Top Road Tax FAQs

Most popular FAQs for Road Tax

Road tax, which goes by different names in different places, is a tax that must be paid on or with a motorized vehicle in order to drive it on a public road.

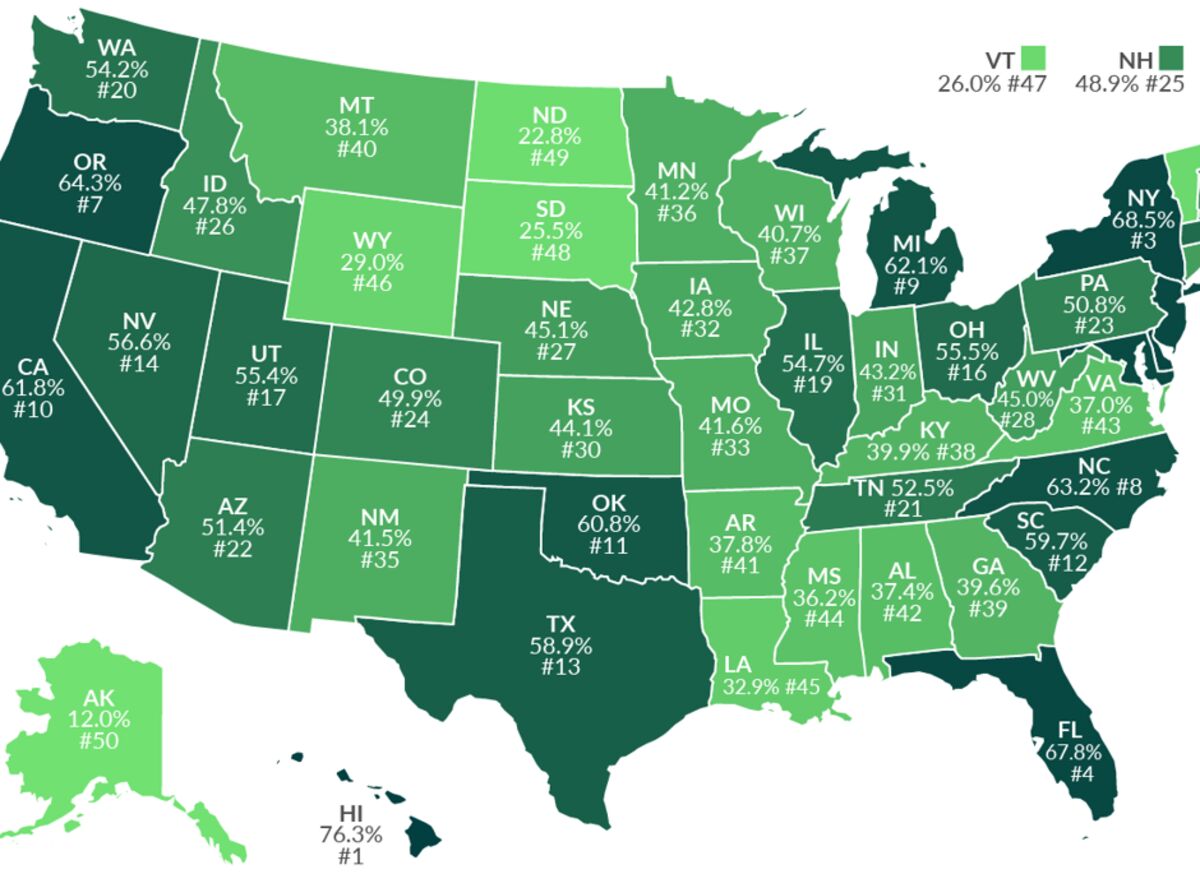

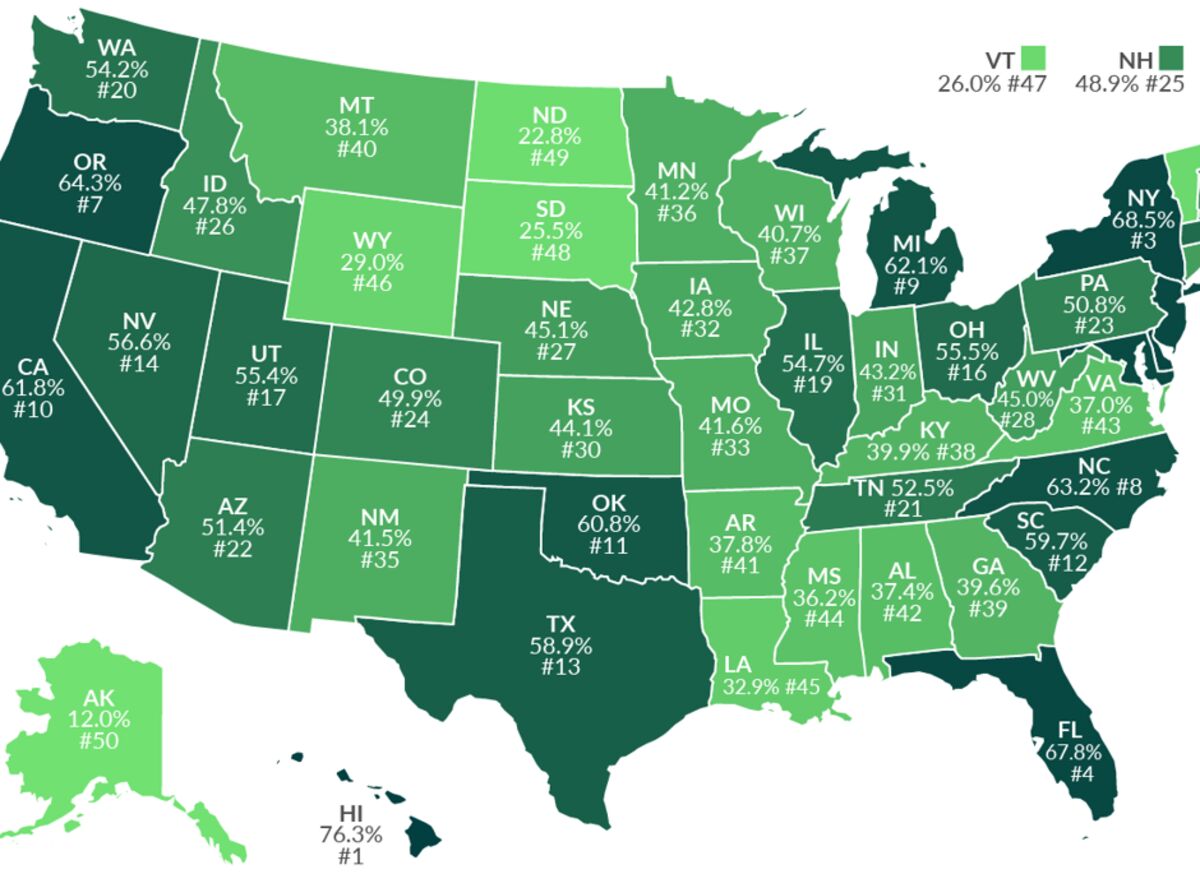

US

Every state has an annual registration fee that is different from one state to the next.

In some states, counties and/or cities are also allowed to charge a tax on vehicles. In Illinois, for example, vehicles registered in unincorporated areas are taxed by Cook County, and a number of cities and towns have their own annual vehicle registration fees. In Massachusetts, the excise tax is charged separately from the registration fee by the town or city where the vehicle is registered. A law from 1980 called Proposition 212 set the rate for the whole state at 2.5%. In some states, the fees can be different from county to county because some counties add extra fees per vehicle. Virginia's personal property tax is an example of this. On the other hand, New York State charges a tax based on the vehicle's weight instead of its value when the registration is renewed.

In California and New Hampshire, the registration tax is based on how much the vehicle is worth right now. So, cars that are older and cheaper will have low registration fees, while cars that are newer and cost more will have fees in the hundreds of dollars.

There is also a federal Heavy Vehicle Use Tax (HVUT), or truck tax, for vehicles with a gross weight of 55,000 pounds or more. This includes trucks, truck tractors, and buses. Usually, this tax does not apply to vans, pickup trucks, panel trucks, and other similar vehicles. The tax does not apply to vehicles that are driven on public roads for less than 5,000 miles (7,500 miles for farm vehicles) during a tax period.

