Credit Suisse: terrifying investors with its message of reassurance

First days on the job can be tough but Dixit Joshi’s tops most. Credit Suisse’s new chief financial officer started on Monday after senior executives had spent the weekend telling clients, investors and counterparties that the bank was solvent.

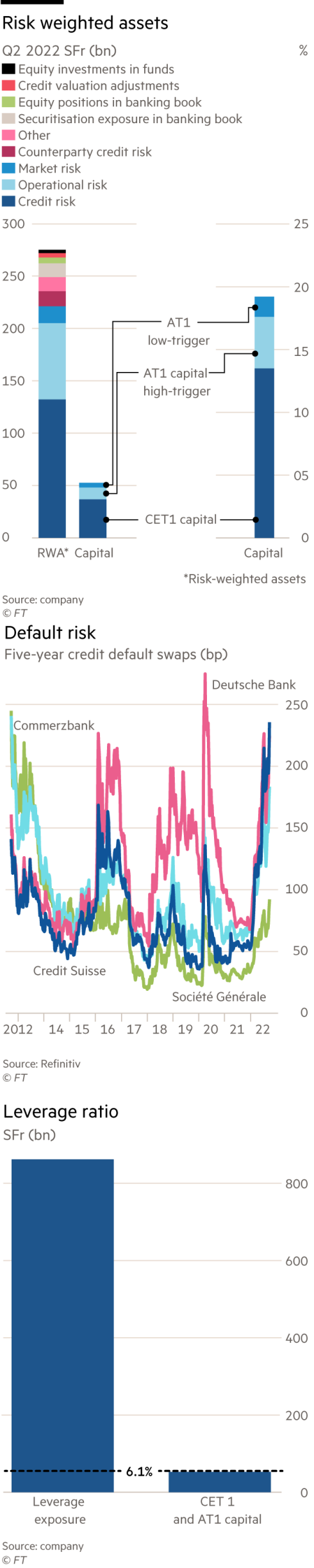

Such reassurance can be spectacularly unsettling. It implies that someone somewhere thinks the business is in serious trouble. Credit Suisse shares fell 8 per cent when markets opened. Spreads on credit default swaps moved even higher. Its share valuation now lines up with Greek banks.

Markets are unforgiving at the best of times. As the UK government found out last week, they are ruthless during times of heightened fear. Credit Suisse has all the makings of an easy short.

Firstly, it has a chequered history, including losses from the Archegos and Greensill scandals. Secondly, there has been a revolving door of managers. The latest of these will not unveil their plans for almost a month. Form says it is difficult to give Credit Suisse the benefit of the doubt. But the banking system regulation today deserves greater trust.

This story originally appeared on: Financial Times - Author:Tax Cognition