A number of nations have implemented carbon taxes, emissions trading schemes (ETSs), and environmental restrictions in an effort to cut carbon emissions.

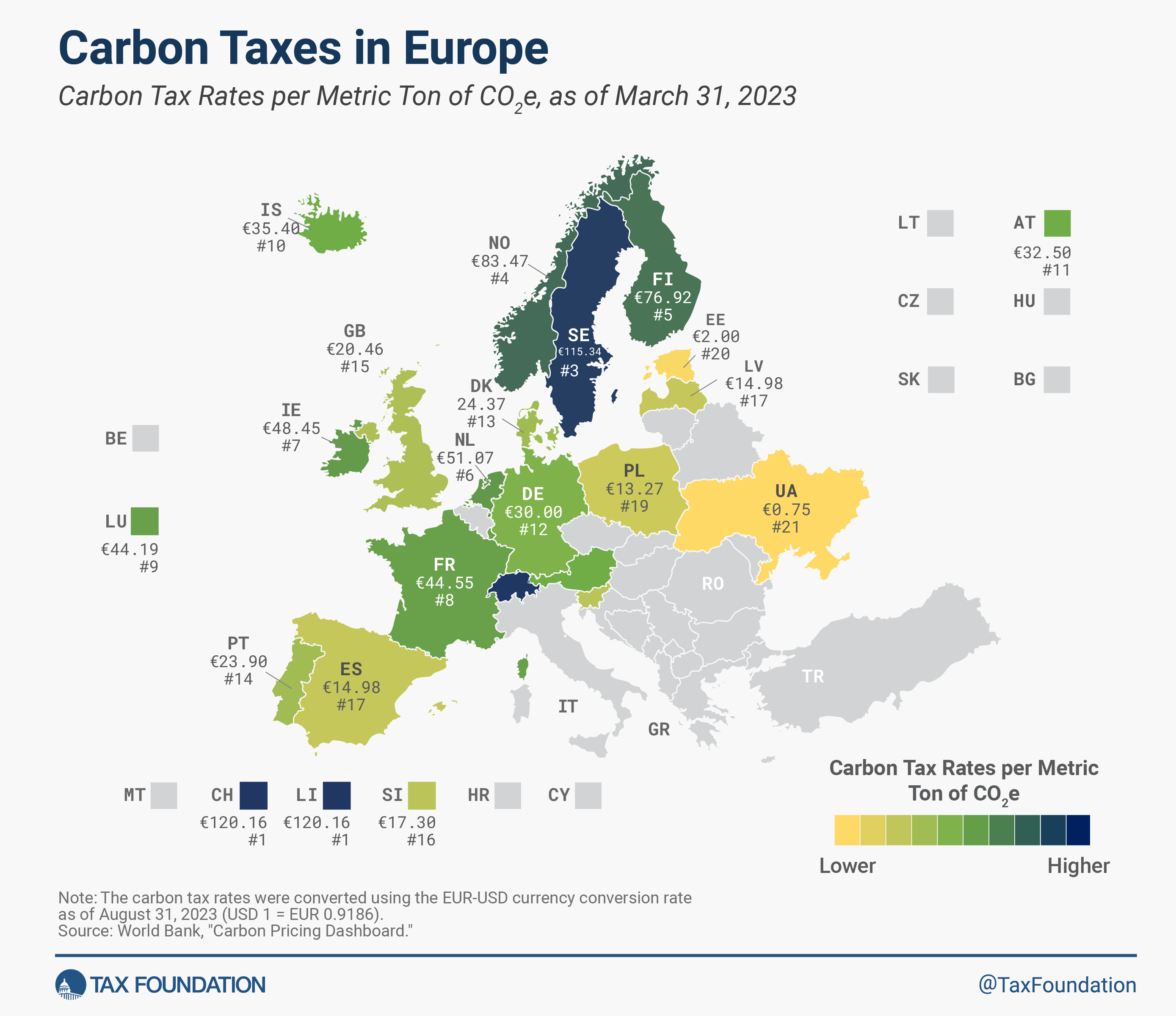

Finland became the first nation in the world to impose a carbon tax in 1990. Since then, carbon taxes have been introduced in 20 European nations; the rates range from less than €1 in Ukraine per metric ton of carbon emissions to more than €100 in Sweden, Liechtenstein, and Switzerland.

The highest carbon tax rates are now found in Switzerland and Liechtenstein, at €120.16 ($130.81) per ton of carbon emissions; Sweden and Norway are next, at €115.34 and $125.56, respectively, and €83.47 and $90.86, respectively. Estonia (€2, $2.18) and Ukraine (€0.75, $0.82) have the lowest rates of carbon taxation.

