Losing interest: how rising rates hit towers and data centre groups

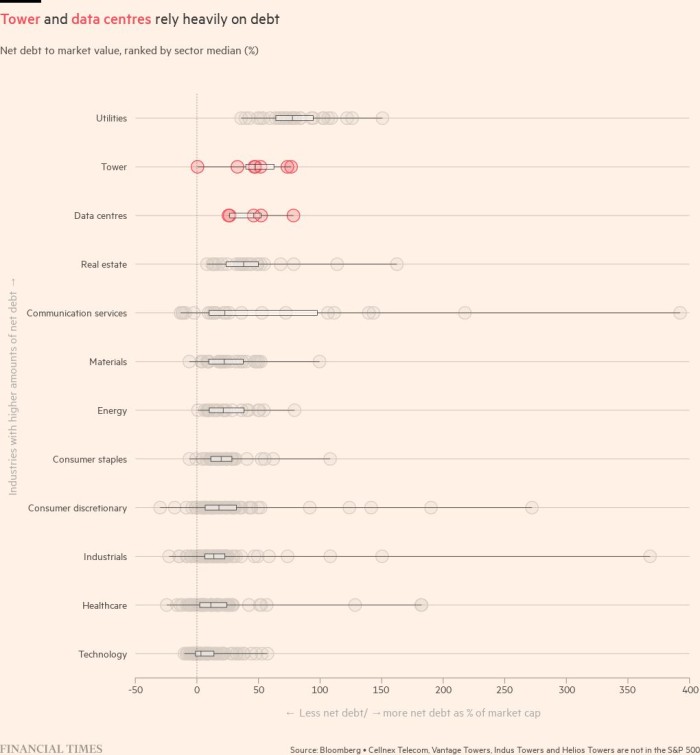

In a world of low interest rates and cheap debt, investors viewed the digital world’s infrastructure assets as ideal sanctuaries for their money.

Both mobile towers — the metal structures on which radio antennas sit — and the real estate groups that house data centres offered steady, long-duration returns in a rapidly digitalising world.

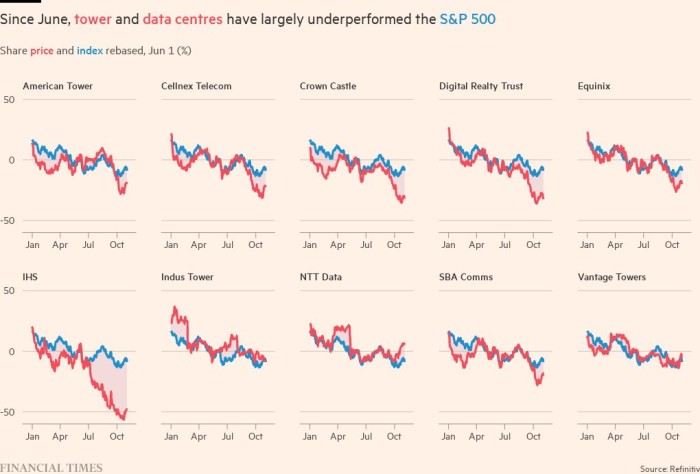

But since June, share prices in many of these sectors’ companies have tumbled as rapidly rising interest rates drive up the cost of capital for their heavily indebted businesses.

Last year, Telefónica disposed of its Telxius towers at a price that represented 30 times earnings before interest, tax, depreciation and amortisation. And just four months ago, Deutsche Telekom was able to secure a sale of its German and Austrian towers to Digital Bridge and Brookfield for 27 times ebitda.

“We had good timing,” said Angel Vila, chief financial officer at Telefónica, adding that all tower company valuations have since “corrected down”. “Sometimes you need to be ready and you need to be lucky.”

Private equity groups were also attracted to the steady returns offered by data centres. Last year, Blackstone bought US data centre group QTS for $10bn, or 26 times ebitda, and earlier this year, Digital Bridge bought Switch, headquartered in Las Vegas, for 31 times ebitda.

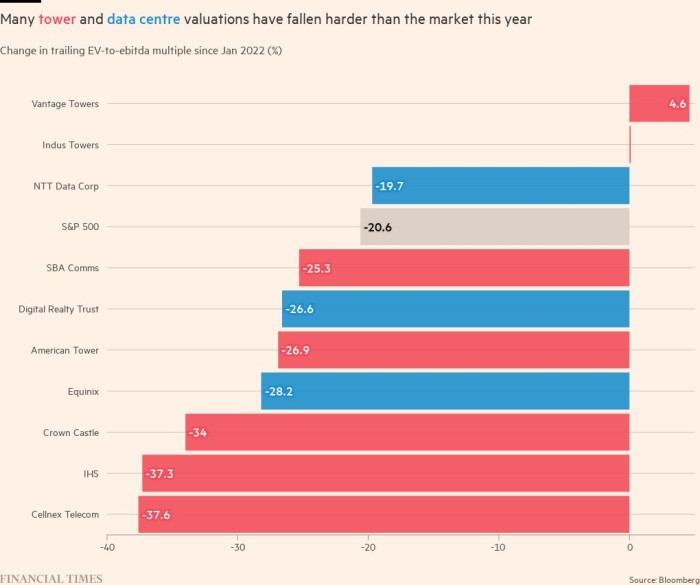

But over the past six months, US tower company valuations have fallen on average from 29.5 times ebitda to 23 times, while US data centre valuations have plummeted from 26.4 times ebitda to 18.9 times, according to analysis by MoffettNathanson.

“I think you should think about ’23 as a challenging year for us,” Rodney Smith, American Towers’ chief financial officer, told investors during an earnings call last week. Smith added that interest rates rising more rapidly than anticipated would be a challenge and “take us off our target” for growth.

Nonetheless, the wider market sell-off masks some company nuances. Vantage Towers, 80 per cent owned by telecoms group Vodafone, has escaped nearly all of the pain in large part because its total debt to ebitda level, at just 4.5 times, has been held lower by its parent company.

By way of contrast, European towers group Cellnex’s net debt stands at around 6.5 times ebitda, American Towers at 5.5 times and US tower group SBA at 6.8 times.

The most severe valuation corrections have hit companies whose development strategies are dependent on raising large amounts of external capital, often to fund ambitious acquisitions. Investors are keen to see those companies make selective decisions about where to funnel their investments.

Speaking to investors last week, Arthur Stein, chief executive of Digital Realty, said that the increased cost of capital has “led us to sharpen our lens and prioritise new investments to those that are the highest strategic merit and offer the best potential risk-adjusted returns”.

“It would be useful for Cellnex to redefine its strategic priorities to take into account current funding needs,” wrote Jerry Dellis, an analyst at Jefferies, adding that “having an investment grade rating would be useful”. S&P currently rates it below that level.

Given that most of these businesses have grown historically via acquisitions, the question now is whether they will have the capital to continue pursuing that model.

“I’ve spoken quite openly about [how] we want to raise more debt even in the current environment,” Keith Taylor, chief financial officer of Equinix, told investors this week, while reassuring them “we definitely have not lost the plot”.

Taylor added that the company still planned to invest prudently in acquiring new businesses: “The question is, where do we source that debt from?”

Otherwise, many of these companies will have to convince investors that growth can be achieved organically.

Jordan Sadler, senior vice-president of investor relations at Digital Realty, said for infrastructure companies looking for higher returns in the new environment, “there’s only one way to move: you have to get higher rents”.

This story originally appeared on: Financial Times - Author:Anna Gross