In addition, "Motor carriers who drive certain vehicles on public roads in New York State have to pay a highway use tax (HUT) (excluding toll-paid portions of the New York State Thruway). The tax rate depends on how much your car weighs and how you choose to report the tax."

United Kingdom

In the United Kingdom, you have to pay "Vehicle Excise Duty" to the government every year to get a vehicle license. Before, vehicles had to have licenses in the form of paper discs that had to be displayed. Even if the vehicle was given to a new owner, the license would still be valid until it ran out. Since the paper discs were taken away in October 2014, the license is now just an entry in a central database. Because of this change, the license is also no longer valid if the vehicle is sold. A Statutory Off-Road Notification (SORN) must be filed for unlicensed vehicles that are not used or kept on public roads.

In 1937, the government broke the direct link between the tax and spending on public roads. The money from the tax was then treated as general taxation.

In the 2015 budget, the government said that, for the first time since 1937, the money would be used directly to keep the roads in good shape. In the 2018 budget, the government announced that there would be a National Roads Fund that would use VED in England to fix up roads.

Australia

To drive on public roads in any state or territory, you have to pay an annual vehicle registration fee. The cost of this fee varies from state to state and depends on the type of vehicle. The fee is sometimes called "rego" (pronounced with a soft g, short for registration). The road tax in Queensland is based on how many cylinders or rotors a car's engine has. There is also a small fee for making traffic better. In New South Wales, you pay road tax based on the tare weight of your car.

China, Hong Kong

In Hong Kong, the license fee is based on the type of vehicle first, such as passenger cars, goods vehicles, taxis, etc. Then, for passenger cars, which are also called "private cars," it is based on the size of the engine. Under 1500 cc is the lowest tax band. At 2500 cc, 3500 cc, and 4500 cc, the tax band changes. Because of this license fee system, most cars with engines between 1600 and 1800 cc don't sell very well. Most people like compact cars with 1500 cc or less. Because of this, some manufacturers, like Toyota and Nissan, only offer the 1500 cc version of their compact cars on the Hong Kong market. There is only a 1500 cc version of each of these two cars.

By engine displacement:

≤ 1500 cc = HK$3,929 1501 cc- 2500 cc = HK$5,794 2501 cc- 3500 cc = HK$7,664 3501 cc- 4500 cc = HK$9,534 >4500 cc = HK$11,329

Ireland

Vehicle registration tax is paid on all new cars and cars that are brought in from other countries. VRT is based on both the amount of CO2 and NOx that a car puts out.

In Ireland, you have to pay a tax on your car every year, with some exceptions. Before 2008, the tax was based on the size of the engine and ranged from €199 per year for engines under 1,000 cc to €1,809 per year for engines over 3,001 cc. Tax rates for private cars that were registered after July 2008 are based on how much carbon dioxide the car puts into the air. The CO2 tax bands go from €120 per year for 0-80 g/km to €2,350 per year for >225 g/km. The tax on commercial vehicles is based on the GVW, not the size of the engine or the amount of CO2 it puts out. The tax ranges from €333 to €900 per year. Tax on vintage cars is €56 per year. A car is considered vintage 30 years after it was first registered.

Israel

Base purchase tax on combustion engine cars is 83%, plus 7% customs tax for manufacturers from countries that don't have a treaty with Israel, plus 17% VAT and a "prestige tax" of between 2.9% and 18% for expensive cars. This means that a new car will be taxed around 100% of its value. The base tax for hybrid cars is 45%, and the base tax for electric cars is 10%. "Why is Tesla so cheap?"

Japan

Under the Local Tax Act of 1950, a tax is paid every May based on how big the engine of the vehicle is. The tax is then based on whether the car is used for personal or business purposes. The outside dimensions and engine size are used to figure out brackets, as stated in the dimension regulations. Then, the tax to be paid is based on the size of the engine, starting at less than 1,000 cc and going up by 500 cc increments up to 6,000 cc and above.

