ingredient in beer, costing more than labor and raw materials combined." In 2005, a study found that the different taxes on production and distribution make up about 40% of the price of beer at the store. Where do all these taxes on beer come from and what are they?

The federal government of the United States takes an excise tax on beer. This tax ranges from $0.11 to $0.58 per gallon, depending on where it was made, how much was made, and where it was made. At the state level, taxes on fermented malt drinks are collected by all 50 states and the District of Columbia. After the prices of the things are added up, sales taxes from the state and sometimes the local government are added on.

State excise fees are often paid by the people who make, sell, or distribute beer. The states collect these excise taxes based on how much beer they sell, which is generally shown as a price per gallon. In these situations, customers won't see the tax as an extra excise tax when they check out. Instead, the tax will be included in the price that the store charges.

In most states, sellers are required by law to pay beer excise taxes. However, how these taxes are collected varies from state to state. Some states, for example, put taxes on brewers, importers, and other wholesalers based on how much money they make or at a set price per gallon, bottle, or case sold.

Many states also get money from beer sellers by charging them license fees. States can also change the price of beer by putting in place price caps, which are often minimum prices for beer set by the state.

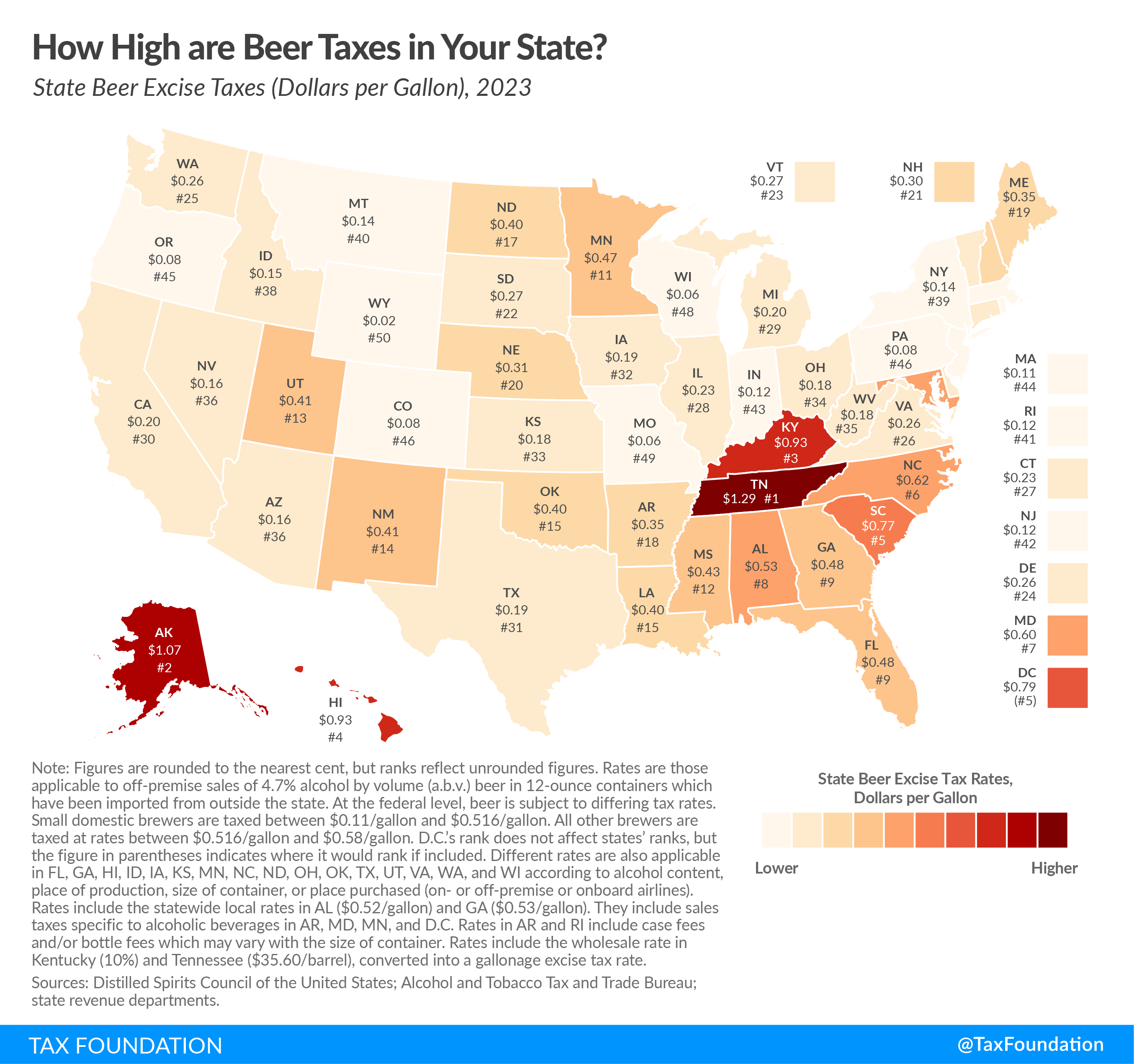

On the map below, you can see how much beer costs in each of the 50 states and the District of Columbia. Rates are very different. In Wyoming, they are as low as $0.02 per gallon, and in Tennessee, they are as high as $1.29 per gallon. At $0.06 per gallon, Missouri and Wisconsin are tied for second place. Colorado, Pennsylvania, and Oregon all have the same price per gallon, which is $0.08. Alaska is second, with a tax of $1.07 per gallon, then Kentucky and Hawaii, both of which charge $0.93 per gallon. The numbers on the map below are rounded to the nearest 1%, but the ranks show the numbers without any rounding.

The per-gallon rate on the map shows the excise tax for a 12-ounce beer with 4.7% alcohol by volume (ABV) and a price per gallon. Sixteen states have different beer excise tax rates based on the amount of alcohol in the beer, where it was made, the size of the container, or where it was bought. For example, in Idaho, "strong beer" with more than 4% ABV is charged at the same rate as wine, which is $0.45 per gallon. In Virginia, the price per bottle changes for bottles that are more than 7 ounces or 12 ounces.

So, while you drink a beer with your friends and family, how does your state stack up?