Russia crisis challenges ETF sector’s ‘cockroach’ status

Just days after Russia launched a full-scale invasion of Ukraine on February 24, stock exchanges around the world called time on the trading of Russia-focused exchange traded funds.

As Vladimir Putin’s missiles hit and his ground troops advanced, one by one the major exchanges halted dealing activity. First came the bourses in Europe, quickly followed by the US. By March 3, the market for Russia ETFs was effectively closed.

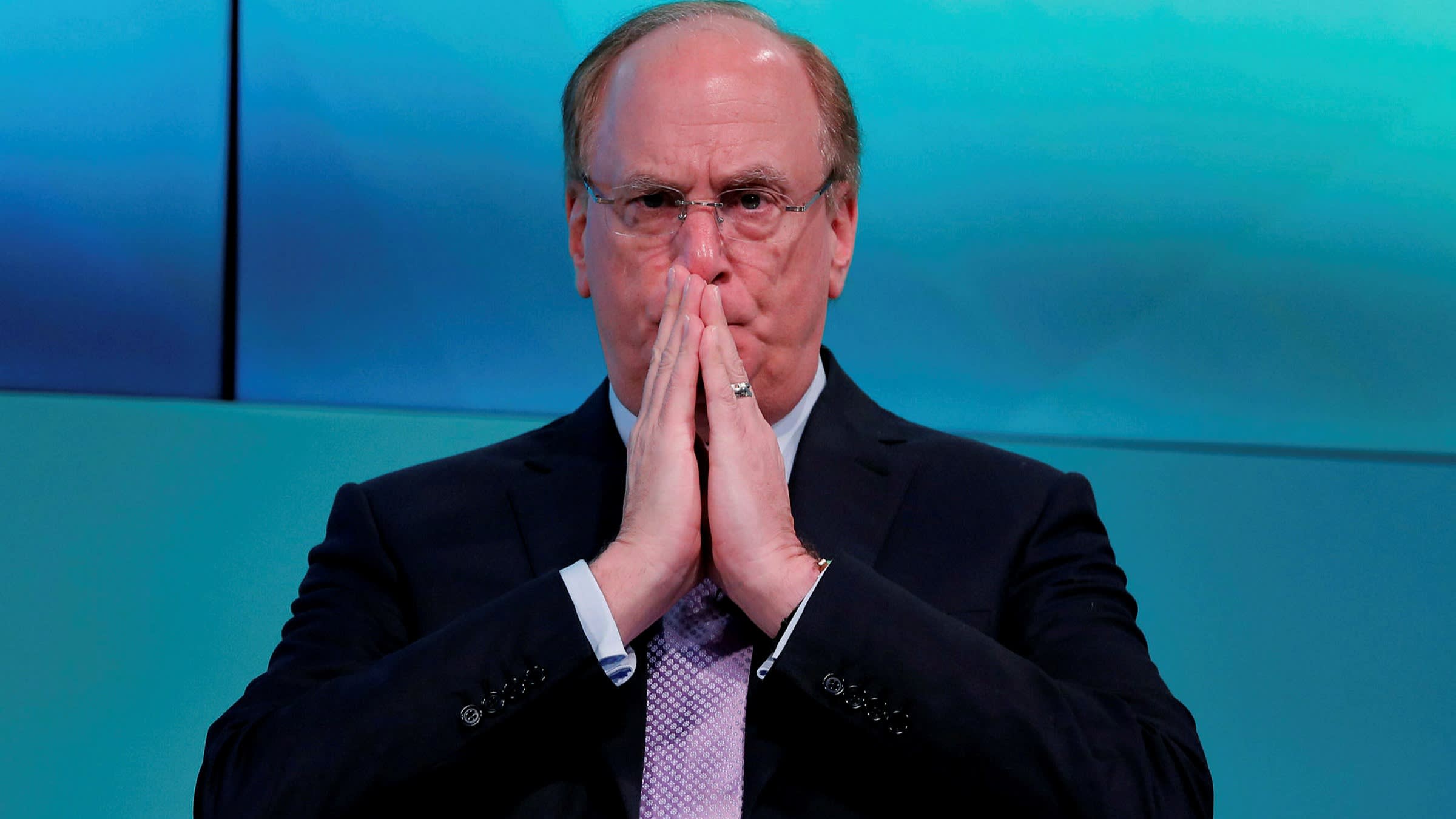

The world’s biggest providers of ETFs took the suspensions in their stride — at least on the face of it — immediately backing the closures. Industry leader BlackRock announced that it “strongly supported” the shutdowns.

“It is unprecedented,” Manooj Mistry, chief operating officer at asset manager HANetf, says of the Russia-related ETF suspensions. “But what’s happened is beyond the control of the ETF ecosystem and is being driven by non-market factors, including specific sanctions [against Russia].”

In spite of these concerns, however, commentators agree it is unfair to set apart ETFs, given all investors in Russian securities have been hit by the outbreak of war and the subsequent sanctions.

This story originally appeared on: Financial Times - Author:Chris Newlands