Capital allowances play a significant part in a nation's corporate tax base and can influence investment choices, having a significant impact on the economy even if they are occasionally disregarded in talks about corporate taxation.

Businesses calculate their profits by deducting costs from revenue (such as salaries, raw materials, and equipment). However, the majority of nations do not view capital expenditures as normal expenses that can be deducted from income in the year of acquisition. Instead, depreciation schedules outline an asset's life cycle, which establishes how many years it must be written off. The business would have deducted the entire initial dollar cost of the asset at the end of the depreciation term.

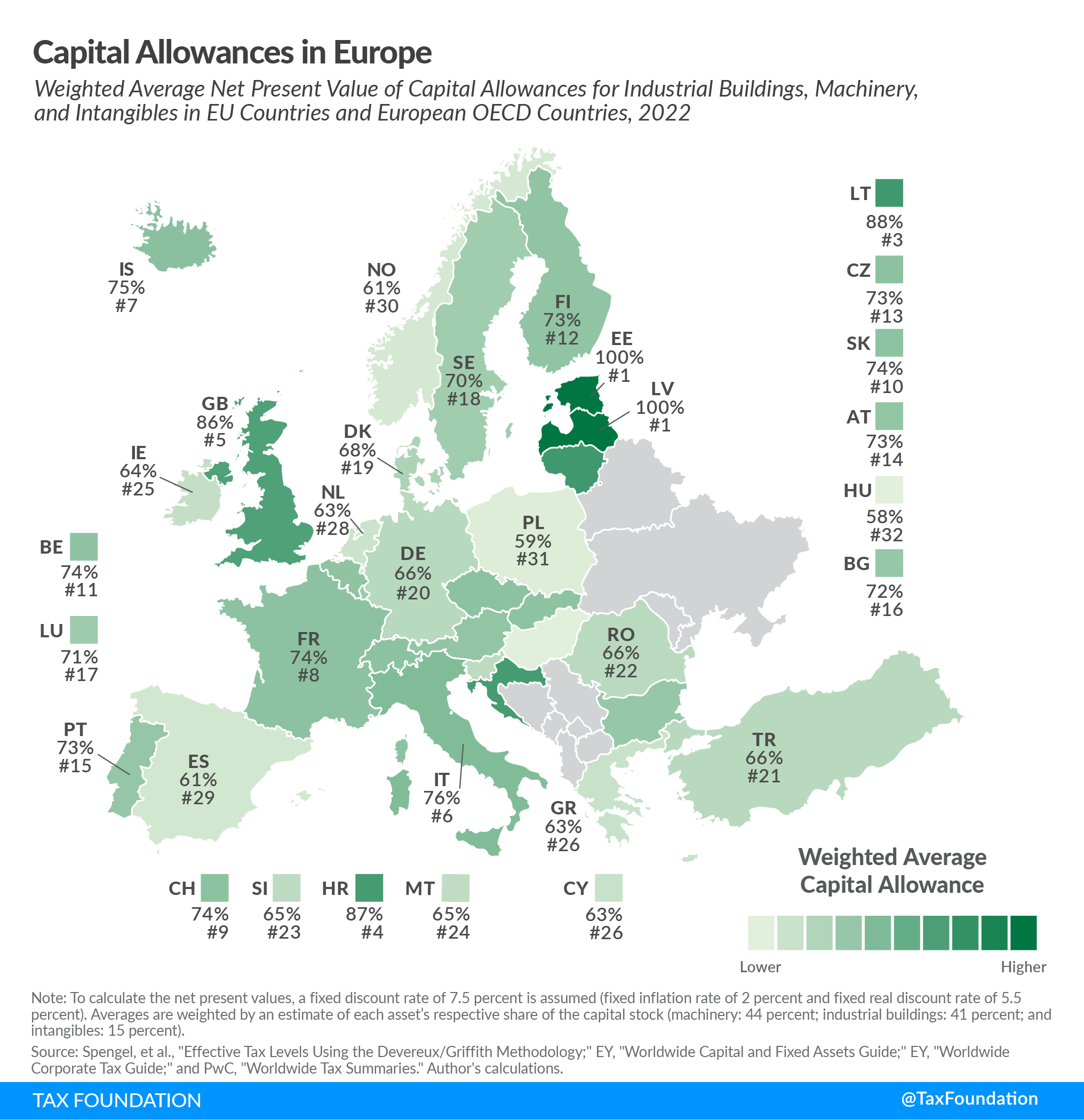

These depreciation schedules typically do not take into account the time worth of money (a normal return + inflation), nevertheless. Let's take the example of a machine that costs $10,000 and has a 10-year lifespan. For ten years, a business might deduct $1,000 under straight-line depreciation. The time value of money, however, means that a $1,000 deduction today is worth more than it would be in the future. The net present value of capital investments cannot therefore be entirely deducted by enterprises. As a result, taxable gains rise, raising the price of capital investments. Increased capital costs can result in decreased corporate investment, decreased capital productivity, and reduced salaries. The map shows the average weighted capital limits for three types of assets: machinery, industrial buildings, and intangibles (patents and "know-how"). Capital allowances are a portion of the cost of an asset's present value that a business can write off over the asset's life. The average is based on how much of an economy each type of capital stock makes up (machinery: 44%, industrial buildings: 41%, and intangibles: 15%). For example, a capital allowance rate of 100% means that a business can fully reduce the cost of an asset, either by paying for it all at once or by getting back the same amount of money. Estonia and Latvia, for example, only tax gains that are distributed. Earnings that are reinvested are not taxed. This makes it possible to write off 100% of the present value of capital investments.

As of 2022, the best way to treat capital investments was in Estonia (100 percent), Latvia (100 percent), and Lithuania (88.2 percent), while businesses in Spain (61.3%), Norway (60.7%), Poland (59.3%), and Hungary (58.3%) could write off less of their investment costs.

In 2022, businesses in the U.S. were able to recoup an average of 67.7% of their capital investment costs. But extra depreciation, which was put in place in 2017, will end in 2023. By 2027, the way business investments are treated will go back to being much less friendly.

In Europe, businesses could write off an average of 72% of their assets in machinery, industrial buildings, and intangibles in 2022. By type of asset, machinery had the biggest capital allowances (87.3%), followed by intangibles (81.7%), and then industrial buildings (52.1%).

Some countries, such as Estonia and Latvia, let businesses offset the full cost of investments in 2022. In other countries, like the United Kingdom and the United States, some purchases in equipment were fully tax deductible. Some of these policies, though, are only temporary, and when they end, the after-tax cost of investing will go up.

Accelerated depreciation plans for machinery used in Germany from 2020 to 2022 ended at the end of 2022. Still, countries like Finland and the UK saw how important capital allowances were for encouraging business investment and chose to extend or change the policies that were set to end.

Finland briefly doubled the declining-balance depreciation rate for machinery from 2020 to 2023. Recently, a plan to keep the increased depreciation rules in place until 2025 was passed.

In the United Kingdom, the temporary super-deduction of 130% for equipment, which ended at the end of March 2023, was replaced by temporary full expensing, which will end on March 31, 2026. Also, investments in long-term assets will be eligible for a 50% deduction in the first year. As of April 2023, the company tax rate went from 19% to 25%.

Aside from capital deductions, statutory corporate income tax (CIT) rates are a big factor in how much a business needs to pay in taxes. One of our past maps shows the statutory CIT rates in Europe.

As European countries try to encourage investment, officials should aim to make permanent deductions for investments in machinery and equipment, and they should make adjustments for inflation and the time value of money for all other capital investments.