Cars that are used for personal use cost more than cars that are used for business. Under the Japanese low-emission vehicle certification system, the tax is less if the car has been certified as a low-emission vehicle. Kei cars, which are small Japanese cars with 660 cc engines and smaller outside dimensions, have a lower tax rate than cars with 1,000 cc engines.

The law is similar to the way European countries tax engine horsepower, while Japan taxes engine displacement.

Automobile Tax (exterior dimensions)

Road Tax for regular four-wheel vehicles (Metropolitan/Prefectural Tax), vehicle plates, and taxes

40/400 and 50/500 license plates in Japan cost 7,500. 33/300 license plates (engines of 4.5 liters or less) cost 19,000. 33/300 license plates (engines of 4.6 liters or more) cost 22,000.

11/100 license plates: ¥32,000

Tax on small cars and trucks

Minicar and motorcycle road tax (city/ward tax)

Kei car: ¥3,000

Bikes with engines up to 125 cc: 500

Motorcycles with 125 cc or more: 1,000

You may also be interested in

Tax your vehicle - GOV.UK

Renew or tax your vehicle for the first time using a reminder letter, your log book or the green 'new keeper' slip - and how to tax if you do not have any documents

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

Road tax - Wikipedia

Road tax, known by various names around the world, is a tax which has to be paid on, or included with, a motorised vehicle to use it on a public road.

All states and territories require an annual vehicle registration fee to be paid in order to use a vehicle on public roads; the cost of which varies from state to state and is dependent on the type of vehicle. The fee is known colloquially as 'rego' (pronounced with a soft g, short for registration).[1] Queensland road tax is based on the number of cylinders or rotors the vehicle's engine has. There is also a small traffic improvement fee. New South Wales road tax is paid based on the vehicle's tare weight.

Passenger cars pay a registration fee based on the engine displacement and power output (degressive towards 2014 (66% in 2012, 33% in 2013, 0% in 2014) and environmental criteria such as CO2 g/km output (increasingly towards 2014). The more CO2 g/km the car produces, the higher the fee will be.[2]

Every year, the plate number owner has to pay the annual road tax contribution. This tax is based on the engine displacement (0-799cc = fiscal HP 4, above 800cc each 200cc is one class higher).[3] Due to CO2-based regulations, diesel cars with above average displacement (>2,000cc) are favoured, and petrol cars with bigger displacements are put at a disadvantage). A supplementary annual fee has to be paid for cars that run on LPG/CNG (0-799cc: €84/year, 800–2,499cc; €148/year and >2,500cc: €208/year) to compensate financial loss for the state due to the absence of excise at the pump.

In Brazil, the states may collect an annual Vehicle Licensing Fee (Taxa de Licenciamento Veicular) which has a fixed value for each vehicle category determined by each state. In addition, each state may impose a Vehicle Property Tax (Imposto sobre a Propriedade de Veículos Automotores), with a rate up to 4%.[4]

LTA | Road Tax

Category:

Part Of Your Vehicle Ownership Tax

Learn more about road tax in Singapore.

For Weekend Cars/Off-Peak Cars/Revised Off-Peak Cars and Heavy Vehicles, there may also be additional prerequisites to meet. The road tax of Weekend Cars/Off-Peak Cars/Revised Off-Peak Cars can only be renewed on a 12-monthly basis.

From 15 February 2017, you no longer need to display your road tax disc on your vehicle windscreen. Please remove your expired road tax discs.

If you are travelling to Malaysia, please keep a valid copy of your vehicle’s certificate of insurance, and a PDF copy or printout of your latest road tax validity, in your vehicle.

Download or print your road tax validity

If you are buying a used vehicle, please check that it has valid road tax before you drive it. The vehicle may come with road tax.

Check the expiry of your vehicle’s road tax here

You have to renew your road tax if it expires before you sell or deregister your vehicle. When a vehicle is sold, any road tax that has been paid will follow the vehicle and be transferred to the new owner. You can consider factoring in the unused road tax into the selling price of your vehicle.

You have to renew your road tax before it expires, or you will have to pay late renewal fees and fines. You may also be charged in Court for keeping an unlicensed vehicle.

Fraud Road Tax? Be aware! Why I'm not paying my road tax? @Denise Marie's Journey

5:10 - 3 years ago

Created by InShot:https://inshotapp.page.link/YTShare.

