‘The wolf is coming’: rising rates push Spain’s homeowners to the brink

Isabel Benito’s four-bedroom chalet in Colmenar Viejo, an airy town with views of the mountains north of Madrid, is not the archetypal home of a family living on the edge. But the bank documents and scribbled notes she keeps in a bulging shopping bag in her living room are testament to the financial strain she is under.

Benito, 56, is worried that the payments on her variable-rate mortgage — the typical contract for most Spanish homeowners — could soon jump from €902 a month to over €1,300. “There’s fear of losing your home, fear of losing what you have paid for so far, and all the sacrifices you have made,” she says. “A lot of fear, and a lot of sadness.”

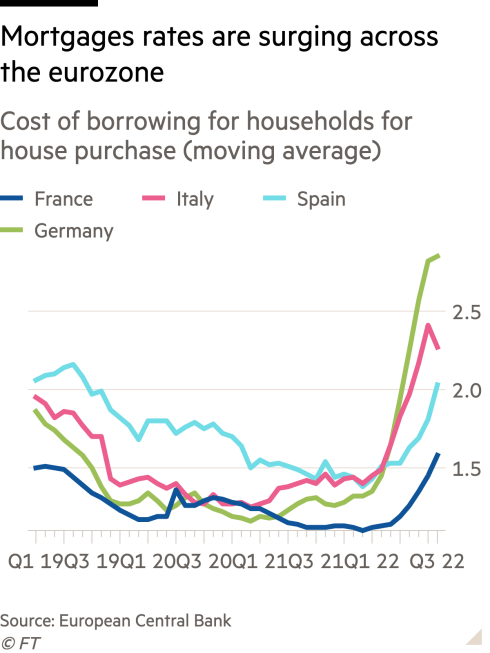

Her angst is shared by millions across the eurozone who are reckoning with a series of aggressive rate hikes by the European Central Bank in response to rampant inflation. For households, the impact of monetary tightening on their mortgages comes as energy and food prices devour an expanding share of their budgets.

Managing the resulting discontent is an urgent task for political leaders — and a make-or-break one for those facing elections next year such as Pedro Sánchez, Spain’s Socialist prime minister, whose government is pressing banks to offer relief.

In Spain the fears are especially acute because memories are fresh of the traumatic housing crisis that began when the property bubble burst in 2007, bringing with it hundreds of thousands of evictions, a financial meltdown, and a destruction of trust in banks.

The Bank of Spain says roughly three-quarters of mortgage holders in Spain have variable rate contracts, which are usually taken out for the duration of the loan. The proportion of flexible rate mortgages is equally high in neighbouring Portugal, but far lower in France and Germany where fixed-rate contracts are the norm.

This story originally appeared on: Financial Times - Author:Barney Jopson