US stock hedging strategies offer little respite from sell-off

Investors who poured money into funds aimed at protecting them from the sell-off in shares are finding many of the strategies have backfired, offering little or no safeguard from a drawdown that has sliced $13tn off the US stock market.

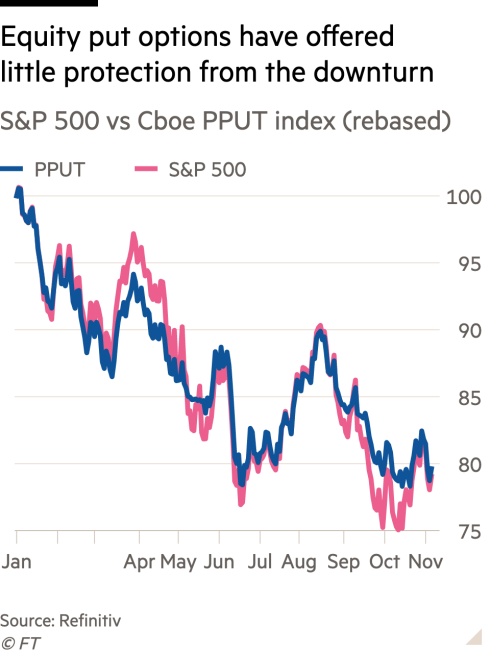

Funds that focused on buying equity put options, which are often used as insurance against stock declines, have struggled to make gains even as the S&P 500 suffers its worst drawdown since the 2008 financial crisis. Those who prepared for violent swings by buying call options on the Cboe’s Vix index — which would pay off if the market gauge of expected volatility spiked — have also been left wanting.

A Cboe index that tracks a theoretical portfolio that buys both stocks within the S&P 500 and equity put options — known as the PPUT index — has fallen roughly 20 per cent this year, not any better than the total return of the S&P 500.

Dylan Grice, co-founder of Calderwood Capital, a hedge fund advisory and research firm, said the performance of put options this year had raised “fundamental” questions about the point of some strategies. “It’s like an insurance company that doesn’t pay out when you have an accident,” he said.

This story originally appeared on: Financial Times - Author:Nicholas Megaw