Amundi warns on hidden leverage in the financial system

Europe’s largest asset manager has warned that the tremors in the UK pensions market should be a “wake-up call” to investors and regulators about the dangers of hidden leverage in the financial system.

Vincent Mortier, chief investment officer at Amundi, which has €1.9tn in assets, said in an interview that the recent turmoil unleashed by the UK government’s “mini” Budget was “a reminder that shadow banking is a reality. I don’t believe that anyone before the crisis had any idea of the magnitude of this shadow banking in the pension fund industry”.

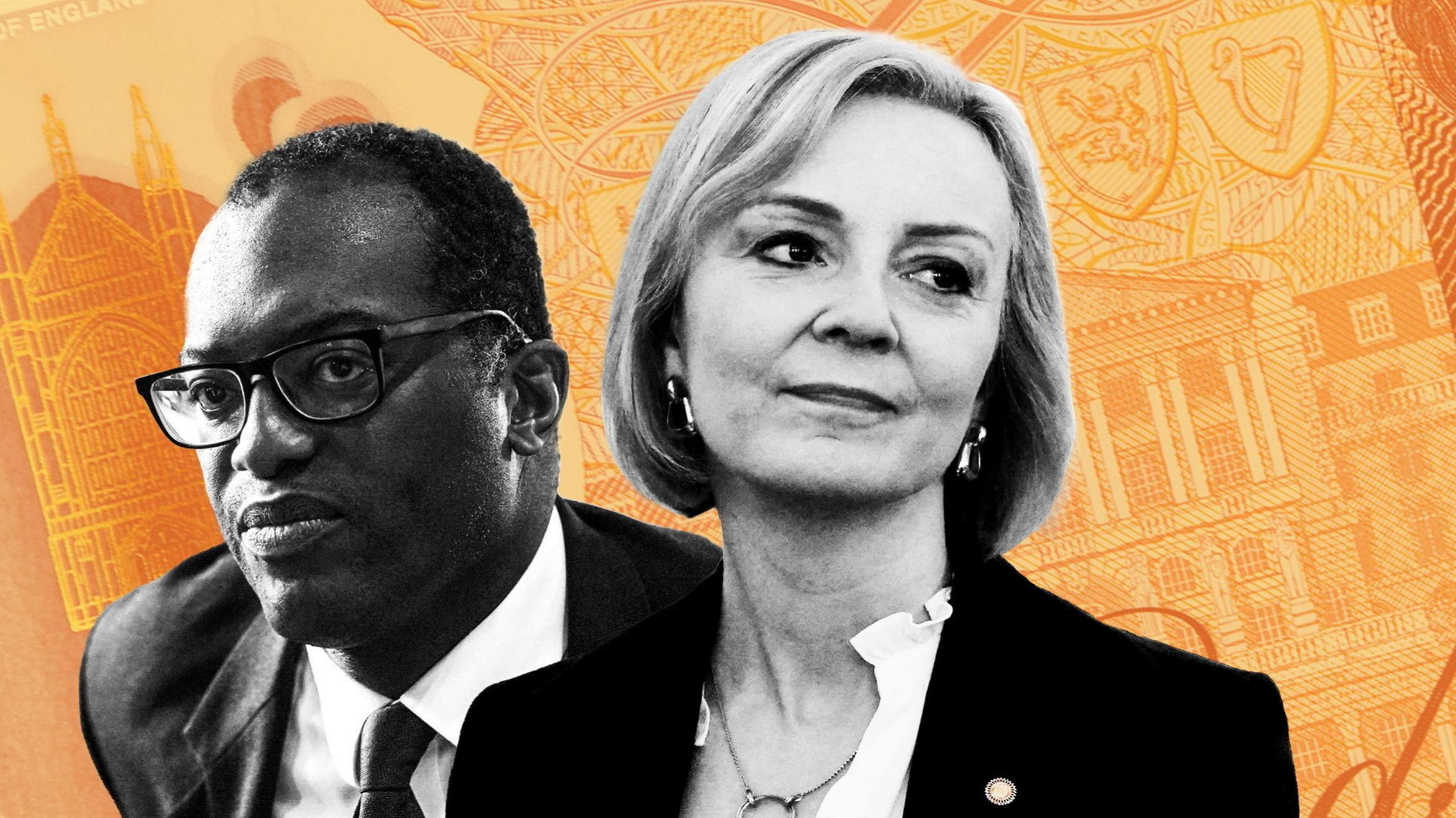

Former chancellor Kwasi Kwarteng shocked markets with £45bn of unfunded tax cuts on September 23, driving up UK government bond yields and wreaking havoc on the country’s £1.4tn defined benefit pension industry, which uses specialised hedging strategies to help schemes better match their assets and liabilities.

Mortier singled out several areas where hidden leverage might be a concern: over-the-counter derivatives, which are negotiated privately, away from exchanges; real estate, and parts of the private credit market including leveraged loans.

The BoE’s Financial Policy Committee recently warned of risks lurking in the US private credit markets. It noted that leveraged lending increased from about $2tn in 2017 to $3tn at the end of last year, and said that companies with such debt “were likely to be particularly vulnerable to the tightening in financial conditions and the weaker growth outlook”.

Mortier also highlighted collapsed family office Archegos Capital Management as an example of how leverage can build up under the radar. Archegos founder Bill Hwang borrowed billions of dollars from blue-chip banks to amass huge positions in US-listed companies. By using derivatives, where the bank it traded with bought or sold stocks on Archegos’s behalf, the firm left no visible footprint of its activity to the investing public.

Archegos’s collapse caused billions of dollars of losses for investment banks including Credit Suisse, UBS, Nomura and Morgan Stanley after it defaulted on margin calls, with more than $100bn wiped from the valuations of nearly a dozen companies as Archegos’s positions were unwound.

This story originally appeared on: Financial Times - Author:Harriet Agnew