In the European Union (EU), taxes dominate the tobacco market. According to the EU Tobacco duty Directive, Member States must collect a minimum excise duty on cigarettes and other tobacco products. Cigarette taxes in the EU include both a fixed euro amount per pack of cigarettes and an ad valorem tax (an additional percentage of the retail selling price).

In the EU, the current minimum cigarette excise tax is €1.80 (US $1.89) per 20-cigarette pack, and the total excise duty must be at least 60% of an EU country's weighted average retail selling price (with few exceptions). These excise taxes on tobacco are in addition to the general consumption value-added taxes (VATs). Only minimal rates are established by EU statute. Most countries impose greater taxes.

EU Average Tax Types and Rates on a Pack of 20 Cigarettes as of July 2023

| Tax | Average Rates and Prices |

|---|---|

| Base Market Price (excluding taxes) | € 1.02 |

| + Excise duty (min. 60% of RSP) | €3.63 (64.1% of RSP) |

| Equals Pre-VAT Price | €4.65 |

| + VAT | €1.01 (21.7%) |

| Equals Retail Selling Price (incl. all taxes) | €5.66 |

In 2023, the average EU member state imposed cigarette taxes that above 80% of the retail selling price. This is a tax-induced price increase of more than 450 percent on average.

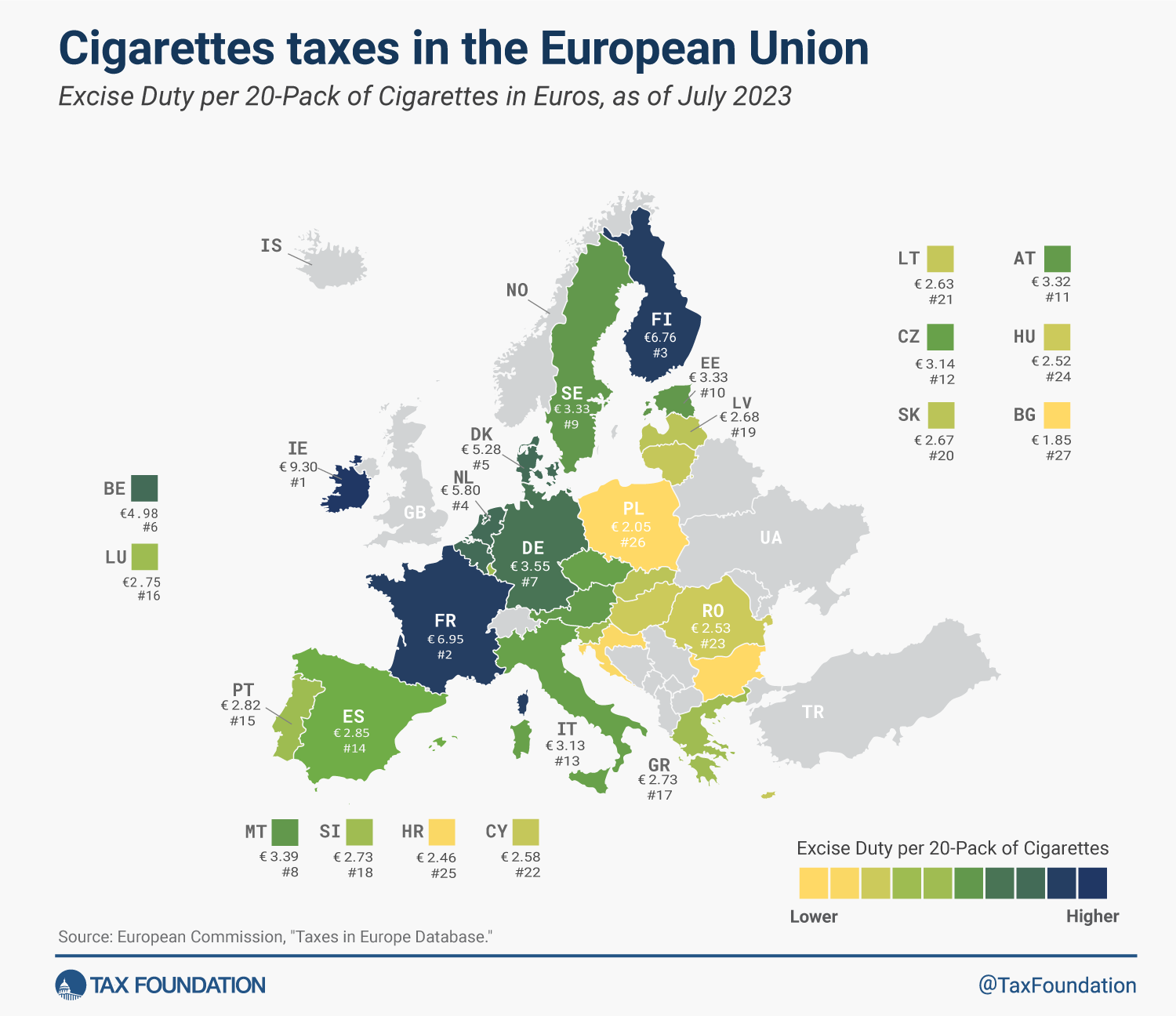

The map below shows how taxes differ significantly across EU member states. Ireland has the EU's highest tariff, at €9.30 ($11.97) per pack of 20 cigarettes. France and Finland have the next highest rates, at €6.95 ($7.31) and €6.76 ($7.11).

