How big is the capital hole at Credit Suisse?

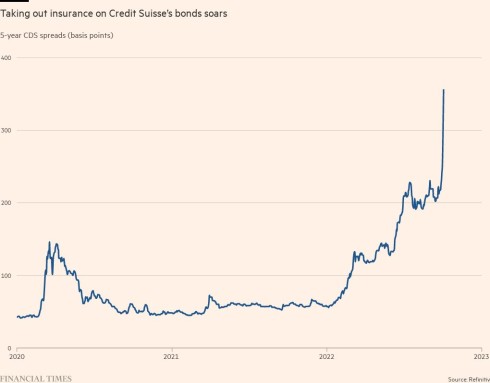

Credit Suisse has spent the past few days battling social media rumours about the strength of its balance sheet and trying to convince investors and clients that its plummeting share price and spiking credit default swaps are not telling the true story of the bank’s health.

At the centre of the storm is a simple question that analysts and market commentators have been asking ever since Credit Suisse announced over the summer that it would strip back its investment bank and cut out SFr1.5bn of costs: How big will the capital hole actually be?

Last month analysts at Deutsche Bank estimated the drastic moves would leave the Swiss lender needing to find an additional SFr4bn due to restructuring costs, the need to grow other business lines and regulatory pressure to strengthen its capital ratios.

By Friday, analysts at Keefe, Bruyette & Woods were putting the figure at SFr6bn. They argued this would leave Credit Suisse, after asset sales, asking investors for SFr4bn of capital “to accommodate a clear growth plan and/or offset any unknowns such as litigation or client attrition fears”.

Credit Suisse managers had been forced into the charm offensive following a spike in spreads on the group’s credit default swaps last week, which indicated investors were becoming increasingly bearish on the group. Over the weekend social media and web forums were awash with rumours about the bank’s imminent collapse.

Credit Suisse raised $1.5bn of AT1 capital over the summer, with a bond offering that paid 9.75 per cent. While at the time the issuance looked pricey, the bank has since been downgraded by several credit agencies and the bond is currently trading at a 12.5 per cent yield.

When it comes to the bank’s liquidity levels, Credit Suisse has a liquidity coverage ratio of 191 per cent, which is significantly higher than most of its peers. The ratio is a reflection of the amount of highly liquid financial assets the bank holds that can be used to meet short-term obligations.

“From our perspective, looking at company financials at the end of the second quarter, we see Credit Suisse’s capital and liquidity position as healthy,” said JPMorgan analyst Kian Abouhossein.

By the end of Monday, the bank’s shareholders appeared calmed by the reassuring messages sent by analysts, even if there were also increasingly loud calls for the unveiling of the new strategic plan to be brought forward. At the close of the market in Zurich, Credit Suisse shares had recovered to roughly where they had started the day at SFr4.

Meanwhile in Australia, an ABC business journalist who had sent a widely circulated tweet on Saturday suggesting that a large international investment bank was “on the brink” had deleted the post and his employer said it had reminded him of its social media guidelines.

Video: Credit Suisse: what next for the crisis-hit bank? | FT FilmThis story originally appeared on: Financial Times - Author:Robert Smith