Official NCDMV: Vehicle Taxes

NCDOT

North Carolina generally collects what's known as the highway-use tax – instead of sales tax – on vehicles whenever a title is transferred. (Vehicles are also subject to

property taxes, which the N.C. Division of Motor Vehicles collects, as defined by law, on behalf of counties.)

Revenue from the highway-use tax goes to the North Carolina Highway Trust Fund and the North Carolina's General Fund and is earmarked for road improvements.The type of vehicle determines the amount of tax paid, as detailed in the following table.

Some vehicles are exempt from the highway-use tax.

Oregon Department of Transportation : Report Your Taxes : Commerce and Compliance Division : State of Oregon

This page has forms and instructions for motor carriers to report their taxes and fees.

Account SuspensionLetters saying that the account will be suspended are mailed out 10 days prior to suspension dates. Insurance letters are mailed out 20 days in advance. Suspension of an account may be caused by:

Note: Credit Card transactions are a-sessed an additional service fee from the credit card company of 2.4%. Charge accounts and checking account direct payments are not charged an additional service fee.

The Road Use A-sessment Fee is paid for heavy loads over 98,000 pounds that cannot be divided, such as a single piece of machinery. Tax enrollment can be completed by enrolling a vehicle under an established account.Instructions and requirements for Oregon Highway Use Tax Reports is found in our Motor Carrier Education Manual.

Oregon Road Use A-sessment Fee (RUAF) Rates:

Participation in the International Fuel Tax Agreement (IFTA) is available to Oregon-based carriers that operate qualified vehicles outside of Oregon. To simplify the reporting of motor fuel use tax, one quarterly tax return is filed for fuel consumed in all participating jurisdictions. Tax returns must be filed even when there is no tax due, regardless of whether there were Oregon only operations or no operations for the reporting period.Oregon issues the following tax credentials to approved IFTA applicants:

The Oregon Apportioned Registration Program made changes to how International Registration Applications are processed. The intent of the changes is to ensure we are adequately reviewing basing materials to comply with the International Registration Plan.

Check if a vehicle is taxed - GOV.UK

Check and report if a vehicle has up-to-date vehicle tax or is 'off road' (SORN)

Find out if a vehicle has up-to-date vehicle tax or has been registered as off the road (SORN). It can take up to 5 working days for the records to update.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

VAHAN 4.0 (Citizen Services) ~SP-MORTH …

Government of India Ministry of

Road Transport and Highways. F5 , CTRL+F5 and Right-Click are disabled on service pages due to security/technical reasons. If unable to view page properly, …

Pay Online – Road Transport and Safety Agency

Category:

Road Tax

Roadworthiness Application (“

Road Fitness Test”) Motor Vehicle Licence (“

Road Tax”) Motor Vehicle Registration – Temporal Registration; Physical Vehicle Examination (Various) Click this …

Trucking Tax Center | Internal Revenue Service

Review information on filing Form 2290, Heavy Highway Vehicle Use Tax Return, and other tax tips, trends and statistics related to the trucking industry.

Processing Delays for Paper Forms 2290, and Expedite Requests for Copies of Schedule 1

Due to the pandemic, you may experience delays in processing paper federal Excise tax forms, including Form 2290 and faxed Schedule 1 expedite requests. Refer to Schedule 1 Copies for Filed Forms 2290 below for additional information. Do not file duplicate forms, but for future filings we encourage taxpayers to consider the ease, convenience and speed of electronically filing Form 2290 .

Do I Need to Pay the Heavy Highway Vehicle Use Tax? is a short, interactive interview that can help you determine if you're required to pay highway use tax on a highway motor vehicle.

File Form 2290 for any taxable vehicles first used on a public highway during or after July 2022 by the last day of the month following the month of first use. See When to File Form 2290 for more details.

Everyone must complete the first and second pages of Form 2290 along with both pages of Schedule 1. You only need to complete the “Consent to Disclosure of Tax Information” and “Form 2290-V, Payment Voucher” pages when applicable.