Several forms of greenhouse gases, including carbon dioxide, methane, nitrous oxide, and fluorinated gases, are subject to carbon taxes. The percentage of greenhouse gas emissions that are subject to the carbon tax varies depending on the extent of the tax in each nation. For instance, only fluorinated gases are subject to Spain's carbon tax, which accounts for 2% of the nation's overall greenhouse gas emissions. In comparison, Liechtenstein absorbs almost 81% of its greenhouse gas emissions.

A market designed to exchange a limited quantity of greenhouse gas emission allowances, the EU Emissions Trading System (EU ETS) is comprised of all EU member states as well as Iceland, Liechtenstein, and Norway. Every European nation that imposes a carbon tax, with the exception of Switzerland, the UK, and Ukraine, is also a member of the EU ETS. Since January 2020, Switzerland's ETS has been linked to the EU ETS. As of January 2021, the UK launched its own UK ETS in the wake of Brexit.)

The national carbon tax bases in Finland, Ireland, the Netherlands, and Norway overlap with the emission base covered by the EU ETS, resulting in double taxation of the overlap. National carbon taxes have the tendency to transfer emissions to sources outside of their tax base when they are applied to emissions covered by an ETS, keeping the overall emissions cap set by ETS allowances unaltered.

Several nations impose various excise taxes or emissions trading schemes (ETSs) on carbon emission sources at varying rates, both explicitly and implicitly. The maximum relevant rate is shown in the table below in these situations. A carbon tax should ideally be applied uniformly to the carbon emissions of all industries.

In recent years, an ETS or carbon tax has been implemented in a number of European nations. Carbon taxes were introduced in Germany and Austria in 2021 and 2022, respectively, and will eventually be converted into ETSs by 2026. A subnational carbon tax is being considered by the autonomous region of Catalonia.

2023 Carbon Taxes in Europe

| Carbon Tax Rate (Per Ton of CO2e) | Share of Jurisdiction’s Greenhouse Gas Emissions Covered (2018) | Year of Implementation | ||

|---|---|---|---|---|

| Euros | U.S. Dollars | |||

| Austria (AT) | €32.50 | $35.38 | 40% | 2022 |

| Denmark (DK) | €24.37 | $26.53 | 35% | 1992 |

| Estonia (EE) | €2.00 | $2.18 | 6% | 2000 |

| Finland (FI) | €76.92 | $83.74 | 36% | 1990 |

| France (FR) | €44.55 | $48.50 | 35% | 2014 |

| Germany (DE) | €30.00 | $35.38 | 40% | 2021 |

| Iceland (IS) | €35.40 | $38.53 | 55% | 2010 |

| Ireland (IE) | €48.45 | $52.74 | 40% | 2010 |

| Latvia (LV) | €14.98 | $16.31 | 3% | 2004 |

| Liechtenstein (LI) | € 120.16 | $ 130.81 | 81% | 2008 |

| Luxembourg (LU) | €44.19 | $48.11 | 65% | 2021 |

| Netherlands (NL) | €51.07 | $55.59 | 12% | 2021 |

| Norway (NO) | €83.47 | $90.86 | 63% | 1991 |

| Poland (PL) | €13.27 | $14.44 | 4% | 1990 |

| Portugal (PT)(a) | €23.90 | $26.01 | 36% | 2015 |

| Slovenia (SI) | €17.30 | $18.83 | 52% | 1996 |

| Spain (ES) | €14.98 | $16.31 | 2% | 2014 |

| Sweden (SE) | € 115.34 | $ 125.56 | 40% | 1991 |

| Switzerland (CH) | € 120.16 | $ 130.81 | 33% | 2008 |

| Ukraine (UA) | €0.75 | $0.82 | 71% | 2011 |

| United Kingdom (GB) | €20.46 | $22.28 | 21% | 2013 |

| €44.49 | $48.56 | 37% | ||

| EU ETS(b) (For Reference) | €88.46 | $96.30 | 38% | 2005 |

|

Notes: (a) Portugal ties its carbon tax rate to the previous year’s EU ETS allowances price. (b) The ETS price displayed is provided for reference only and subject to daily changes. Real-time and historical carbon price data can be tracked using financial information tools provided by relevant exchange platforms. The carbon tax rates were converted using the EUR-USD currency conversion rate as of August 31, 2023 (USD 1 = EUR 0.9186). |

||||

|

Sources: The World Bank, “Carbon Pricing Dashboard,” last updated Mar. 31, 2023, https:// carbonpricingdashboard.worldbank.org/map_data; Financial Administration, Republic of Slovenia – Environmental Taxes, retrieved Aug. 31, 2023. |

||||