The US housing market’s big chill

Home prices in US cities, particularly in the west, are cooling as rising mortgage rates have shrunk the pool of property shoppers.

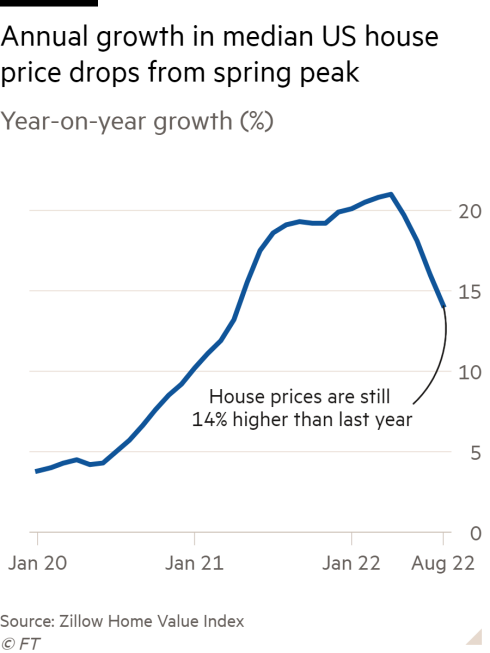

In April, annual growth in US prices peaked at 21 per cent, according to property company Zillow’s home value index. By last month, that had fallen to 14 per cent. Prices in the US residential property market are resetting, says Zillow senior economist Jeff Tucker, “but it’s too soon to tell how big a price reset it will be”.

In July, the S&P Case-Shiller index, which measures house prices in 20 US cities, recorded its first monthly decline in a decade, dropping by 0.44 per cent. In August, the median house price in the US was $356,054 according to Zillow, only about $1,500 down from its all-time high in June.

“It’s going . . . to be a rocky couple quarters for the industry,” says Andrew Vallejo, a real estate agent in Austin.

The rising rates are pushing home ownership beyond the reach of some buyers, cooling demand for homes. Buyers hit an “affordability ceiling” in April and May, Tucker says. The monthly mortgage payment on a typical home with a 20 per cent down payment jumped from $1,035 in August 2021 to $1,643 last month, a 59 per cent increase.

Buyers began to drop out of the housing market. At the same time, sellers continued to list their homes in the spring and summer, encouraged by the record prices commanded during the first two years of the pandemic. Home sales began to slow, and as properties sat on the market for longer, inventory — the number of homes available to purchase — began to build.

The longer they sat, the more pressure grew for homeowners to cut their list prices. According to the Case-Shiller index, July prices declined the most in San Francisco, at 3.5 per cent; Seattle at 3.1 per cent; and San Diego at 2.5 per cent.

This story originally appeared on: Financial Times - Author:Claire Bushey