Cerberus in checkout line for $14bn payday

One thing to start: Binance has abandoned a deal to rescue Sam Bankman-Fried’s FTX cryptocurrency exchange, citing concerns about its business practices and investigations by US financial regulators. Get the latest developments here.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: [email protected]

In today’s newsletter:

Cerberus turns $2bn into $14bn profit

Sovereigns lend buyout firms a hand

Musk: Oops I did it again . . .

Cerberus is close to bagging $14bn at the supermarket

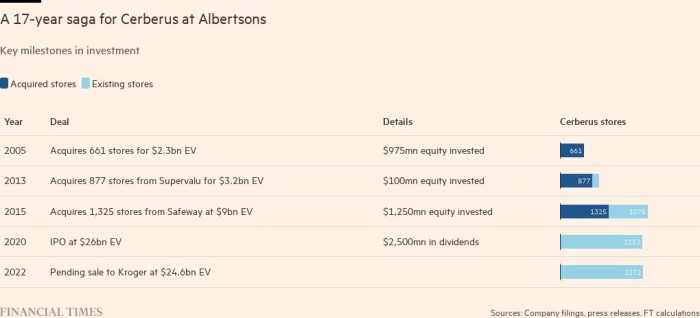

In 2006, Cerberus Capital Management was mostly an afterthought in a mega buyout of the US grocery chain, Albertsons. Stephen Feinberg’s private equity firm picked up about 700 unwanted stores while the main Albertsons buyer, a Midwestern food wholesaler, Supervalu, took on more than 1,000.

That is if they can get the sale past authorities in Washington, DC as well as state capitals, who are naturally not excited about the supermarket business shrinking. Those opposed to the consolidation are putting up a spirited-fight, arguing that the deal will be bad for grocery prices, grocery workers and cities and towns across America.

It underscores how politics, for the private equity industry, has become as important a skill as financial engineering and operations.

As DD’s Antoine Gara and Sujeet Indap report in this feature, the key to Cerberus’ huge windfall is a set of real estate specialist investors. Starting with the 2005 transaction, the likes of Kimco, Lubert-Adler and Klaff, all of who are experts in “PropCos”, joined Cerberus in buying the unwanted Albertsons stores.

Eventually the group acquired the rest of Albertsons as well as the national chain Safeway. In between, Cerberus and friends sold properties and land, paid down debt, took some dividends and eventually listed Albertsons in 2020 with a $25bn enterprise value.

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

The Lex Newsletter — Catch up with a letter from Lex’s centres around the world each Wednesday, and a review of the week’s best commentary every Friday. Sign up here

This story originally appeared on: Financial Times - Author:Tax Cognition