You must have an established employer identification number (EIN) to file Form 2290. Apply online now if you don’t already have an EIN; it will take us about four weeks to establish your new EIN in our systems.

Motor Fuel Taxes

There are seven different motor fuel taxes and fees imposed by the Department of Revenue.

Road Tax Calculator - oto.my

oto.my is the best way to buy and sell new, used and reconditioned cars in Malaysia.

Use oto.my to reach over 2,000,000 car buyers on Malaysia's #1 automotive network.

Or find your next car amongst the quality listings at oto.my.

Taxes

The Department of Revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees a-sociated with those laws. Within each tax type, you will find the definition of the tax, tax rates and due dates for returns. The department also a-sists with the collection of certain local taxes. Information about those taxes is available as well as forms needed. The information contained in all these pages constitutes “published guidance,” as defined in Tenn. Code Ann. § 67-1-108.

The Department of Revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees a-sociated with those laws. Within each tax type, you will find the definition of the tax, tax rates and due dates for returns. The department also a-sists with the collection of certain local taxes. Information about those taxes is available as well as forms needed. The information contained in all these pages constitutes “published guidance,” as defined in Tenn. Code Ann. § 67-1-108.

Road Tax India : Calculations & Online Payment - Paisabazaar.com

Category:

Road Tax

Jun 15, 2020 ·

Road tax is a state-level

tax which is levied on all motor vehicles be it two-wheelers, four-wheelers, or goods-carrying vehicles used either for private or commercial purposes.

Road …

Enquire Road Tax Payable | 1

Category:

Road Tax

Vehicle Registration and Licensing System

Please Select

Less than or equal to 10 years

More than 10 years, less than or equal to 11 years

More than 11 years, less than or equal to 12 years

More than 12 years, less than or equal to 13 years

More than 13 years, less than or equal to 14 years

More than 14 years

Please Select

Euro IV

Euro V

Euro VI

Euro VI (WLTP)

J-WHVC + PN limit

JPN 2009

JPN2009 + Euro VI PM/PN limit

JPN2009 + Euro VI PN limit

JPN2009 + Port Fuel Injection

JPN2018 + Euro VI PM/PN limit

JPN2018 + Euro VI PN limit

JPN2018 + Port Fuel Injection

Non-Euro IV/V/VI

PPNLT + Euro VI PM number

The information and materials contained in this website are provided on an "as is" and "as available" basis. While every effort is made to ensure that the information and materials are correct, the Land Transport Authority does not warrant their accuracy, adequacy or completeness and expressly disclaim liability for any errors or omissions.

Without prejudice to the Conditions of Use, the Land Transport Authority shall not be responsible or liable for any damages, losses or expenses including direct, indirect, special, punitive, economic or consequential losses and damages, howsoever arising from or in connection with the provision of information and materials provided to you in this regard.

Consent for collection, use and disclosure of personal data: You consent to us collecting from and/or disclosing to any other Government agency or public authority, and/or using, your personally identifiable data, including those that you have provided in this application, so as to serve you in an efficient and effective way. In addition, you consent to us collecting from and/or disclosing to any person (whether a natural person or a body corporate), and/or using, your personally identifiable data (i) where such person has been authorised to carry out any specific service on behalf of the Government or a public authority; (ii) in accordance with legislation under our purview to enable us to perform our functions or duties; (iii) to comply with any order of court; (iv) to comply with any written law; (v) to enable a Town Council to enforce, investigate and/or prosecute an offence under its purview; (vi) for the purpose of any legal proceeding involving any motor vehicle, power-assisted bicycle and/or personal mobility device registered with us; or (vii) for the purpose of taking any action against any person for the breach of any of our terms and conditions. Data provided to us may be used for verification and record of your personal particulars, including comparing with information from other sources, and may be used to communicate with you.

Videos of Road Tax

Fact-checking road tax ad claims

3:09 - 3 years ago

You may be seeing plenty of political ads in your social media feeds. But how many of these targeted ads are actually true?

