'The Earth speaks to us through the elements of nature. In every natural thing, we can find a hidden, powerful message.' —Ralph Waldo Emerson

Every part of nature that the earth has has a use, or a purpose. Gold tells us loud and clear that it is money if we listen to it. Gold's most important job is to be used as money.

The progress of civilization shows that, to our good fortune, nature has always given people everything they need to move forward, including money. Few people today, though, understand money as it has been since the beginning of time and as it was thought of up until the beginning of the 20th century. Since the start of the First World War in 1914, long-held beliefs have been thrown out the window. Humanity has become obsessed with money substitutes like national currencies and, more recently, cryptocurrencies. As a result, people have forgotten about natural money.

Gold Is Natural Money

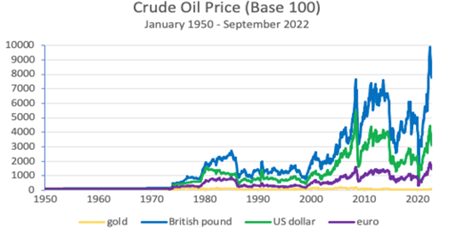

Although gold these days rarely circulates as currency because of government imposed restrictions and impediments, gold still retains all the features that explain why humanity in prehistory chose it to be money. Gold is natural money, or stated another way, nature’s money is gold, which is well illustrated by the following chart that presents the price of crude oil measured in four different currencies from a base of 100.

Today, a gram or an ounce of gold still buys about the same amount of crude oil as it did seven decades ago. I chose oil on purpose because the energy it gives us is so important to our way of life.

The same thing happens when you use gold to measure the price of other commodities, but not the price of manufactured goods. They tend to go down over time because as technology gets better, production gets more efficient. One clear example is computer chips, whose prices have dropped a lot over the past few decades but still make money for the companies that make and sell them.

Gold keeps its buying power, which is one of the most important things money needs to do. As the above chart shows, this is something that no national currency can do.

Money is also needed so that good economic calculations can be made. This is only possible when prices are measured with a unit of account that stays the same over time. Gold is the best choice for this job because it is the only element in the known universe that will never break down or change. A gram of gold mined by the Romans is the same as a gram of gold mined by us.

The fact that gold naturally meets the two requirements of money mentioned above explains why people save gold. Commodities are used up and go away, but because gold is money, all of the gold that has ever been mined still exists above ground, with the exception of small amounts lost in shipwrecks and coin wear.

The Gold Stock

In 1492, when reliable records of production and stocks began to be kept, it is thought that there were 297 tons of gold in stock. When you imagine that amount of gold, it looks like a cube with sides of 4.3 feet (131cm). That's 79.5 cubic feet, which is the same amount of space as a small kitchen table. The arches of the Eiffel Tower would just about be able to fit under a cube made today.

Rareness does not make gold valuable. There is a lot of gold on land, under the oceans, and even in the water of the oceans that hasn't been mined yet, but will be when the technology is ready. Gold is valuable because it can be used, but it is only mined (made) when it is profitable to do so. This depends on how gold is spread out in the earth's crust and how much money, time, and technology are available to find, mine, and refine it.

Growth of the Gold Stock Compared to the Stock of Dollars

Over time, it has become harder to find and mine gold, but the amount of gold above ground has grown at about the same rate every year. In the last 529 years, the average rate has been 1.2% per year. Since 1960, it has been between 1.4% and 2.2%, averaging 1.8%.

Since 1960, the total amount of dollars has grown by an average of 1.1% per year, with the highest rate being 19.1% in 2020. This lack of consistency causes swings in the dollar stock, which in turn makes prices in dollars change a lot because there aren't enough or too many dollars in circulation for the level of economic activity at the time.

Gold comes closer than any other currency managed by a central bank to Milton Friedman's k-percent rule, which says that the amount of money should grow by a constant percentage rate every year, no matter what happens with bank credit. The amount of gold in the world grows at about the same rate as the number of people on Earth and new money being made. Because of this, gold is the only thing that can be used to accurately figure out the prices of goods and services over time. This is because gold's buying power comes from the interaction between its supply (its aboveground stock) and the fact that it is money, which means that people will always want it. It is something that the dollar and other national currencies can't do because their annual growth rates aren't the same, which causes their "aboveground" stock to change. Since 1950, the weight of the gold stock has grown by 3.5 times, but you can still buy the same amount of crude oil with 1 gram of gold.

Also, since 1960, the average rate of growth of the dollar stock has been 7.1%, which is four times higher than the average rate of growth of the gold stock during this time. This faster growth of the dollar stock makes the dollar less valuable compared to gold. The above chart of crude oil prices shows this clearly and brings up an important point.

The people who run the banking system are in charge of how many dollars are in circulation. Bank and currency crises have happened over and over again throughout history. This is because people make mistakes and have other flaws that destroy fiat currency, like not wanting to "take away the punchbowl" after a long period of credit expansion. Gold is different.

Gold doesn't need to be run by a government or central bank. Gold is money that takes care of itself because the amount of gold in the world depends on two things that can't be changed: nature and profitable mining. Together, they put rules on the way gold is made. This keeps the money punchbowl from getting too full, which is a key reason why gold keeps its value over time.

The Essential Nature of Honest Money

Gold is different from national currencies because its supply and demand have always been linked. Its essential nature also sets it apart. Gold is something you can touch, but national currencies are just financial promises that you can't touch. This risk comes from the fact that promises are sometimes broken, as the 2008 financial crisis and many other banking and fiat currency crises have shown.

Gold is a natural form of money that has helped people improve their standard of living over the course of history. We can think about whether this is just a lucky accident or if it was planned by a creator who gave the earth's resources in a way that would give people natural money. No one knows where gold came from, but that doesn't change the fact that it is money and just as useful today as it was in the past.

==========