-

NVIDIA has just become the first company in history to reach a $5 trillion market cap — an astonishing leap powered by artificial intelligence and next-gen chips. For technology lovers, career builders and anyone curious about the future, this moment marks a shift in what “big tech” really means. Dive into how it happened, what it signals for your own growth, and why now is the time to rethink how you ride the wave of disruption.

-

The internet is choking on “AI Slop” — a storm of low-quality, machine-made content that looks smart but feels soulless. From fake news to recycled quotes, our feeds are drowning in digital noise. But there’s still hope. The future belongs to thinkers, curators, and creators who choose depth over dopamine. Here’s how we reclaim authenticity in an algorithm-driven world.

-

Discover the book list that the world’s most successful entrepreneurs and investors actually follow. These aren’t just business manuals—they’re mindset-shifters, productivity boosters, frameworks for the modern tech-career world. If you’re aged 25-45, passionate about tech, growth and self-mastery, this post is for you. Dive in, pick your next read, tag a friend who needs it, and share your favourite quote in the comments! #readinglist #billionairemindset

-

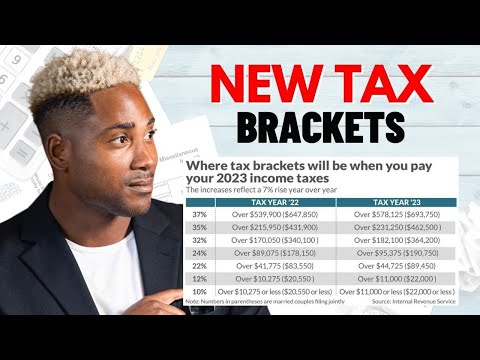

Are you ready to take control of your finances? Discover how the IRS’s VITA program offers free tax-preparation help for eligible taxpayers—learn what it is, how it works, and why it matters.

-

Gold has leapt to historic highs, leaving many asking: “Why now?” Join me as I unravel the layers — safe-haven flows, real interest rates, institutional demand, supply constraints — that explain this surge. With clarity and nuance, I invite you to think differently, comment, and share your views. Because knowledge is best when it spreads.

-

What if the data center powering your AI assistant is quietly drawing as much electricity as a small city? As AI surges, hyperscale campuses, edge nodes, microgrids, advanced cooling, and novel energy sources all collide at the frontier of tech and sustainability. Dive into the untold story—see how “green” gets real, where regulation, community pushback, and emerging power models are reshaping the backbone of the digital age. Share to spark conversation.

-

How close are we to building a machine that thinks like a human? In this post, we dive deep into expert predictions for AGI timelines, the monumental technical and ethical barriers in the way, and what those breakthroughs might look like. Whether AGI arrives in 2030 or 2050, this journey reshapes how we live, work, and dream. Let’s explore together—and discuss where you think we’ll really land.

-

AI isn’t just for engineers anymore. In this post, I dive into the top non-technical AI programs that are trending in the U.S. — from DeepLearning.AI’s “AI for Everyone” to MIT’s No-Code AI certificate — with full breakdowns of their curriculum, what people love (and don’t), and tips on which suits you best. If you’ve ever wondered how to leverage AI without writing a single line of code, this is for you. Let’s demystify AI together.

-

Your emotions aren’t invisible. They rewrite your hormones, your immune system, even how your cells repair themselves. Dive into the science of how stress, joy, love, and gratitude can literally shape your body — and discover how to regain balance through simple, natural changes.

-

What if your body could heal itself, clean out toxic waste, and reset your metabolism — simply by pausing eating? Grounded in “The Complete Guide to Fasting” by Jason Fung, this post breaks down the science, real-life benefits, and easy steps to incorporate safe, effective fasting. Whether you’re a busy professional or health seeker, get inspired to try a smarter, gentler path to detox, energy, and freedom. Share this with someone who’s ready to break free from diet rules.