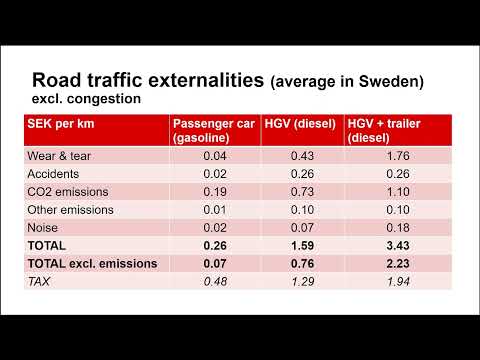

Distance-based Road Taxes - Pros and Cons

32:15 - 3 years ago

Distance-based Road Taxes - Pros and Cons Jonas Eliasson, Swedish Transport Administration (Trafikverket) Presentation for ...

Folding trailer helps reduce road tax on freight carriers

1:14 - 3 years ago

This trailer can be folded during empty runs to reduce road tax and increase maneuverability. More info: https://bit.ly/3CmC9nV ...

Acceptability of Road Tax Reform

38:07 - 3 years ago

Acceptability of Road Tax Reform Stefan Proost, KU Leuven Presentation for the Decarbonisation and the Pricing of Road ...

You may also like

-

Global hiring is booming — but traditional HR tools can’t keep up. Payroll software built for remote teams is now the backbone of fast-growing companies. It ensures accurate payments, automated compliance, reduced errors, and happier employees across borders. This post uncovers the silent revolution behind modern remote work and shows why businesses that adopt payroll automation scale faster, retain talent better, and avoid costly mistakes. A must-read for founders, HR leaders, and remote professionals.

-

Global hiring should not feel like a legal minefield—but for most U.S. small and mid-sized businesses (SMBs), that’s exactly what it is. Building a remote global team exposes you to permanent establishment risks, misclassification penalties, country-specific tax requirements, complex payroll mandates, and HR compliance that changes monthly.

-

The power of video advertising lies not in its creativity alone, but in its ability to deliver quantifiable, measurable, and repeatable business results. Small businesses that integrate video into their marketing see substantial improvements across engagement, conversions, brand perception, and overall customer lifetime value.

-

NVIDIA has just become the first company in history to reach a $5 trillion market cap — an astonishing leap powered by artificial intelligence and next-gen chips. For technology lovers, career builders and anyone curious about the future, this moment marks a shift in what “big tech” really means. Dive into how it happened, what it signals for your own growth, and why now is the time to rethink how you ride the wave of disruption.

-

The internet is choking on “AI Slop” — a storm of low-quality, machine-made content that looks smart but feels soulless. From fake news to recycled quotes, our feeds are drowning in digital noise. But there’s still hope. The future belongs to thinkers, curators, and creators who choose depth over dopamine. Here’s how we reclaim authenticity in an algorithm-driven world.

-

Discover the book list that the world’s most successful entrepreneurs and investors actually follow. These aren’t just business manuals—they’re mindset-shifters, productivity boosters, frameworks for the modern tech-career world. If you’re aged 25-45, passionate about tech, growth and self-mastery, this post is for you. Dive in, pick your next read, tag a friend who needs it, and share your favourite quote in the comments! #readinglist #billionairemindset

-

Are you ready to take control of your finances? Discover how the IRS’s VITA program offers free tax-preparation help for eligible taxpayers—learn what it is, how it works, and why it matters.

-

Gold has leapt to historic highs, leaving many asking: “Why now?” Join me as I unravel the layers — safe-haven flows, real interest rates, institutional demand, supply constraints — that explain this surge. With clarity and nuance, I invite you to think differently, comment, and share your views. Because knowledge is best when it spreads.

-

What if the data center powering your AI assistant is quietly drawing as much electricity as a small city? As AI surges, hyperscale campuses, edge nodes, microgrids, advanced cooling, and novel energy sources all collide at the frontier of tech and sustainability. Dive into the untold story—see how “green” gets real, where regulation, community pushback, and emerging power models are reshaping the backbone of the digital age. Share to spark conversation.

-

How close are we to building a machine that thinks like a human? In this post, we dive deep into expert predictions for AGI timelines, the monumental technical and ethical barriers in the way, and what those breakthroughs might look like. Whether AGI arrives in 2030 or 2050, this journey reshapes how we live, work, and dream. Let’s explore together—and discuss where you think we’ll really land.