Bulgaria has the EU's lowest tax of €1.85 ($1.95). Polonia applies €2.05 ($2.15) tax rates, and Croatia applies €2.46 (2 2.59).

According to research, cigarette taxes are regressive and exploit a small base to provide a volatile revenue source that isn't used to treat smoking-related problems. Recent tax increases have also contributed to an increase in worldwide cigarette smuggling and illicit trade.

According to KPMG, more than 30 billion counterfeit and illegal cigarettes were consumed in the EU in 2020, accounting for 7.8 percent of overall cigarette consumption and a tax revenue loss of €8.5 billion ($9.7 billion). France (23.1 percent), Greece (22.4 percent), and Lithuania (20.2%) were the top three users of illicit cigarettes as a percentage of total consumption.

As an amendment to the EU Tobacco Tax Directive being contemplated, tobacco policy will most certainly be a prominent issue in the coming year. Any changes to the EU Tobacco Tax Directive would have a significant influence on EU well-being.

Excise Duties on Cigarettes in EU Member States as of July 1, 2023

| Excise Duty per 20-Pack | Total Tax per 20-Pack (Excise Duty and VAT) | Average Retail Selling Price per 20-Pack (Including Tax) | Tax as a Share of Final Selling Price (Includes Excise Duties and VAT) | ||||

|---|---|---|---|---|---|---|---|

| EUR | USD | EUR | USD | EUR | USD | ||

| Austria (AT) | € 3.32 | $3.49 | € 4.23 | $4.45 | € 5.50 | $5.79 | 77.0% |

| Belgium (BE) | € 4.98 | $5.24 | € 6.25 | $6.57 | € 7.29 | $7.66 | 85.7% |

| Bulgaria (BG) | € 1.85 | $1.95 | € 2.32 | $2.44 | € 2.78 | $2.92 | 83.4% |

| Croatia (HR) | € 2.46 | $2.59 | € 3.28 | $3.45 | € 4.11 | $4.32 | 79.8% |

| Cyprus (CY) | € 2.58 | $2.72 | € 3.28 | $3.45 | € 4.36 | $4.58 | 75.2% |

| Czech Republic (CZ) | € 3.14 | $3.30 | € 4.02 | $4.23 | € 5.11 | $5.37 | 78.8% |

| Denmark (DK) | € 5.28 | $5.55 | € 6.73 | $7.07 | € 7.25 | $7.63 | 92.8% |

| Estonia (EE) | € 3.33 | $3.50 | € 4.11 | $4.32 | € 4.67 | $4.91 | 87.9% |

| Finland (FI) | € 6.76 | $7.11 | € 8.58 | $9.02 | € 9.38 | $9.86 | 91.5% |

| France (FR) | € 6.95 | $7.31 | € 8.64 | $9.09 | € 10.16 | $10.68 | 85.1% |

| Germany (DE) | € 3.55 | $3.73 | € 4.61 | $4.85 | € 6.65 | $7.00 | 69.3% |

| Greece (GR) | € 2.73 | $2.87 | € 3.54 | $3.72 | € 4.17 | $4.38 | 84.9% |

| Hungary (HU) | € 2.52 | $2.65 | € 3.52 | $3.70 | € 4.71 | $4.95 | 74.7% |

| Ireland (IE) | € 9.30 | $9.78 | € 11.97 | $12.59 | € 14.32 | $15.05 | 83.6% |

| Italy (IT) | € 3.13 | $3.30 | € 4.07 | $4.28 | € 5.20 | $5.47 | 78.3% |

| Latvia (LV) | € 2.68 | $2.81 | € 3.37 | $3.54 | € 3.97 | $4.18 | 84.7% |

| Lithuania (LT) | € 2.63 | $2.77 | € 3.36 | $3.53 | € 4.17 | $4.38 | 80.5% |

| Luxembourg (LU) | € 2.75 | $2.90 | € 3.47 | $3.64 | € 4.90 | $5.15 | 70.8% |

| Malta (MT) | € 3.39 | $3.57 | € 4.21 | $4.43 | € 5.35 | $5.63 | 78.6% |

| Netherlands (NL) | € 5.80 | $6.10 | € 7.11 | $7.48 | € 7.56 | $7.95 | 94.1% |

| Poland (PL) | € 2.05 | $2.15 | € 2.64 | $2.77 | € 3.15 | $2.87 | 83.8% |

| Portugal (PT) | € 2.82 | $2.97 | € 3.72 | $3.91 | € 4.78 | $5.03 | 77.8% |

| Romania (RO) | € 2.53 | $2.66 | € 3.24 | $3.41 | € 4.45 | $4.67 | 72.9% |

| Slovakia (SK) | € 2.67 | $2.81 | € 3.38 | $3.55 | € 4.25 | $4.47 | 79.5% |

| Slovenia (SI) | € 2.73 | $2.87 | € 3.49 | $3.67 | € 4.18 | $4.40 | 83.4% |

| Spain (ES) | € 2.85 | $3.00 | € 3.65 | $3.84 | € 4.62 | $4.85 | 79.1% |

| Sweden (SE) | € 3.33 | $3.50 | € 4.51 | $4.74 | € 5.88 | $6.18 | 76.7% |

| Average | € 3.63 | $3.82 | € 4.64 | $4.88 | € 5.66 | $5.95 | 81.1% |

Source: European Commission, “Taxes in Europe Database,” accessed September 2023, https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html.